ANN7 said the board was part of an advertising campaign centred on wordplay

Who owns the mysterious offshore company tucked away in the shareholding of the empowerment company that is jointly controlled by the youngest Gupta brother, Rajesh, and President Jacob Zuma’s son, Duduzane?

The answer could open a can of worms for ANN7, the Gupta family-controlled broadcaster, which wants the communications regulator Icasa to issue it a free-to-air TV licence.

The practice of registering companies in offshore secrecy jurisdictions is frowned upon internationally, because they are used to evade tax and to conceal true beneficial ownership from regulators and the public.

The empowerment company, Mabengela Investments, is a key shareholder in Infinity Media Networks, the company that owns ANN7.

Mabengela also holds empowerment stakes in other Gupta companies, i ncluding Shiva Uranium, which is well placed to benefit from South Africa’s R1-trillion nuclear expansion programme.

ANN7 is positioning itself to become a broadcast big-hitter as soon as South Africa makes its long-awaited transition from transmitting TV signals in outdated analogue to modern digital format.

Part of the pro-government Gupta media empire, which includes the daily newspaper The New Age, ANN7’s footprint would expand exponentially if Icasa grants Infinity the licence.

Infinity is one of four companies vying for a digital terrestrial licence to join established players such as the SABC and e-TV as free-to-air broadcasters on the new spectrum (see “Meet Gupta TV’s rivals” below).

As part of the application process, the four companies made presentations to Icasa at a two-day public hearing in Midrand earlier this month. In their written application papers, applicants were required to disclose their ownership structures. Infinity’s hefty three-volume presentation is publicly available from the Icasa library in Sandton.

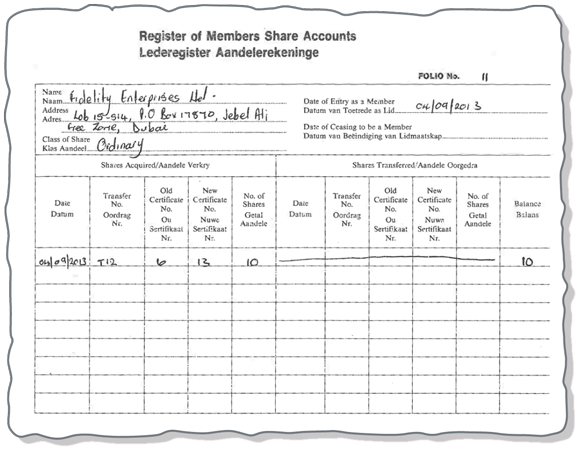

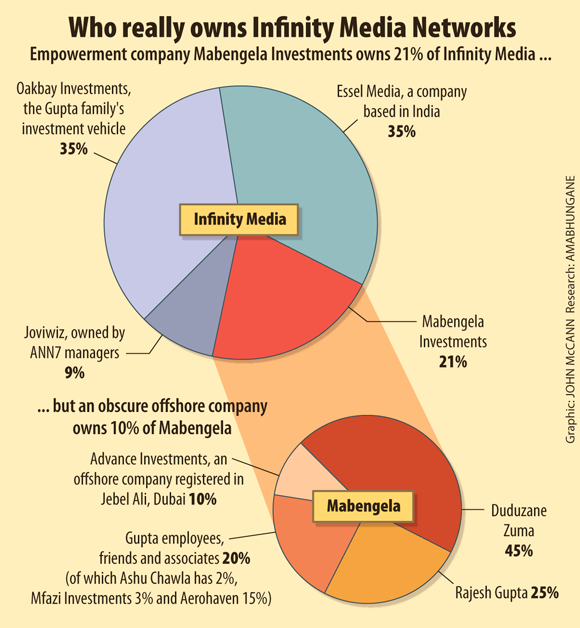

Infinity discloses that it is 35% owned by the Gupta family’s investment vehicle, 35% by an Indian-based media company, 21% by Mabengela Investments and 9% by ANN7’s top management.

The Guptas exert substantial control over Infinity. Apart from their direct 35%, they hold significant sway through Mabengela’s 21%.

Mabengela is disclosed as being owned 45% by Duduzane Zuma, their long-time protégé, and 25% by Rajesh Gupta. Another 20% of Mabengela is owned by an array of Gupta employees, former business partners and friends.

