(John McCann)

Oddly enough, committing to a two-year cellphone contract is not really an angst-ridden experience for most South Africans.

Instead, most of us revel in the retail therapy and are more occupied with choosing a phone than we are with assessing its ultimate cost. A high-resolution screen, quick processing power and, of course, a good camera for taking the perfect Instagram selfie are more likely to be key to making a decision.

In some cases, your handset will be subsidised by the network provider, but in others, the phone tied to your contract can ultimately cost you more than if you bought it for cash. Depending on which provider and package you choose, the price difference can range from a few hundred rands to a few thousand.

According to research by Tariffic, a company that helps businesses and individuals to minimise their cellphone bills, weighing up the cost of a handset that is part of a contract compared with buying it for cash yielded some “astounding” results.

“There’s no such thing as a ‘free phone’ when it comes to cellphone contracts,” said Antony Seeff, Tariffic’s chief executive. “Sometimes you’ll pay less for your phone and receive a decent subsidy from the networks, but other times it will be better to

get a SIM-only deal and buy your phone cash or finance it through your bank.”

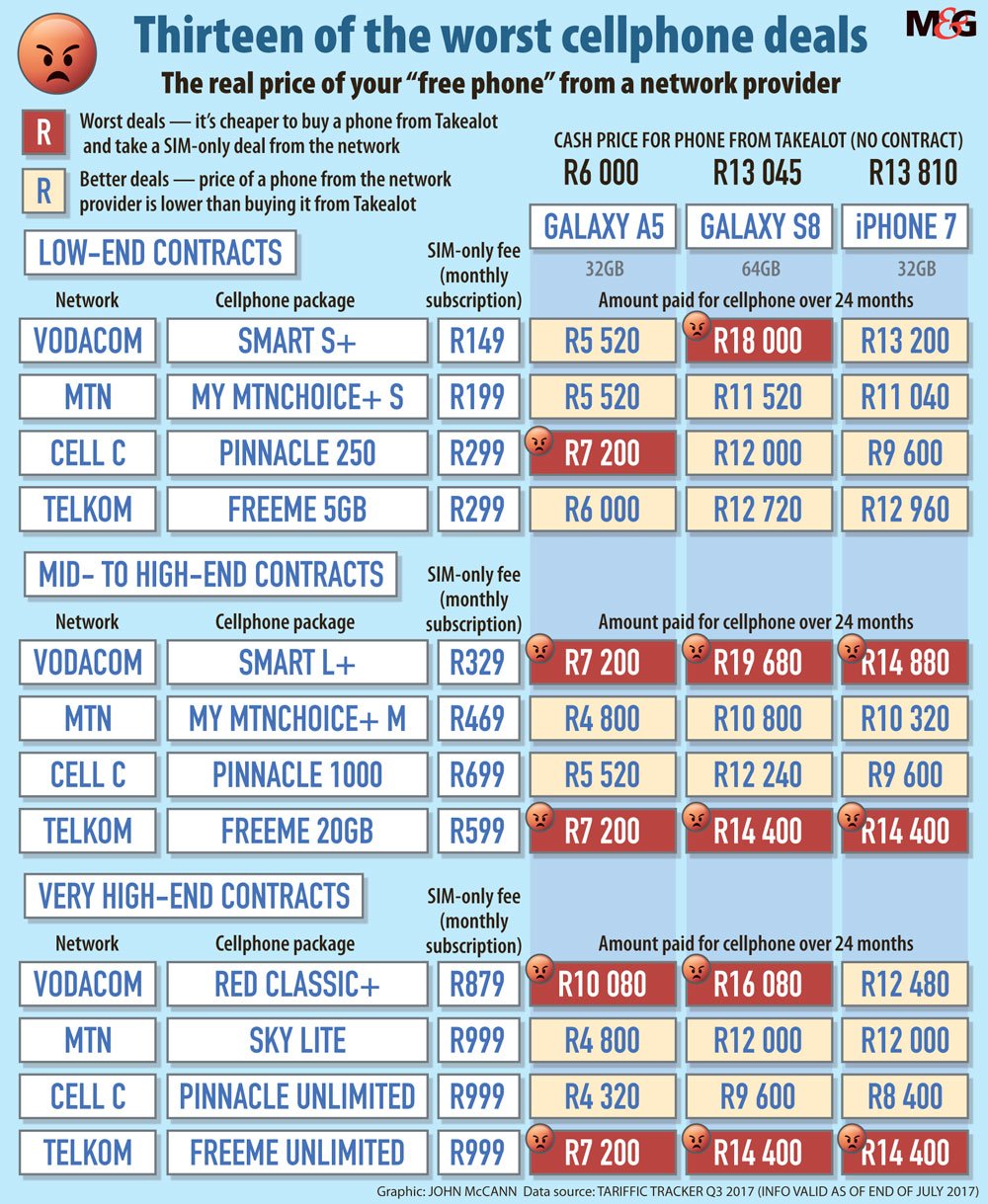

Tariffic analysed three subsets of cellphone packages for each of the four major mobile network operators — Vodacom, MTN, Cell C and Telkom — and some of the most popular models — the Samsung Galaxy S8 (64 GB), the Apple iPhone 7 (32 GB) and the more affordable Samsung Galaxy A5 (32 GB).

The effective amount that customers land up paying over 24 months is calculated by comparing the “deal fee” — how much you will pay every month for the contract plus the phone — against the SIM-only fee for the exact same package, according to Tariffic.

It said its analysis is based on packages that are publicly available in the service providers’ brochures and on their websites, and all tariffs and prices were valid as of end of July.

“There are cases where you get a great deal on a handset and receive a substantial subsidy from your network.

