Core asset: 36 years on, Jwaneng in Botswana is still the worlds largest diamond mine. (Philip Mostert)

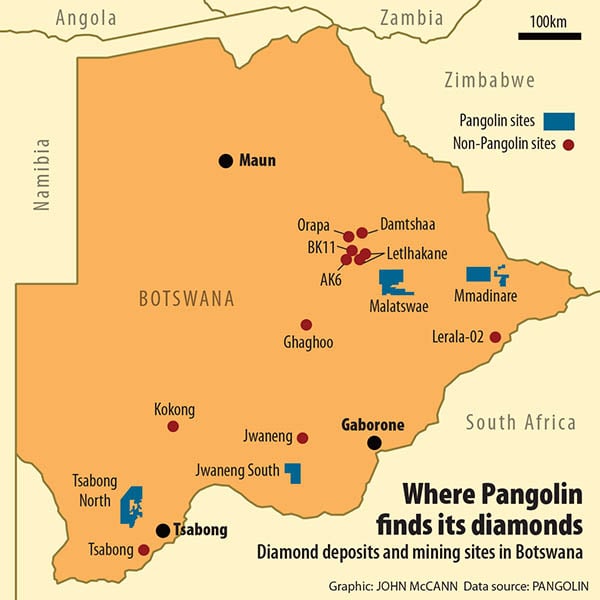

Two weeks ago Canadian junior miner Pangolin Diamonds issued a statement to the Toronto Stock Exchange that it had found one of the world's biggest kimberlite formations in its Tsabong North prospecting area in southern Botswana.

A week later there was yet another statement that it was exploring another huge kimberlite formation in its Malatswae exploration area in the south.

I immediately started getting emails saying things such as "see, Botswana faces no fiscal cliff; you are exaggerating and there will be more Jwanengs and Orapas [the world's biggest diamond mines] … and why do we need even to think about coal". One could only wish!

Of course, there was one magic word missing from the Pangolin statement — diamondiferous, that is, diamond bearing.

Only about one in 200 kimberlites (named after Kimberley) — the usual geological structures in which diamonds are found — contains sufficient diamonds to be mined.

Junior miners play a very important role in the mining "food chain" in Botswana.

Rare exploitation

The country remains essentially a frontier province for all kinds of exploration and it needs the sort of experienced high-risk takers from Canada and Australia who play a pivotal role in the country's mining development.

These junior miners usually find deposits, but rarely exploit them.

Their usual role is to discover them and sell them to someone who has deep enough pockets and enough expertise and experience to develop the deposit into a profitable mine.

The risk to Botswana is that the juniors can run out of money and are then unable to continue the exploration to reach the point at which it might be marketed.

For this reason, the juniors begin to mine the stock market long before they ever mine a tonne of ore.

The reason is that unless they are able to provide sufficient good news they cannot attract risk capital and their exploration comes to an abrupt end.

Luck matters

But even getting the capital to continue exploration and finding something is not enough to find you a buyer for even an otherwise lucrative deposit.

Luck really matters. If you are looking for diamonds and happen to find a giant iron ore deposit in the Caprivi Strip or a zinc deposit on the Namibian border hundreds of kilometres from the nearest rail head then your chance of finding a buyer is slim, and you end up holding the concession for too long and the Botswana government will eventually tell you to use it or lose it.

Pangolin has been very successful in mining the Toronto Stock Exchange and its shares have doubled in value in the past six months, closing on November 1 at Canadian $0.42, up from its initial offer of C$0.08 a share early in the year.

Its share price is down from a peak of C$0.52 after it announced the kimberlite discoveries. This will make it much easier for Pangolin to raise the necessary capital to continue exploring.

Botswana has had the good fortune to be blessed with two of the richest diamond mines ever found.

Diamonds are incredibly rare and, despite 35 years elapsing since the discovery of Jwaneng, the world's richest mine, no one in Botswana or anywhere else has managed to discover anything that size.

Small deposits discovered

And that is certainly not for want of trying by both De Beers and the junior miners.

Several small deposits have been discovered in Botswana and it is the continual discovery of these — along with reliable governance structures and policies — that continues to excite prospectors and miners.

The deposits have been developed by firms outside the direct orbit of De Beers, which owns the main mines.

De Beers was never interested in the "paltry" mines such as Lucara's Karowe mine or the potentially risky and controversial mines such as Gope in the Central Kalahari Game Reserve.

They were too small (less than one million carats a year) to fit the De Beers business model and were sold off to smaller companies.

For almost a decade now, economists and international financial institutions have been warning whoever would listen in the Botswana government about the imminent decline of revenue in the nation's diamond reserves.

Imminent end of 40-year diamond boom

Indeed, in development economics, there is now an entire industry writing about the imminent end of Botswana's 40-year diamond boom.

The only problem is that mine life, like human life itself, does not come with an expiry date.

Very often geologists have no firm idea what the limits of a deposit are.

But Botswana remains almost totally dependent on diamonds, and there are several good reasons why policymakers yawn when the expiry of the revenue from Jwaneng and Orapa is raised.

If Botswana's 10th National Development Plan was to be believed, the crisis was supposed to happen around 2017.

But almost as soon as that date was published five years ago, it was shifted forward and is now 2027.

Mines on life support

The reason is that De Beers went for cut eight, and will likely go for cut nine thereafter, which will extend the life of Jwaneng.

At some point both Jwaneng and Orapa will go into serious decline, probably in the 2030s, and the 50% share of the mines' profits accruing to the Botswana government will decline drastically.

But this "fiscal cliff" will happen long before the last carats are extracted.

Mines, like people, can be put on life support for a very long time where, although nominally alive, they cease to be of any great value.

The second reason why people find it hard to take the discussion seriously is that by the time you become a senior policymaker in any country, that is a minister or a permanent secretary, you are normally in your late forties and early fifties, so issues about how the state will generate revenues long after you have retired are obviously less than pressing.

The third reason is the "Pangolin effect". No one wishes to believe that tomorrow will bring economic decline and it is easier to think that nature has blessed the country with a third major diamond deposit, no matter how improbable this may be.

Well wishes

Given the massive infrastructure investment required and the water and environmental issues involving the mining of coal and base metals, which are plentiful in Botswana, it is hard work compared with diamonds and nowhere near as profitable.

Everyone in Botswana wishes Pangolin well and hopes that it will defy the odds and make a big win.

But it is one thing to dream about marrying a rich spouse or winning the lottery, but quite another to conduct national economic policy along similar lines.

The future of Botswana rests in using the abundant resources it knows it has to develop a sophisticated mining and processing sector, but this will require difficult and expensive infrastructure and policies that will be hard to implement.

The nation's future cannot rest on kimberlite pipe dreams.

These are the views of Professor Roman Grynberg and not necessarily those of the Botswana Institute for Development Policy Analysis where he works. He owns no shares in Pangolin