Cell C acting chief executive José dos Santos.

In South Africa’s saturated mobile market, the market’s underdog, Cell C, has made a bold move to capture consumers by offering to buy them out of their existing contracts.

But the operator appears to be a puppy nipping at the heels of the telecom big dogs, which have fearlessly hiked their rates, despite enjoying earnings well above international averages, yet retained the bulk of their customers.

In April this year, MTN announced price hikes for many of its products, including existing contracts.

This followed Vodacom’s announcement at the end of March that, come May 1, existing and new contract customers would incur higher prices on voice and data services.

Then two weeks ago Cell C launched an offer, accompanied by a high-powered media campaign, to help buy customers out of contracts on condition that they take up one of Cell C’s Epic contracts (see below).

Gimmicky offer

Vodacom’s chief executive, Shameel Joosub, has described the offer as gimmicky but Cell C’s boss, José dos Santos, said this week “the take-up has been exceptional”.

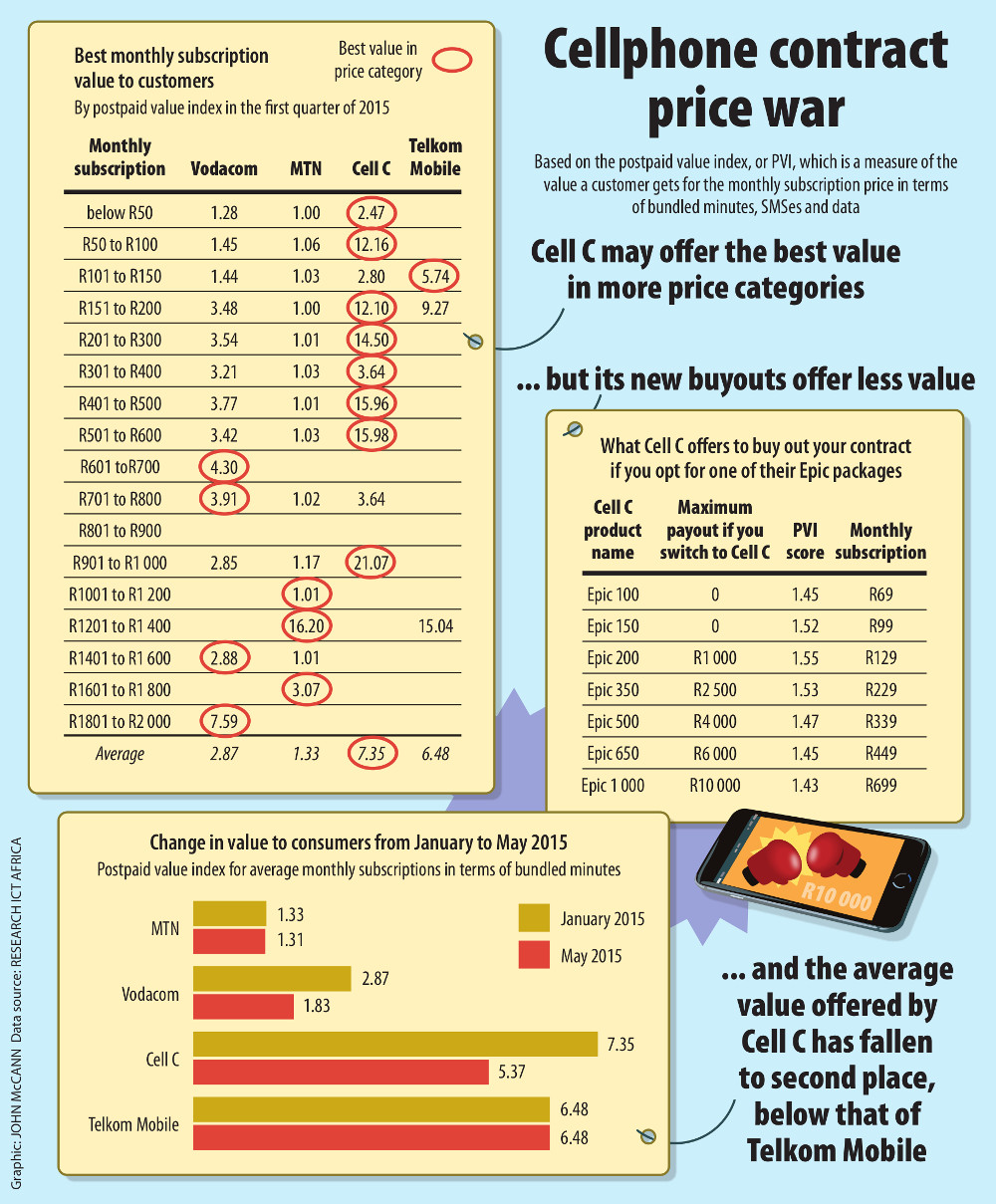

Following Cell C’s offer, researchICTafrica.net, a nonprofit public research network, amended a recently published policy brief that assessed the value one gets for a monthly subscription price in terms of bundled minutes, SMSes and data.

In its assessment of the first quarter of the year, Cell C provided the best average value.

Surprisingly, by launching its Epic products, its overall value was dragged down.

In May, Telkom mobile provided the best average value to its customers.

Postpaid value index

The researchers used a measurement called the postpaid [aka contract] value index (PVI), which assesses the value of products offered by network operators. It does not take into account out-of-bundle rates or handsets.

Although the PVI found Cell?C’s Infinity Select contracts and SmartChat 1GB offer to be the best value for customers in particular price ranges, the authors describe Cell C’s buy-out offer as “a bit sanctimonious”, given that the operator itself increased contract subscription prices early this year.

