Eskom faces fines of up to R5-million under South Africa’s air quality legislation for supplying blatantly false and misleading information about its toxic pollution at the Kendal coal-fired power station to authorities.

(Waldo Swiegers/Bloomberg/Getty Images)

(John McCann/M&G)

(John McCann/M&G)

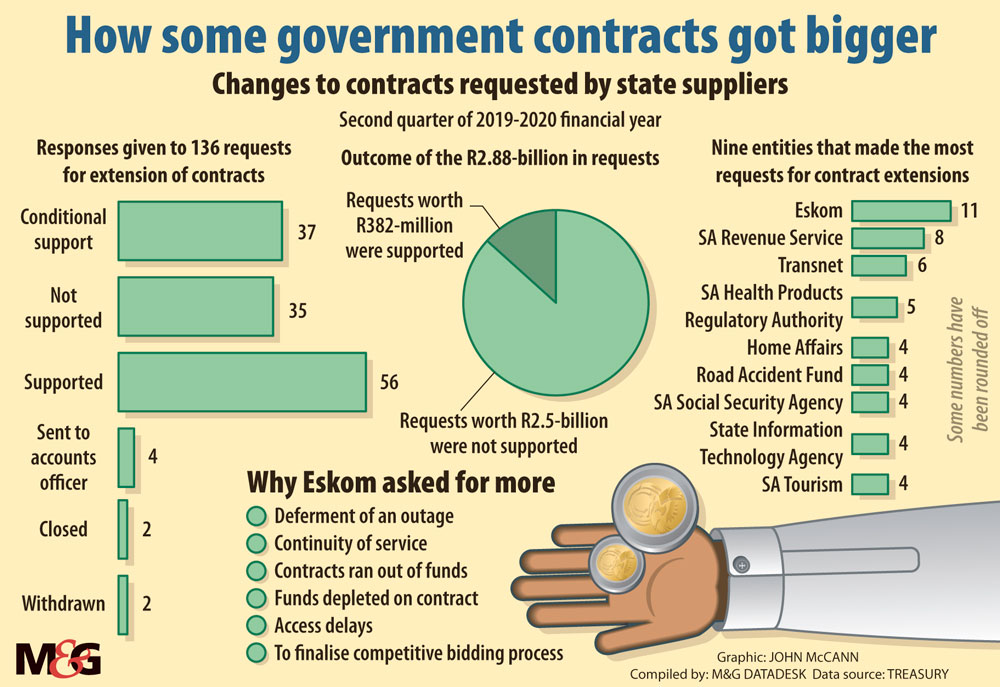

Struggling power utility Eskom is under threat of a possible strike — which could lead to more load-shedding — from one of its biggest coal suppliers, South 32. This after the national treasury rejected a request to hike its coal supply contract by R1.2-billion.

The threat places more than 7 000 megawatts of power on Eskom’s grid at risk: South32’s two mines are tied to supply coal to the utility’s Duvha and Kendal power stations in Mpumalanga.

A loss of this much power would almost guarantee load-shedding as Eskom’s latest energy availability numbers — issued in its weekly system status report — show that the average total available generation last week sat at 31 844MW, with demand at 29 189MW.

Yesterday Eskom announced that it would implement stage two load-shedding on Thursday night after delays in bringing back units that were down for maintenance. This means that only 2 655MW stood between the company and a situation where demand outstripped available capacity. Losing more than that would also scupper new chief executive André de Ruyter’s plans to implement much-needed maintenance, through controlled low-intensity load-shedding, over the next 18 to 24 months.

De Ruyter said this week that he hoped his new plan, which could postpone Eskom’s plans to unbundle the company into three separate entities with their own boards

and executives, could be approved by the end of the first quarter of the year.

The Mail & Guardian has learned that last November, treasury’s acting chief procurement officer, Willie Mathebula, rejected Eskom’s request to increase the Australian mining giant’s now R39-billion contract by a further R1.2-billion. According to South32, this leaves the company with little option but to halt mining and the supply of coal from its Ifalethu Colliery — which has lost the company nearly R3-billion in the past three years.

The request, which is provided for in the contract between South32 and Eskom, is reminiscent of Gupta-owned Tegeta Exploration and Resources’s increase in price from R150 a tonne to R201.46 a tonne in 2018, while relaxing coal quality.

Tegeta threatened to pull the plug on Eskom’s supply from Optimum unless the company approved an increase from R150 a tonne in the 20-year supply contract signed in 1998, when the company was run by mining giant Glencore.

A letter written by South32 SA Coal Holdings president Kgabi Masia to Eskom, and attached to the treasury submission, said: “The agreement forms a large part of South 32 Coal’s portfolio commitment and, as such, creates a consequent ripple effect on South32 Coal’s other Eskom commitments.

“Every small delay in resolving the problem extends the South32 Coal losses and threatens its viability as a coal supplier to Eskom, across all its operations. If the hardship is not ameliorated, the future supply of coal to Eskom is in serious jeopardy.”

Masia offered two proposals: that Duvha, whose coal stocks are at 40 days and not operating at full capacity, accept less coal, or increase the price to R416 a tonne. “Should Eskom not revert with an acceptable, equitable solution by 7 November 2019, South32 Coal would be placed in the undesirable position of having to exercise its options,” he ended.

