The retirement savings industry has received a shot across the bow from financial services provider Outsurance with its new OUTvest offering encompassing all the features of a retirement annuity but with rock-bottom fees.

The retirement savings industry has received a shot across the bow from financial services provider Outsurance with its new OUTvest offering encompassing all the features of a retirement annuity (RA) but with rock-bottom fees.

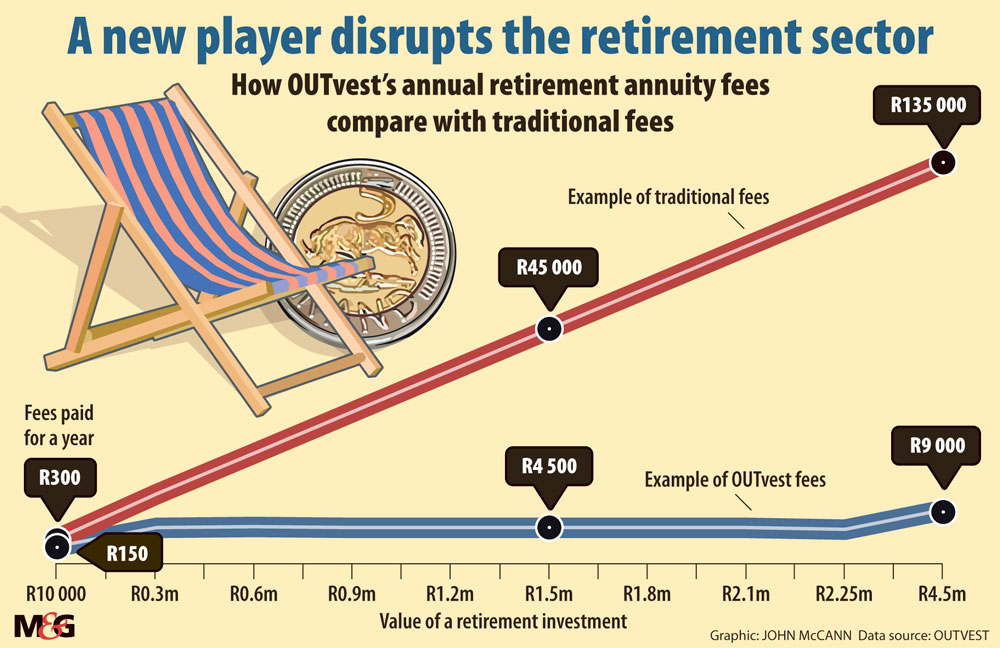

Where the industry typically charges fees of 3% for these products, OUTvest’s equivalent fee is just 0.2%. It says that the difference over a lifetime of saving can mean as much as an extra 60% at retirement. Investors could save up to 90% in fees.

OUTvest’s offering includes an online calculator to enable clients to set, monitor and alter their financial goals. Should additional advice be needed, human interaction is available.

“OUTvest’s OneFee is like shots fired at the industry,” says personal finance expert, Galileo Capital’s Warren Ingram, who adds that the product may prompt more South Africans to prioritise their retirement savings.

“Most of the complaints are that people don’t understand percentages because it’s confusing and unclear. If you have something that is simple and easy to understand and you are paying your fees with a rand amount then you don’t have to calculate any percentages,” he says.

“OUTvest’s low fees will have an impact on the retirement annuity world and force other players in the industry to look at their fees more seriously,” he says.

Most RAs in South Africa have annual fees of between 2% and 3%. This excludes any trading costs or taxes. Many services in the investment value chain are performed by different providers and each of those providers also charge a fee, which is taken from the investment.

The 2% to 3% may not sound like much to pay for an investment but, say you have invested R1-million into your RA, R20 000 to R30 000 would go annually to manage the investment. The more you invest, the more you pay even though the service provided does not necessarily change.

By comparison, OUTvest’s 0.2% fee on R1-million invested would have an annual cost of just R4500.

OUTvest’s OneFee offers one of the lowest RA fees in the country. Clients who invest between R300 000 and R2.25-million pay a single fixed fee of R4 500 a year. This represents a 0.2% cost of managing the investment.

