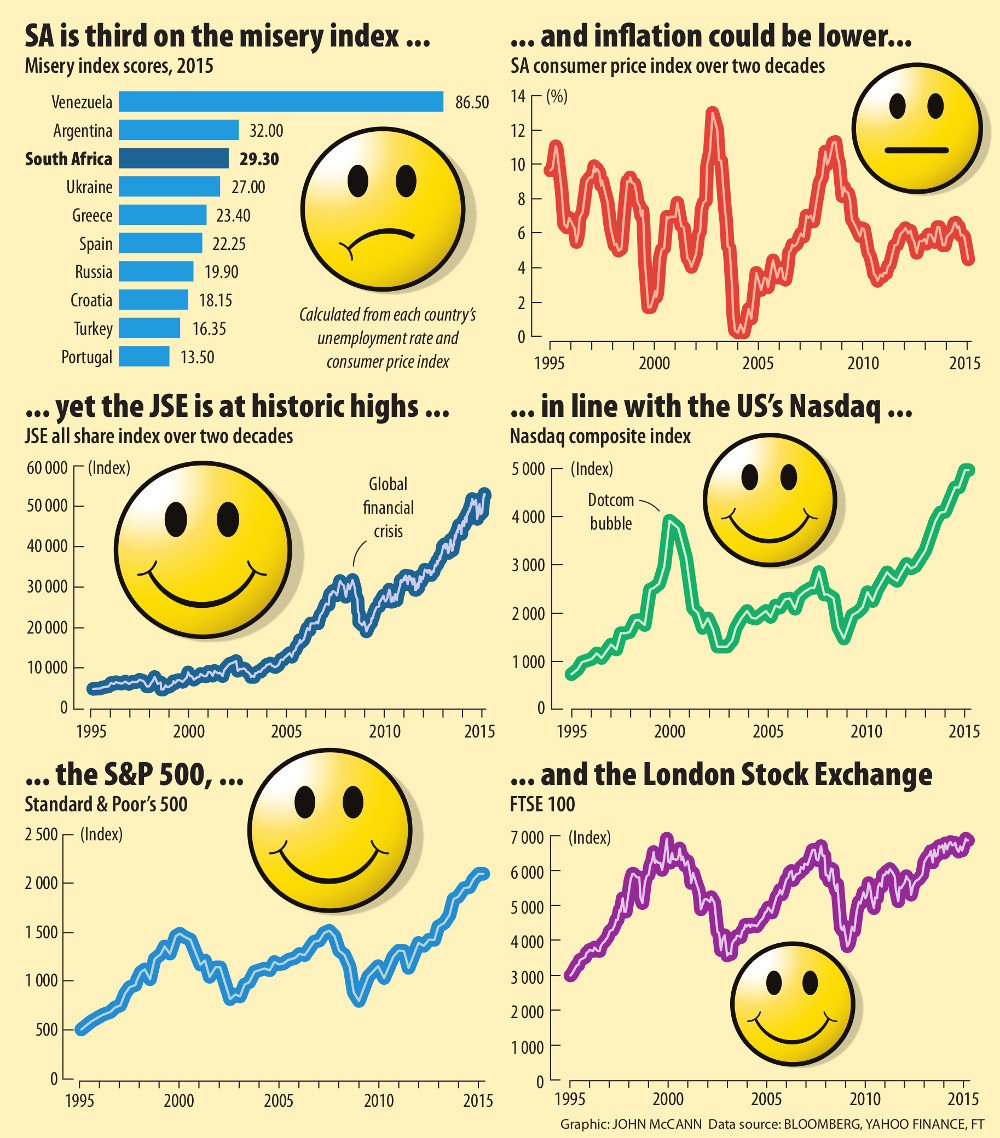

Like many stock exchanges around the world, the JSE climbed to its highest levels ever in recent days – despite a worsening growth forecast for South Africa, the extraordinary parliamentary shenanigans and the possibility of a credit rating downgrade.

The JSE all share index went above 53 500 points on Tuesday last week and the London Stock Exchange reached its highest levels ever. Next was Wall Street’s tech-heavy Nasdaq, which on Monday reached a level last seen during the dot-com mania of 2000 and then passed it, ringing in at 5 800 points. The S&P 500 and the Dow Jones also closed at record highs on the day.

Improvements in the United States economy could be behind the dollar passing the highs last seen 11 years ago, but the trouble at home does not seem to warrant the JSE’s buoyant activity. In fact, Bloomberg’s “misery index”, released this week, declared South Africa as the third most painful economy in which to live and work. It came in after Argentina and Venezuela.

The emerging markets analyst at Nomura, Peter Attard Montalto, said the disruptions during President Jacob Zuma’s State of the Nation address, which saw plainclothed and armed policemen forcibly removing opposition members from the chamber, was cause for concern, particularly for investors, but the markets did not appear to be perturbed by it.

Mohammed Nalla, the head of strategic research at Nedbank Capital, said the JSE was driven by international factors, as its biggest listings by market capitalisation were multinational corporates. One factor playing a key role was the question of the US interest rate, which is at a historical 0.25% low.

“Recent economic data has disappointed, so the assumption is that the US will postpone a hike and that is construed as sportive for financial markets,” Nalla said.