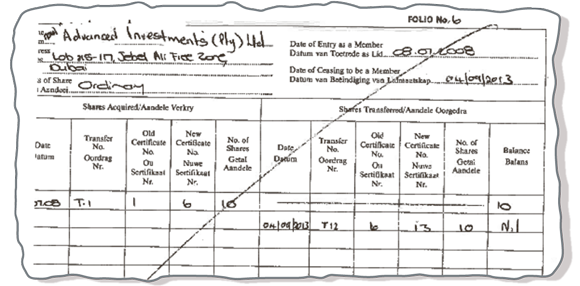

A final 10% of Mabengela is disclosed as being held by a mysterious company that is registered offshore in the Dubai free zone of Jebel Ali. AmaBhungane discovered this when it obtained Mabengela’s share register in December 2013.

Jebel Ali’s companies registry rivals the most notoriously opaque of island secrecy jurisdictions – it declined to confirm even the existence of the 10% Mabengela shareholding company.

Infinity disclosed to Icasa that the Jebel Ali company, which it called Advance Investments, is 100% owned by Sanjay Grover, a Dubai resident with discernible traces in South Africa.

He is the sole director of a company registered in 2012 with a business address in the Free State town of Vrede.

The address is a guesthouse belonging to Estina, the dairy company with several Gupta links that entered into a controversial private-public partnership with the Free State government in 2011.

Mabengela has another Free State connection – at one stage it reportedly employed Tshepiso Magashule, son of Free State Premier Ace Magashule.

The secrecy surrounding Advance is a puzzling anomaly because the existence and ownership of the other companies in the Infinity-Mabengela structure can be verified from publicly available share registers.

And the mystery about who really owns the 10% is deepened by an inconsistency in Infinity’s disclosure to Icasa. The share register obtained by amaBhungane shows Advance’s shareholding in Mabengela was transferred to another company, Fidelity Enterprises, in 2013. Fidelity is also registered in Jebel Ali.

Duduzane Zuma, the Infinity chief executive, Nazeem Howa, and the Gupta family spokesperson, Gary Naidoo, failed to respond to questions this week.

Infinity’s application to Icasa contains an affidavit by Howa, acknow-ledging that the regulator is entitled to set aside any issued licence “should it be found that any material statement in this application is false and has been made by the applicant or any other officer thereof knowing it to be false”.

However, because of their incorporation in secretive Jebel Ali, there is no way for the regulator to verify independently who owns Advance or Fidelity – they are the “black box” at the heart of Mabengela.

Meet Gupta TV’s rivals

Infinity Media Networks is one of four companies applying to the communications regulator, Icasa, for a free-to-air TV licence. Unlike Infinity, whose 24-hour news channel ANN7 is available on Multichoice’s pay-TV platform, DStv, the other applicants are new entrants to broadcasting.

Rubicon TV

Rubicon’s proposed niche is “educational TV” and it intends to “use the medium of television to promote life-long learning”.

Rubicon TV’s controlling shareholder is Rubicon Holdings, which is majority-owned by Louis Pasteur Holdings.

Directors in the Louis Pasteur group of companies who together control Rubicon Holdings include the director of the Louis Pasteur private hospital in Pretoria, Mohamed Adam; deputy president Cyril Ramaphosa’s spokesperson Ronnie Mamoepa, who also sits on the hospital’s board; and former minister Sydney Mufamadi.

Change TV

Pastor Xola Nzo, founder of the Katlehong-based Change Bible Church, is the 70% shareholder in Change TV. Change Bible Church holds the other 30%.

Change TV proposes four channels covering religion, women, youth and “community events”.

Hola Media

Hola Mahala TV plans to “focus on South African and African content”.

It can offer a “hybrid solution” that includes free-to-air TV as well as video-on-demand services for smart phones and other devices.

The 80% shareholders behind Hola are Lincoln and Nolwandle Mboweni. The Mbowenis feature as shareholders and board members across a wide range of companies, primarily in the social grants, transport, leisure and fuel sectors.

Their technology partner is a local subsidiary of Southern African telecommunications company, Liquid Telecom, which has a 20% stake in Hola. – Lionel Faull

* Got a tip-off for us about this story? Click here.

The M&G Centre for Investigative Journalism (amaBhungane) produced this story. All views are ours. See www.amabhungane.co.za for our stories, activities and funding sources.

The M&G Centre for Investigative Journalism (amaBhungane) produced this story. All views are ours. See www.amabhungane.co.za for our stories, activities and funding sources.