For clients who invest less than R300 000, OUTvest will charge 1.5%, which is still below industry standards.

A 0.2% fee applies from R2.25-million.

An RA is a popular retirement investment plan as it offers tax advantages over other savings products. It is similar to a pension fund except that it is completely independent of your employer. One benefit of this type of investment is that it is exempt from tax on dividends and interest. Once you retire, you are allowed to take a third of your savings, up to R500 000, as a cash lump sum which is tax free.

Although ensuring that you’re adequately provided for in your golden years is attractive and often advised, RA’s offered by the various insurers can be tricky to understand. Critics say there is a lack of transparency, particularly about fees, and the selection of RAs is wide and confusing.

First, there is a staggering number of brokers and agents looking to sell you the latest products. Second,

the associated costs and fees mean you often forfeit a large amount of your investment to paying off these costs.

“Usually there are up to four different fees and each of them receive a payout of your investment in percentage terms. All of the investment’s administration, such as generation of taxes, keeping track of the value of the investment and making sure that all your information is safe are included in the annual R4 500 with OneFee,” says managing director of OUTvest, Grant Locke.

“We’re taking on responsibility for the cost of the funds.”

He says one of the reasons the company is able to provide the low flat rate on the investment is because the management of the fund is done “in house” by using robo-advisers.

In a traditional scenario, you would meet a financial adviser to help you choose the correct product for you, Locke says. With OneFee, “robo-advice” asks the pre-qualifying questions and generates answers.

For additional assistance, there is a call centre staffed by qualified, salaried people, rather than commissioned individuals; so they are not incentivised to sell the product.

Locke says OneFee aims to change the low number of people prioritising their investments by making it easier for clients to invest “by leaving it up to the professionals”.

“It’s not like the client has to go back and forecast what the equity markets will do or how the [JSE] Top 40 will perform or whether or not they need to worry about putting more of their investments offshore. They just need to track their investment on the online tracking system and they can save costs while doing it,” he says.

(John McCann/M&G)

(John McCann/M&G)

Independent financial experts see value in the OUTvest offering both in terms of costs and transparency.

Simon Brown, a market commentator and founder of financial education platform, JustOneLap, says the cost of running a traditional RA is often not simple to decipher, making it difficult to have a clear breakdown of what fees are being charged and how your money is being invested.

Brown, who has been in the business of investing for two decades, says RA costs often have a negative effect on investment growth and these costs are compounded over time. These costs are often calculated as a percentage of the investment. Brown says this adds to the “complexity” for individuals being unable to truly know how much of their funds are paid towards fees.

“A lay person has almost zero chance of knowing what they are going to end up paying. The complexity was just to make it difficult for individuals to really know what they were truly paying for any investment,” he says.

Brown says that the RA offered by the Outsurance group is a game changer.

“The fees being paid on other investment platforms are not worth it. It [OUTvest] is very much playing in favour of the investor instead of the product provider because fees have a significant drag on your retirement money over the decades that you have the product,” Brown says.

Depending on your investment, OUTvest’s fees may come in well below its competitors, including market leaders such as 10X which charges 0.9% for the first R1-million invested in the RA. Charges are reduced on a higher balance reaching 0.35% by R10-million.

Brown says clients who invest in OneFee have no reason to be suspicious of a fund being a lower-grade investment compared to other options. One of the reasons for this, he says, is what he calls the “supermarket approach”; to sell at low prices but to sell at large volumes. The company intends making its profits from the large volumes of the products sold.

“I do think that the ability to markedly reduce the fee and still offer a compelling product to the end user is entirely possible. What we will see is a lot of shifting within the industry. There are still a vast number of RA’s that are sold and people are unaware of their fees and unaware of the impact of the fee,” he says.

A report into the retirement landscape in South Africa compiled by 10X Investments showed in 2019 that 67% of economically active South Africans had no retirement plan at all or an inadequate one.

The report also showed that of the more than 15-million people surveyed, 72% of those with some plan were concerned that they will not have enough money saved to live on after they retire.

Most accepted they would need to continue earning an income after they retire.

Thando Maeko is an Adamela Trust business fellow at the Mail & Guardian