(John McCann)

I spent the past week “playing in the USA” from the comfort of my laptop in Johannesburg. And no, I didn’t go on a virtual gambling spree. I signed up for EasyEquities’ #PlayintheUSA project, a test drive that allows you to invest Monopoly money in the world’s most-loved American stocks.

Without spending a cent, I became a proud shareholder in Amazon, Google, Facebook, Apple, Alibaba, Starbucks, Tesla and Costco (the latter because their oversized muffins are amazing).

It’s part of EasyEquities’ launch of its United States stock platform, which will soon allow South African investors to buy into American brands through fractional investing. #PlayintheUSA is one of several products available locally to those keen on investing in their favourite United States companies.

The “game” is also available on other platforms, such as Standard Bank’s Webtrader, as a 20-day free trial account that gives the user a simulated $100 000 to invest.

“Many of the large brokers — such as Sanlam, FNB, PSG, Standard Bank and Absa — offer full-service, online offshore investing in the US, Europe, United Kingdom and some other markets,” Justonelap.com founder Simon Brown told the Mail & Guardian.

“Mostly they are white-labelling Saxo Bank offerings that one can also get direct locally.” Another option for South Africans is to open a US-based brokerage account, he said.

Many local investors have been beefing up their foreign exposure since the country’s downgrade to junk status. But South Africans have been keen on the foreign market for some time now, with the US being the most popular destination. Wealth trading and investment platform PSG Online had more than 4 000 users investing internationally, according to its 2014 user figures.

“The US stock exchanges, for example the New York Stock Exchange and Nasdaq, offer access to the broadest and most liquid listed investment options, more than 7 000 of them, available anywhere in the world — from the most recognisable brands in the world to exchange-traded funds [ETFs] that offer everything from direct regional exposure to other exchanges all around the world to thematic, style-based ETFs that cover everything from biotech to fintech and everything in between,” said Charles Savage, chief executive of Purple Group, the parent company of EasyEquities.

“As a result, it’s the most desirable market to have access to and our clients have been on us since day one to give them the same easy access to other markets, starting with the US.”

Statutory requirements

If you’re interested in investing abroad, you need to be aware of the limitations and legalities. South Africans can invest up to R1-million offshore in a calendar year through what the Reserve Bank calls a “single discretionary allowance”.

The added bonus is that you don’t need a tax clearance certificate from the South African Revenue Service (Sars). The only admin requirement is that you “must produce a valid green bar-coded South African identity document or Smart ID card for identification purposes and the identity number is mandatory when reporting the transaction in terms of the reporting system”, according to the Reserve Bank website.

You can invest another R9-million — adding up to R10-million offshore in a calendar year — if you get a tax clearance certificate from Sars. If you’re one of the fortunate few with more than R10-million a year to invest offshore, your bank will need to apply to the financial surveillance department at the Reserve Bank for approval and the tax clearance certificate has to accompany the application.

“The barriers to entry are high,” said Cannon Asset Managers chief executive Adrian Saville. “The number of hurdles involved in this exclude many, if not most, from participating.” And that’s the attraction with something like EasyEquities, he said: “It lowers the barriers to entry.”

Fractional ownership is an important component of this. “If you wanted to buy a share in Berkshire Hathaway, it would cost you hundreds of thousands of rands to buy just one share, whereas this way you could buy a fraction of a share at a more affordable price,” said Saville.

The long game

With the US markets seesawing every time President Donald Trump says something inflammatory or a new Russia-linked email becomes public, some might wonder about the timing of getting into that market. But Saville says that if you’re taking an investment rather than a trading approach, the “best time to invest is now … If you are truly an investor, you’re going to allocate capital for five, 10 or 30 years. When you look back, your point of entry will make little difference,” he said.

But with so much dual listing (and therefore international exposure) on our local stock exchange, is it worth bothering to invest abroad?

“Great question,” said Brown. “Offshore investing is an important part of a diverse portfolio. But you can do all within reason from a JSE account. We have a lot of global companies on the JSE and ETFs tracking global markets. On ETFs, US companies listed have cheaper fees and a much, much wider range.

“Going offshore is really about individual companies you want to invest in.”