Rate cuts

And in developing markets rate cuts are not uncommon of late. India, for example, cut its key interest rate for the second time this year on Wednesday.

But the rocket fuel in the equities engine, the underlying reason for no expected rate hike, could well be the low oil price, which has brought down inflation.

According to Wayne McCurrie of Momentum Wealth, last year, the outlook was for higher inflation, but two things had changed.

“The lower oil price means there is no inflation worldwide, and the result is the chances of higher interest rates are quite remote.”

Brent crude dropped spectacularly from more than $110 a barrel in mid-2014 to less than $50 at the beginning of the year. The low prices were driven by oversupply, particularly in the US market, where new shale gas production has come on line.

The low price was further sustained by Saudi Arabia, one of the world’s largest oil producers, which chose not to cut production.

Oil influence

Market speculation was that the Saudis’ intention was to keep the oil price so low that some shale gas producers would go bust. And many have since stopped their operations. As a result, the oil price has risen to $61 a barrel, but some analysts forecast the price will remain low for 2015.

McCurrie said, on the back of the low expectation of interest rate hikes, bond rates had collapsed again. “Bond markets have been at historic [low] yields.

The oil price, being lower, has offered bond rate support. Liquidity out of Europe in the form of quantitative easing [a bond buying programme worth €1.1-trillion, announced by the European Central Bank in January] has also helped.”

He said the markets were driven by two factors – liquidity and profit growth, which were equally important.

“Liquidity, how much money is around, essentially boils down to interest rates, which boils down to inflation … Since 2008, liquidity has been a far bigger influence on markets than profits,” he said.

Rand weakness

Rand weakness may be bad news for some parts of the South African economy, but it’s good news for the stock exchange.

“We have got a funny share market. There is actually virtually no South African manufacturing companies listed, but retailers would be vulnerable because they import a lot. Essentially, a weak rand is good for our market. Between 70% and 75% of our share market do business in a foreign currency,” McCurrie said. “Our share market is a highly effective rand hedge.”

He said the JSE was clearly a global market. “Only about maybe 25% or 30% of our share market is directly related to what happens in South Africa … [But] the JSE clearly does factor in the political landscape, although, sometimes we don’t know how. Most of the domestic exposure is in the retail sector, and that has run like crazy, so sometimes you wonder how it factors in.”

Attard Montalto has also been left wondering about the anomaly and, in a note this week, he said equity markets were not fully pricing in political risk. “Portfolio markets [equity and bond markets combined] seem not to care about the significant constitutional and political issues arising from President Zuma’s State of the Nation address. There has effectively been a major political sovereign risk event with no market reaction.”

McCurrie said: “When you look at politics, we sometimes overstate it. Government finances are in a bit of a mess, but otherwise we are a fairly stable country politically. Effectively, in South Africa, what you must factor in is a 2% to 2.5% economic growth rate, but global events are far more important.”

Market boom

Attard Montalto said supportive US data and the rhetoric of the federal open market committee (which suggests a rate hike is not imminent) could be partly to blame for the market boom, “we also notice a distinct lack of questioning from portfolio market investors, unlike their corporate counterparts who undertake foreign direct investment into South Africa, who have had many questions”.

The increase on the 10-year government bond rate, considered a benchmark, was only slight, from 7.61 to 7.77, after Finance Minister Nhlanhla Nene delivered his maiden budget speech last week, in which he said times would remain tough for South Africa.

Nalla said, again, international factors were at play and driving the bond market. South African bond yields tended to have a high correlation with US yields, which were low.

For the JSE, its record levels have been helped by expectations of a potential rise in commodity prices, which bottomed out in January.

Attard Montalto said: “The JSE has too much upside momentum that is exacerbated by rand weakness and continued growth …

“The South Africa Reserve Bank is also providing support to the markets with its hawkish stance [using rates to target inflation], standing out from its peers in emerging markets, who are cutting rates or at least being dovish. This provides a degree of stability to markets.”

Foreign investment

Interestingly, the JSE hit these record highs despite a large withdrawal of foreign funds over the past four months. Statistics provided by the JSE show R24.65-billion in foreign investment flowed out of the equity market from the November to the end of February, as opposed to R16.4-billion which flowed in the four months from July to October.

Nalla said he thought the markets had weighed in the risks.

“Ironically, curtailing energy supply in South Africa puts a drag on growth, which implies lower yields, because it’s implied monetary policy will remain accommodative for some time,” he said.

“So I think domestic factors are priced in, with the exception of a credit ratings downgrade.”

Of particular concern is that Standard & Poor’s could again downgrade South Africa’s credit rating in June. That would relegate government bonds to subinvestment grade (or junk status), which could rattle investors, who might dispose of them, and it could raise the cost of borrowing.

Dangerous market

Technical analyst Clive Roffey said the only thing driving the markets was stupidity and greed.

“At the top of the market is euphoria. Effectively, you have the greed syndrome kicking in, and the expectation of superb delivery,” he said.

“From a technical point, this is one of the most dangerous markets I have seen in 50 years. Everyone has their reasons for believing what they believe.

“The point is there is not more money around but there is easy money around.”