(Graphic: John McCann/M&G)

With the country thrashing out a solution to its Eskom problems, foreign investors appear to have taken a renewed shine to South Africa, given the improved performance of government bonds and the rand in recent weeks.

But experts claim it has less to do with local efforts to allay investor unease or address concerns about the utility, deemed the biggest threat to the economy, and more to do with global events.

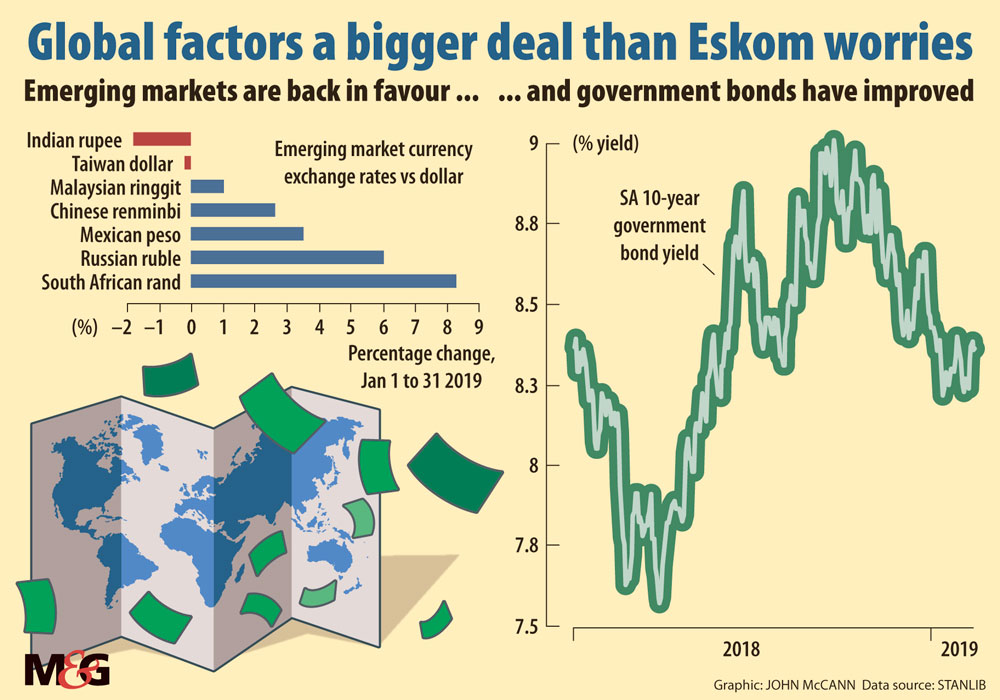

Despite the start of load-shedding late last year, indications of mounting Eskom losses and lacklustre economic data, government 10-year bond yields have steadily dropped from more than 9% in October to about 8.5% at the start of February.

Meanwhile, the currency was the best emerging market performer in January, gaining 8%, according to information from Stanlib.

There has been a sweeping change in sentiment towards emerging markets in the past few months, said Elena Ilkova, the fixed income and credit strategist of Rand Merchant Bank. “The more favourable emerging market growth outlook, combined with the change in the [United States] Federal Reserve’s hawkish stance, has seen most emerging markets benefit. South Africa’s sovereign bonds have reflected the changing sentiment.”

Last week the Fed left interest rates unchanged, saying it “will be patient” as it determines what future adjustments it will make, which has widely been read as confirmation of a softening on interest rate hikes.

This buoyancy in emerging market sentiment has coincided with a marked improvement in credit spreads on Eskom bonds, particularly from the start of the year.

Credit spreads on Eskom’s foreign- issued bonds, particularly those not guaranteed by the government, have declined sharply in the past month— in the case of Eskom’s 10-year unguaranteed bond as much as 170 basis points, according to data from Futuregrowth Asset Management.

“There’s been a risk on environment for emerging markets in the last three or so months, catalysed by the Federal Reserve adopting a more dovish monetary policy stance,” said Yunus January, interest rate market analyst at Futuregrowth. He added that as a result there has been an increase of capital flows into emerging markets. Credit spreads on South Africa’s sovereign dollar denominated bonds have also been declining.

“But the compression we are seeing in the Eskom dollar bonds has been significantly more,” said January. The shift is not explained by any material changes to Eskom’s fundamentals, however, so there is clearly “something else at play”, he said.

“But the compression we are seeing in the Eskom dollar bonds has been significantly more.”

The build-up to the State of the Nation address and expectations of an announcement about resolving Eskom’s troubles may explain some of this.

But recent information coming out of Eskom has, if anything, been more alarming. At public hearings earlier in the week, it revealed it requires a 17% increase in tariffs in the first year of the upcoming three-year cycle instead of the 15% initially applied for. The hikes requested for the following two years were increased to 15.4% and 15.5%.

This came after the utility adjusted its application to cater for newer data, including on its sales forecasts and its regulatory asset base, which inform how Eskom calculates its required revenue.

The utility’s chief financial officer, Calib Cassim, also told the hearings that the utility is expecting to make a net loss of R20-billion for the current financial year. This is well above the already dire forecast of losses of R15-billion, which Eskom announced late last year. He added that these losses were expected to continue for the next few years, “even with the applied-for increases”.

In South Africa’s case, the positive emerging market sentiment has coincided with significantly better messaging from the government on a plan to resolve Eskom’s difficulties, according to Ilkova. Investors are finally beginning to believe in the government’s commitment to taking action to address Eskom’s structural issues, she said.

Eskom’s “significantly improved disclosure” about its problems — including neglected maintenance at older coal stations, design and operational defects at Kusile and Medupi and the need for emergency coal procurement — helps in understanding the scope and size of the problem, Ilkova added.

The extent of the difficulties posed by Eskom notwithstanding, global factors very often have a much bigger effect on South African markets over time than domestic policy issues, said Kevin Lings, Stanlib’s chief economist.

The recent improvement in the bond market and the strengthening of the rand have been largely driven by foreign investor sentiment after the change in the signals from the Fed.

A significant amount of these capital flows are opportunistic and are aimed at taking advantage of the interest rate differential between South Africa, whose rates are higher, and the US.

“A particular segment of the global investment community is opportunistic in nature and is not especially concerned by these types of events,” Lings said.

But South Africa relies heavily on these portfolio flows and is particularly vulnerable to their reversal, he said.

The way to balance this is to attract long-term foreign direct investment and this is where conundrums such as Eskom and other domestic policy problems do affect the economy’s ability to attract the more stable kind of investment that establishes businesses, creates jobs and boosts infrastructure development, Lings said.

It is very possible that, if global trade tensions ease, concerns about China’s growth dissipate and growth in the US economy picks up — all factors influencing the US position on rates — the Fed may begin hiking rates again.

If this happens, sentiment is again likely to turn against emerging markets and foreign flows may reverse, even if it coincides with South Africa making material headway in addressing Eskom’s problems, Lings said.