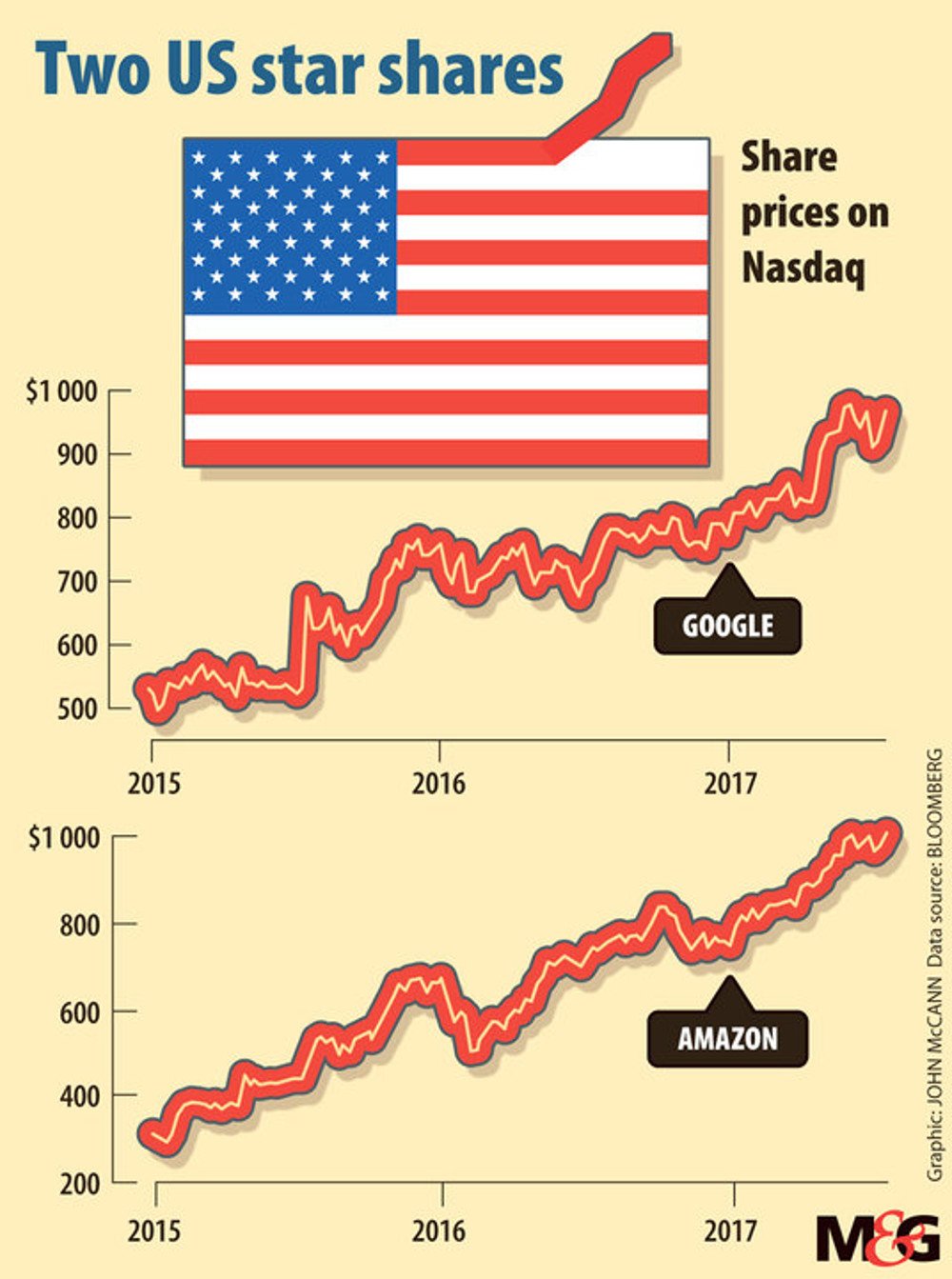

A recent Wall Street Journal article said a third of S&P 500’s gains in the past year came from just four stocks: Amazon, Apple, Google parent company Alphabet and Facebook. If this year’s performance is anything like that, stock-picking your favourites could be a winning strategy.

Other ways to get your dollar on

If you don’t want to exercise your single discretionary allowance, you could still get exposure to the US market by conducting a foreign investment asset swap.

You could choose to invest your money through an investment house that allows for an asset swap facility. Several of the large investment firms and banks provide Financial Services Board-approved platforms for South African individuals, trusts, companies, partnerships and joint account holders to invest offshore without using their foreign investment allowance.

When making use of an asset swap, you can choose to invest in underlying foreign-listed shares, foreign-listed ETFs, foreign-listed money market instruments or -foreign unit trust funds.

Because you don’t have to use your foreign investment allowance, there is no limit to how much money you can invest through an asset swap.

But the investment house or bank that you use as an intermediary must have the requisite asset swap facility available. And most investment houses will require that you invest a minimum amount, often around R100 000 or more.

What is an ETF?

Investopedia defines an exchange-traded fund as “a marketable security that tracks an index, a commodity, bonds or a basket of assets like an index fund.” Unlike mutual funds, an ETF trades like a common stock on a stock exchange. ETFs experience price changes throughout the day as they are bought and sold. ETFs typically have higher daily liquidity and lower fees than mutual fund shares, making them an attractive alternative for individual investors.