Eskom’s request to the treasury, seen by the M&G and sent two days before the deadline, said the amendment will secure delivery of five-million tonnes in six months to Duvha at a price between R380 a tonne to R416 a tonne — at least R110 a tonne more expensive than the current R269.80 a tonne.

During the six months of the contract, which would be backdated to November 1, Eskom would review South32’s hardship claim and determine a price going forward. “In doing so Eskom will avoid a similar fate to Optimum Colliery and the resulting contribution to the acute coal-supply shortages of 2018,” said the request.

It went on: “The coal price offered in the interim amendment proposal is competitive compared to the replacement coal, which is sourced by Eskom from alternative suppliers in the short- to medium-term market. Sourcing replacement coal on [an] urgent/emergency basis comes at a premium, with additional transportation costs.”

In internal Eskom documents attached to the request to the treasury and motivating for the extension, the utility’s finance business partner in primary energy, Snehal Nagar, said an analysis of South32’s South African coal business reported an R8.7-billion loss for the year ending 2019 and had reported R337-million loss in the first three months of the new financial year ending in 2020.

Mathebula however was not convinced. “It is not clear whether the price increase quoted by the supplier is competitive and market-related. It is also not clear whether there are no other measures the supplier can explore in ensuring financial assistance except through the intervention of the state … The institution has an obligation to ensure that any contract for goods and services is in accordance with a system which is fair, equitable, transparent, competitive and cost-effective.”

The treasury, which last year appropriated R69-billion in emergency cash to Eskom, which was struggling to pay interest on its R450-billion debt, this week said it had no comment on the request, which is not budgeted for and has serious implications for Eskom’s precarious financial position.

In the past two years Eskom introduced South Africans to two new stages of load-shedding, stage four and stage six, as a combination of plant breakdowns, adverse weather, and strange equipment malfunctions caused a serious loss of capacity.

The last round of load-shedding, at the beginning of January, resulted in the resignation of Eskom chairperson Jabu Mabuza amid accusations of him misleading President Cyril Ramaphosa, who told the nation — just a month before —that there would be no black-outs between December 11 and January 13. The blackouts were also used by ANC factions to ramp up pressure for Public Enterprises Minister Pravin Gordhan — and the rest of Eskom’s board of directors — to either step down or be removed.

Last week the Council for Scientific and Industrial Research released a report that found that the cumulative cost of 530 hours of load-shedding last year cost the economy between R59-billion and R118-billion.

This week Eskom declined to discuss specifics of the South32 contract, citing commercial sensitivity. It also said “as per the national treasury regulations, modifications to contracts require their approval and Eskom applied to national treasury based on the outcomes of engagements with South32.

“Eskom is currently engaging national treasury on this matter,” an Eskom spokesperson said.

In his letter, Masia notes that although Eskom, at a meeting attended by then chairman and interim chief executive Mabuza, acknowledged hardship, it did not appreciate the severity of the situation, which is costing his company R120-million a month in losses.

The hardship has seen respective losses of R1.3-billion, R1.2-billion, and R370-million in the financial years ending in 2018 and 2019, and by the end of June last year.

South32 — which, according to the documents has not met coal-quantity requirements since June 2019 — said discussions with Eskom were ongoing. “Despite numerous cost reduction initiatives, the contract remains economically unsustainable, materially impacting the whole South Africa Energy Coal business,” a spokesperson said.

(John McCann/M&G)

(John McCann/M&G)

South32 chief operating officer Mike Fraser said last year: “As a major supplier of coal to Eskom, we acknowledge the government’s request for suppliers to support cost reduction and will continue to work with them to manage their cost, while ensuring our operations are sustainable. Reinvesting in cost-plus operations enables the lowest-cost coal procurement with delivery by conveyor — removing the need for short term procurement from high-cost producers.”

South32 inherited the contract — which was signed in December 1994 as a fixed-term contract to deliver 10-million tonnes a year for 10 years — in the demerger of BHP Billiton in 2015. That saw the creation of South32 SA Coal Holdings to house the new entity’s thermal coal mines.

The initial contract had an option to be extended every 10 years until 2034. In accordance with contractual provisions, in 2012 Eskom’s board tender committee approved an amendment that saw contract’s value increase by a whopping 246%, from just more than R11.5-billion to R39.5-billion a year. Had this latest proposal been approved the price would have increased to R40.7-billion.

Last November, engineeringnews.co.za reported that South32 and Seriti agreed for the latter to acquire South32’s 91.8% stake in South Africa Energy Coal, the operator of the coal mines, for R100-million cash and a further R1.5-billion a year in deferred payments until 2024. The remaining 8.1% would remain in the hands of Phuthuma Nhleko’s Pembani Group.

The sale has been shrouded in controversy and allegations of favouritism after it was revealed that both South32 and Seriti’s top officials were entertained by the department of mineral resources, while other prospective bidders were not afforded the same treatment.

This week, Eskom said: “Eskom is undertaking its own due diligence process on the successful bidder. Should Seriti successfully acquire South32’s coal assets, they will be among the largest coal suppliers.”

Several commentators have questioned why Seriti Resources would be so keen to buy South32’s coal assets, if it were in such a tight spot.