(Graphic: John McCann/M&G)

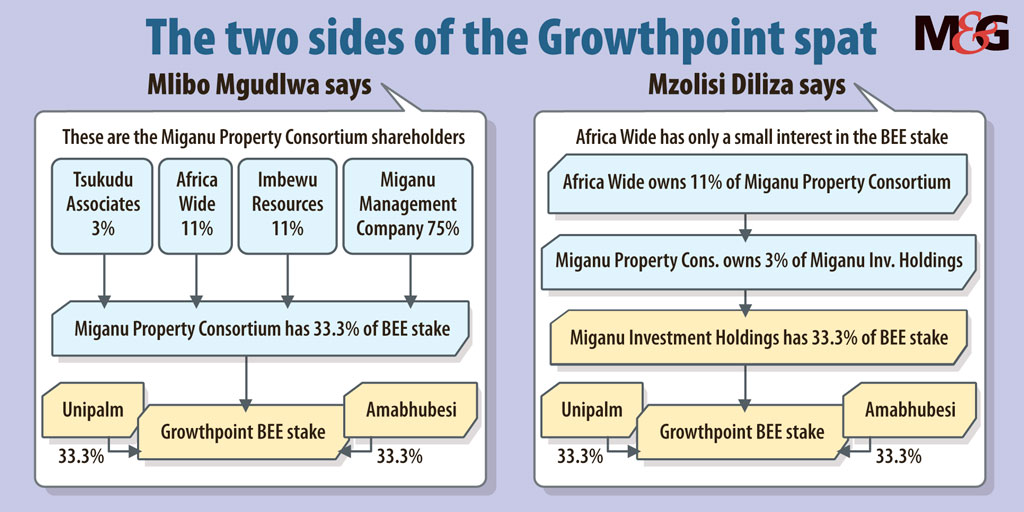

One of the biggest black economic empowerment property deals ever signed is at the centre of a shares battle between two of its BEE stakeholders, Mlibo Mgudlwa, and business mogul Mzolisi Diliza.

Mgudlwa claims that less than two years after his company, Africa Wide Investments, was made a shareholder in the Growthpoint BEE share scheme back in 2005, Diliza unilaterally removed it from the deal without following due process and for years he has been trying to get information from him.

“Around 2007, we came to learn that Africa Wide’s participation in this BEE transaction had been subverted. We then requested information from Mr Diliza to clarify Africa Wide’s participation interest, with no success. He claimed that Africa Wide had no direct participation interest in the consortium,” Mgudlwa said.

Diliza is the founding executive chairperson of Strategic Partners Group, which is the broad-based black economic empowerment partner in the Bombela Concession Company that was responsible for the design, construction and maintenance of the Gautrain.

He said he picked Africa Wide as one of the prospective shareholders.

“Underline prospective. Africa Wide is not a shareholder of Growthpoint, neither is it a shareholder of Miganu Investment Holdings [the company that has direct shares in the Growthpoint deal],” he said.

He said, according to a relationship agreement, direct shareholders in the deal are Miganu Investment Holdings, Unipalm and Amabhubesi.

Africa Wide was three degrees removed — it has shares in a company that has a stake in Miganu Investment Holdings, he said.

More than 10 years ago, when Growthpoint properties embarked on the biggest BEE deal at the time, Diliza was the driver of Miganu Investment Holdings. According to the stock exchange news service, the BEE consortium to benefit from the transaction consisted of three BEE companies: Amabubesi Investments, Miganu Investment Holdings and Unipalm Investment Holdings. The transaction at the time was worth R1-billion.

But, according to a notarised relationship agreement from 2005, Africa Wide was a direct shareholder in Miganu Investment Holdings.

Mgudlwa said his company was removed as the direct beneficiary.

He sought an opinion from Professor Harvey Wainer from the school of accountancy at the University of Witwatersrand. In a preliminary report, Wainer wrote that, from the documents provided by Mgudlwa, it could not be discerned why Africa Wide apparently ended up with no shareholding in Migannu Investment Holding and apparently no interest at all in the Growthpoint BEE scheme.

“Unless there are facts that explain the above, it appears on the face of it that Africa Wide may have been denuded of its interests in Growthpoint, about 3.7-million units,” the report stated.

But Growthpoint’s chief executive officer, Estienne de Klerk, said the company was far removed from the relationship between Africa Wide Investments and Miganu.

“We wouldn’t want to get involved and dictate who our BEE shareholders should choose as partners; that would not be right. We wanted to start the transformation process with this deal but we don’t have insight into how the entities interact,” De Klerk said.

In 2006, after the transaction had been approved, Diliza, who is also currently the chairperson of Growthpoint’s social, ethics and transformation board committee, was removed as the chairperson of Africa Wide for allegedly a “nefarious attempt to buy us [board members] out of Africa Wide”, according to Mgudlwa.

“We believe this is the motive for his [Diliza’s] conduct in appropriating and subverting Africa Wide’s participation interest in the GrowthPoint BEE transaction,” Mgudlwa said.

He also said Diliza had short-changed Africa Wide on dividends “using a fake consortium structure”. “The money remains in the bank account today, untouched,” he said.

But Diliza said Africa Wide’s involvement at the beginning was that of a prospective shareholder and the deal was not sealed.

“This issue has been coming over and over again and I have explained that, guys, we don’t have shares in Growthpoint. This transaction was my transaction and I invited a number of people … They weren’t the only ones.”