(Graphic: John McCann/M&G)

Warnings to watch your spending and not take on unwanted debt on Black Friday are becoming as numerous as the deals being advertised.

Despite expectations that some consumers will gorge on credit to shop on Black Friday and throughout the festive season, there are indications that South Africans are getting better at managing their debt, according to economist Mike Schussler.

Although there will be people who take on too much debt and although consumers are under stress because of high unemployment levels and slow economic growth, South Africa’s levels of household debt to disposable income are at their lowest levels in a decade, says Schussler.

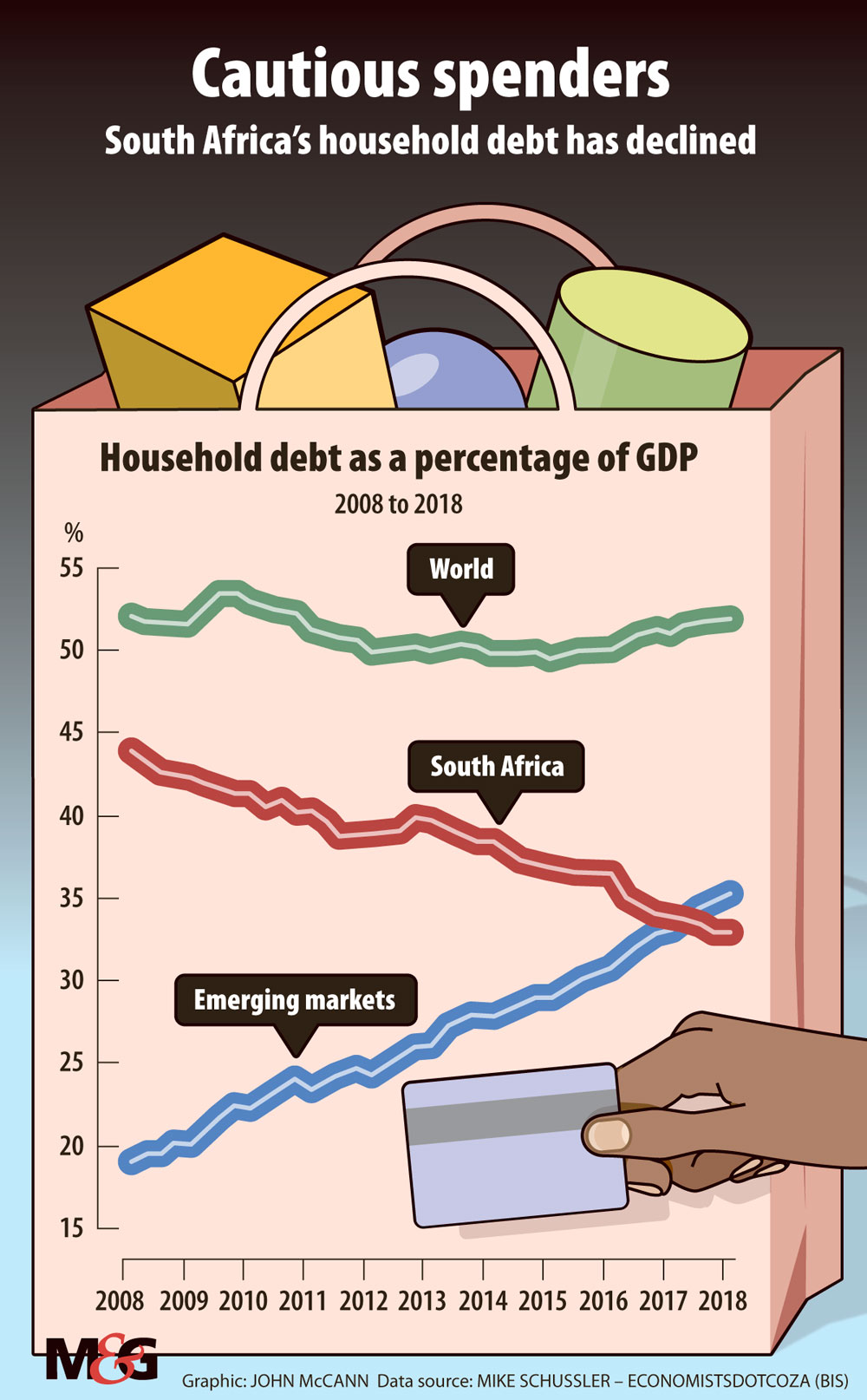

Data compiled by him, using information from the Bank of International Settlements, reveals that South Africa’s ratio of household debt to gross domestic product (GDP) has declined steadily compared with other emerging markets.

Household debt to GDP declined from 43.9% in the first quarter of 2008 to 33.1% in the first quarter of this year. In other emerging markets, household debt rose from 19.1% to 35% in the same period.

In addition, household debt to disposable income levels in South Africa declined from peak levels of almost 88% in 2008 to just over 71% in 2018.

“Quite frankly, the South African consumer no longer has the same debt problem and that’s why our retail sales continue to increase, albeit slowly,” Schussler says. “If people are not becoming further indebted, they have a bit more to spend.”

Consumers are also becoming more careful about how they shop, waiting for discounts on days like Black Friday, he says. They are also becoming more savvy about how they manage their debt levels.

The National Credit Regulator (NCR), however, is less upbeat about consumer debt levels and has cautioned shoppers against splashing out on shopping, especially if it involves taking on more debt.

Black Friday, which is a relatively new development in South Africa, is quickly growing into an annual shopping event and is changing the seasonality of South Africa’s retail sales, which have traditionally been dominated by Christmas and New Year spending, says Schussler.

Last year, Black Friday pushed retail sales levels for the month of November up to 8.2% from the previous month’s 3.5%, or what amounted at the time to the largest year-on-year leap in five years, according to a note from FNB.

According to the bank, it processed on average more than 800 000 card transactions an hour on last year’s Black Friday, peaking at 1.5-million transactions between 4pm and 5pm.

Jimmy Golele, the NCR’s acting manager for education and communication, says consumers should avoid Black Friday spending if they have not planned and budgeted for it, or need to take on extra debt to do their shopping. If a consumer buys on credit on Black Friday, any savings they might make are likely to be cancelled out by the cost of the credit, which includes interest and service fees. An item could end up costing the same as it would normally do, if not more, Golele says.

The regulator has also noted a spike in people looking for additional credit in January, which Golele attributes to the reckless spending that takes place either on Black Friday or during the festive season.

It can also be more difficult for people to get additional credit in January, says Golele. “Remember, during the festive season, people will also skip paying their accounts, trying to use the cents from not paying [their debts] for the festive goodies that they buy.”

Their accounts fall into arrears and as a result they are “red-flagged” come January, which makes them less likely to qualify for credit, he says.

According to the NCR, there are about 24.59-million credit-active consumers, of which about 61% are in good standing, or their accounts are up to date.

But about 9.6-million are impaired, which means they are three months in arrears and have an adverse listing with a credit bureau, Golele says.

But there has been a relative improvement in these figures since 2015, according to the regulator’s data. In that year, the proportion of consumers in good standing was about 57.7%. The number of consumers in arrears, meanwhile, declined from 9.91-million in 2015 to the current figures.

This is because of a number of factors, including that consumers “are making wiser and more informed decisions about how they use credit”, Golele says.

“However, it may also be … [that] the tough economic times are making it impossible for consumers to actually access credit,” he says, pointing to increases in value-added tax, the price of fuel and the cost of living more generally.

Tighter National Credit Act regulations, which require credit providers to assess what clients can afford more thoroughly, have also played a key role in these changes, he adds.