“However, in many cases you will actually land up paying more over 24 months for the phone than if you would have just bought it retail from [the online shopping site] Takealot,” Tariffic said in its report.

From its analysis of 36 package deals spanning low-end, mid-to high-end and very high-end contracts, Tariffic found that in 13 cases the handset cost more as part of a package deal than if it was bought for cash.

The worst deal is from Vodacom, where consumers on a mid- to high-end contact will pay R6 600 more for a Samsung Galaxy S8. On a Vodacom Smart L+ package, the handset will in effect cost the consumer R19 680, compared with the retail cash price of R13 045 from Takealot.

But in 22 cases, the phones worked out cheaper if bought as part of a package deal rather than buying them for cash.

The results show the biggest subsidised deals are on the iPhone 7, whereas MTN and Cell C generally give the largest subsidies.

The best subsidy available was from Cell C, which subsidises an iPhone 7 by nearly R5 500 on a Pinnacle Unlimited package. The consumer pays R8 400 during the course of the contract for the phone, which currently retails for R13 800 on Takealot.

Seeff recommended that people who are looking for a new contract should find the one best suited to their needs, based on the phone they want but also based on their unique behaviour.

When comparing the cost of airtime and data between providers, assessing value becomes even harder.

Last year the department of telecommunications and postal services reported on the cost of communication to the parliamentary portfolio committee.

For cost per minute of airtime, the department, using Independent Communications Authority of South Africa data, found that Vodacom was the most expensive at R1.20 a minute.

MTN was the second highest at 79c a minute and close behind was Telkom at 75c a minute. Cell C was the cheapest at 66c a minute.

In a further comparison of data tariffs, based on a 2016 analysis of the cost of post-paid data bundles by Mybroadband, the department said there were striking differences.

For 500MB, Telkom charged R39 compared with Vodacom’s R45. For 1GB, MTN charged the highest tariff of R79 compared with Telkom’s R59.

For 2GB, Vodacom charged R169 compared with R99 charged by MTN, Cell C and Telkom.

This was an indication that competition in the broadband markets was ineffective, the department said.