The City of Cape Town's ANC caucus has described De Lille as the DA's "sacrifical lamb".

This week yet another global brand launched on South African soil, greeted by throngs of consumers waiting in line. This time it was Popeyes Louisiana Kitchen, a fried chicken institution in the United States and cuisine of choice to stars such as Beyoncé Knowles.

Looking at the queue snaking around the Sandton City food court, you wouldn’t think consumers were feeling the pinch, or that the country was in a technical recession, with leading indicators suggesting more tough times ahead. Online, 200 spots to skip the queue and be the first to taste Popeyes in South Africa were secured long ago.

In recent years, global retail brands have piled into South Africa’s sluggish economy and show no sign of stopping anytime soon. Clothing brands have made real inroads but fast-food brands appear to be more aggressive in their marketing than in their actual roll-out.

In 2011 Australian clothing brand Cotton On entered the market and today its largest store in the world is in Midrand’s Mall of Africa.

The next year Topshop arrived, as did fast-food giant Burger King. In 2014 Spanish clothing retailer Zara entered the South African market as did Pizza Hut and Domino’s Pizza. In 2015, H&M opened its first outlet at the V&A Waterfront in Cape Town to frenzied shoppers – the same year that saw persistently long queues weeks after the opening of the first Krispy Kreme in Johannesburg.

Last year Dunkin’ Donuts, Starbucks and American ice cream chain Baskin-Robbins entered the domestic market. Now Popeyes Louisiana Kitchen hopes to become a favourite among South Africans. It launched its first outlet this week, with more stores and drive-throughs in the pipeline before year-end.

All the while, the data shows the South African retail environment is down in the dumps. “It’s sombre. We haven’t seen a positive data point in quite some time,” said Derek Engelbrecht, consumer products and retail sector leader at EY.

“A few weeks ago there was objective confirmation that we were in a technical recession. That weighs heavily on consumer confidence,” he said.

There is no sense that the situation will improve anytime soon and that affects the willingness to invest. “So we are all asking whether it’s a good time for a competitor to come into the market.”

The biggest indicator of a healthy retail sector is volume growth, but that’s been absent for the past six or eight quarters, Engelbrecht said.

“Over the past two or three years the predominant way retailers have grown turnover is selling a similar number of widgets [volume] at a higher price. That’s called inflation.”