“Further, the low PVIs of the Epic product range show that switching customers may actually not get a much better product.”

Safia Khan, one of the researchers, said: “Cell C bundle offerings are really good, but the Epic bundle is just airtime – there are no bundled SMSes or data [apart from one, Epic Infinity]. When you hear R10 000, you get very excited, but it is important for consumers to be aware that it’s on condition you take one of their lowest-value offerings.”

Dos Santos said researchICTafrica.net‘s analysis of the Epic plans took into account only the monthly subscription value and not the cash-back buy-out value. He insisted the packages were competitive.

Constant criticism

Cell C is consistently criticised for its network coverage and quality.

“With contracts, Cell C are targeting a high-end customer, but why on earth would they go to a network with such poor quality?” said a telecommunication company analyst, who did not want to be named. “Productive sectors of the economy can’t afford to go with Cell C.”

A 2013 study conducted by the Independent Communications Authority of South Africa (Icasa) found that, in Johannesburg, Cell C had the highest dropped call rate – 8% – compared with MTN’s 5% and Vodacom’s 2.9%.

Richard Hurst, a senior analyst at Ovum, said Cell C needed to keep it “lean and mean” in terms of coverage. “They are marketing themselves to the cost-conscious consumer. That is where they are going.”

Dos Santos said Cell C had invested significantly in its network coverage and capacity.

Capital investment

That included a combined capital investment of more than R4-billion during the 2014 and 2015 financial years. More than 1 350 3G sites were planned, and additional projects were underway in various provinces to enhance network quality and stability.

He added that Cell C had also signed deals worth R8-billion with Huawei and ZTE to roll out LTE across the network over the next three years.

ResearchICTafrica.net said Vodacom was the telecommunications company that was currently investing the most. It had spent R30-billion over the past four years.

“The increased investment by Vodacom is good news for consumers and the price hikes may be worth it for the increased quality of service,” it said.

Khan added: “But that doesn’t mean a subsection of customers must bear the brunt.”

Customer base

MTN has seen its customer base grow over the past five years, but revenue for the past three financial years has dropped.

ResearchICTafrica.net‘s brief said its operating and capital expenditures had decreased too.

Hurst said one of the key issues was the regulatory environment and whether Icasa would flex its muscle to allow competition to flourish.

“We have seen bits of it with the arrival of the asymmetrical interconnect rate, which is designed to let smaller operators compete. But there is still a whole host of other things the regulator can do for smaller guys to flourish and gain a foothold in the market.

“Cell C is in danger of long-term failure. I can’t see how they can continue to keep this up,” the anonymous analyst said.

“Even in big markets around the world, companies are consolidating. They have realised they made a mistake … a small market like South Africa, at the end of the day it can’t sustain four players. But I suppose as long as the [Cell C] shareholders can foot the bill they’ll carry on.”

Revised interconnect rate

Dos Santos would not comment on the benefit of the revised interconnect rate, but said Cell C had exceeded its revenue and Ebitda (earnings before interest, taxes, depreciation and amortisation) targets for the first quarter of 2015, and was on track to deliver on its business plan.

“The company’s financial position has significantly improved,” he said.

Vodacom reports a subscriber base of 32-million, MTN about 26.7-million and Cell C nearly 18-million.

On Device Research last year estimated that mobile penetration was 133% in South Africa.

Price hikes ‘unjustifiable’

Research ICT Africa says an increase in contract prices is contrary to global trends and, because earnings for South Africa’s largest network operators remain significant, this makes recent price hikes “unjustifiable”.

The policy brief says earnings before Ebitda margins in excess of 30% generally indicate healthy operating profit. It references a sector analysis indicating the average telecommunications service sector operator in the United States has an Ebitda margin of 20.3%.

Both MTN and Vodacom have had Ebitda margins higher than this over the past years, Research ICT Africa said. For the financial year ended in 2014, MTN’s Ebitda margin was at 32.1% and Vodacom’s was at 36.8%. For the financial year ended in 2015, Vodacom reported a margin of 36.8%.

This gives Vodacom “a lot of room to absorb electricity cost before shareholders get nervous”, the brief said. “Contract price increases are not justifiable,” said Research ICT Africa researcher Safia Khan.

Research ICT Africa concluded that “the operators seem to have a short-term view to satisfy their shareholders”.

“This may backfire in the long term in two ways: decreasing trust of consumers, and harming the bottom line by increasing the move to Over the Top services [such as Skype, WhatsApp, Facebook].”

Cell C offers an Epic new idea with a price

Termination fees and the outstanding amount owed on a phone or device are a major deterrent to ending contracts with service providers prematurely.

Cell C’s Epic offer remedies this through helping to buy customers out of their existing contracts – provided they switch to one of their Epic offerings, all of which offer devices.

For example, if one opts for an Epic 200 – offering R200 airtime – one receives a R1 000 gift card from Cell C to offset termination charges with the previous contract provider.

The gift card credit ranges upward to R10 000 with the Epic 1000, which offers a device and R1 000 airtime a month, and the Epic Infinity offers unlimited calls and additional SMS and data allocations.

The offer is also extended on the condition that customers trade in their existing device, in exchange for one offered through the Epic packages.

Customers will need to buy themselves out of their contracts first and, with proof of cancellation, can qualify for the specific gift card credits that apply to each Epic offering – although Cell C on its website notes that “any value offered in terms of the contract buyout will be at the sole discretion of Cell C”.

Cell C said its packages flexibly allow customers to choose any handset with any deal.

“The Epic tariff subscriptions are discounted by an average of 30%, which gives the customer 30% additional telco value.

“In addition, Cell C guarantees there will be no price increase for the duration of the contract on these Epic plans,” it said.