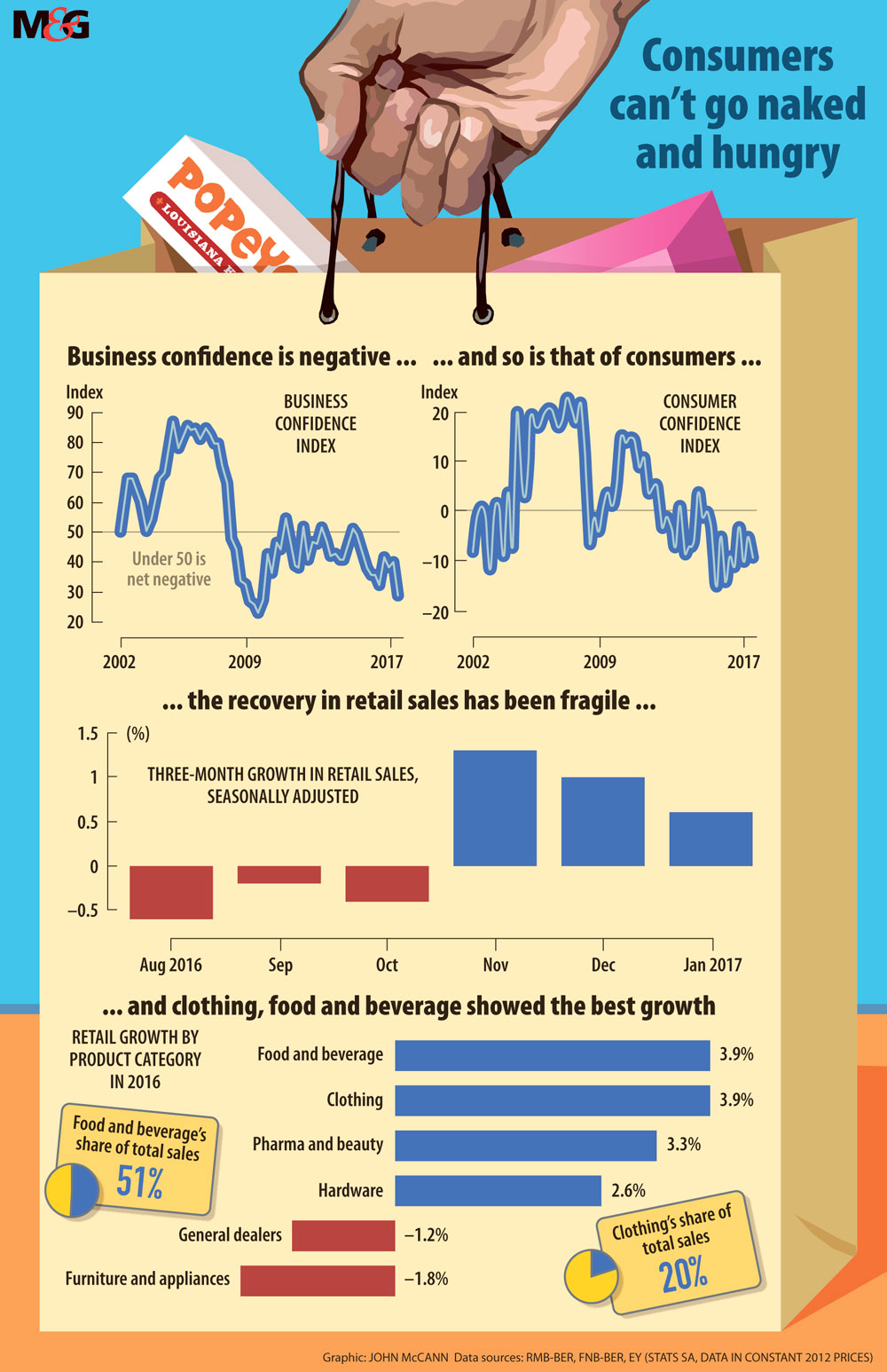

Seasonally adjusted retail sales figures show a slight recovery from negative growth in August, September and October to positive growth into January.

But the Rand Merchant Bank and Bureau of Economic Research (BER) business confidence index released last month showed retail confidence had fallen in the second quarter of the year as a result of weak consumer spending.

This week, the FNB/BER consumer confidence index fell back to -9 in the second quarter from -5 in the first quarter, indicating weak consumer confidence, given that it has averaged +4 since 1994. According to FNB, this marks the longest streak where consumer confidence has been at or below zero since the survey started in 1982 – 12 consecutive quarters.

“Obviously we are in a recession and that will make people tighten their belts, but people have to eat,” said Jaye Sinclair, chief executive of Siyaghopa Trading Group, the holder of South Africa’s master franchise rights for Popeyes for the next 10 years.

Sinclair said he believed people who made use of quick-service restaurants would continue to do so, even in a tough economy, because of the value they offered.

He said Siyaghopa had been awarded the master franchise rights because it has the experience and the management team that could bring Popeyes to market the right way and to deliver.

“We have the ability to weather the storm, but our intention is to make profits. So it’s important how and where we roll out,” Sinclair said.

Sandton City, the richest square mile in Africa, is also attached to several hotels, a convention centre and office space.

“It’s a captive market environment we don’t believe is replicated anywhere else in South Africa,” said Sinclair. “It gives us a cross-section of our target market and so ideally we can go from LSM 6 to LSM 10 in one market.”

The quick-service restaurant segment is growing in South Africa, Sinclair said. “We are in a very time-sensitive environment … convenience is definitely important,” he said, adding that South African consumers also looked for value and quality.

Tasneem Karriem, chief executive of Grand Parade Investments, which has brought Burger King, Dunkin’ Donut, Baskin-Robbins and other brands to the country, said there was no doubt that South Africa remains an attractive destination for global consumer brands looking to find growth opportunities in a new market.

“In South Africa, urbanisation is still topical and with the continued migration from your lower LSM consumer band to the middle LSM, we have found that companies who are invested in and operate in this LSM consumer market are a lot more resilient to the economic change.

“These consumers are looking for convenience and cost-effective offerings and are somewhat ‘brand conscious’ with regards to high quality brands, which is what some global consumer brands offer, providing a lucrative market for these brands to operate in and gain market share.”

An EY analysis of profitability across retail segments did find general food to be resilient. But Engelbrecht said global clothing brands had had greater successes than global food chains.

“The influx of global clothing brands by and large has been very successful. They have taken a certain segment of the retail clothing market and owned it very successfully. Food brands have had a far less prosperous time, and the only way they have done it is in a very measured way,” Engelbrecht said. “But the PR has been excellent, they have been very good at creating hype.”

He said five or so stores in a country of 50-million people would not normally be a compelling investor story, but brands such as Starbucks have been highly successful in the marketing, when in truth “they are all talking about a deliberate roll-out and measured strategy”.

But clothing brands such as H&M and Zara have given established retailers a run for their money. Fast fashion retailer Mr Price this year, and for the first time, reported a drop in headline earnings, yet H&M recently announced it would open six new stores by year end, bringing its total for the year to 17.

“When we looked at Africa we saw there were so many clothing stores in South Africa … What we saw [was] a very big interest for fashion,” said H&M country manager Pär Darj. “What we saw was a price component, also a market that had stagnated. There was room for someone who could be a bit quicker to get global fashion and international garments into the market. Price has always been important for us, and it has been very important for South Africa.”

H&M, established in 65 markets around the world, knows it can take a few years to “set the brand”. Short-term, the market is tough, said Darj, but he noted this presented opportunity, especially for smaller players. “There is so much shopping centre space we have conversations with property owners about where we want to be and invest for the future.”

South Africa, he said, presented an edge in customer service thanks to the availability of good employees who cared about their jobs and so there’s plenty of potential management material.

Cotton On’s 3 200m2 megastore in Mall of Africa achieved the highest sales for a first day of trade in the company’s 26-year history, although, now, “it’s a tough time for retailers in South Africa, and we’re no exception”, a spokesperson said. “But we’re happy with our performance during the last financial year, which included launching our teen girl brand, Supré, which is performing really well.”

The group has grown its South African store footprint to 176 locations, plus five in Namibia, and plans to add four stores in South Africa in the next six months.