Naspers delivered a strong performance during a transformative year, as we build the leading lifestyle ecommerce company in Latin America, Europe and India, driven by AI and innovation.

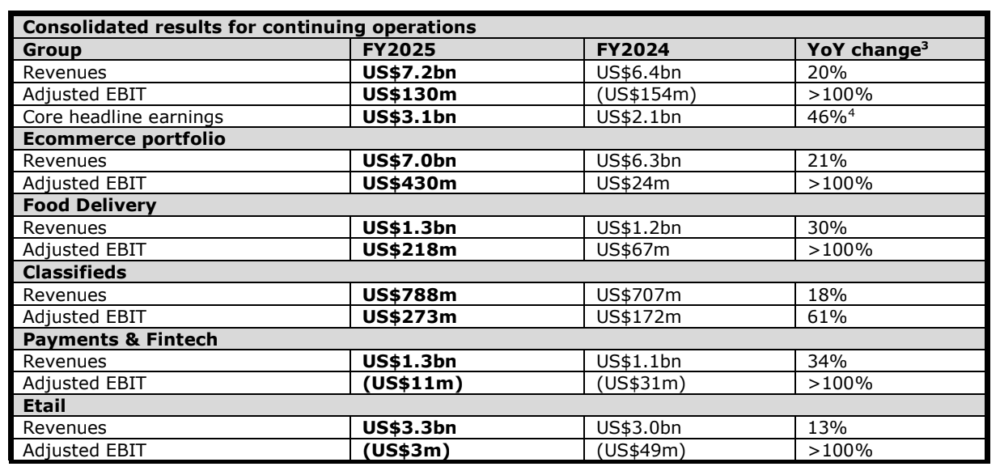

● Ecommerce revenue growth of 21%, to US$7.0bn.

● Adjusted EBIT increased 18 times to US$430m.

● iFood aEBIT grew 178%, OLX aEBIT up 61% and eMAG achieved profitability. ● Free cash flow improved by US$263m, excluding Tencent.

● US$7.8bn1invested to strengthen our regional ecosystems and expand our portfolio of AI-native startups.

● Buybacks returned over US$50bn2, driving 15% NAV per share accretion.

Fabricio Bloisi, Group CEO, Prosus and Naspers said: “Naspers is rapidly transforming into an operating technology company, focused on lifestyle ecommerce, and powered by innovation and collaboration. This past year, we announced two significant deals to strengthen our regional ecosystems. We completed the acquisition of Despegar in May 2025 and are already integrating its products into iFood’s Clube membership. We are making good progress with the purchase of Just Eat Takeaway.com, which will create a new AI-powered tech champion in Europe.

“I believe that truly great companies are shaped by their culture. Through ‘The Prosus Way’, we’ve implemented a cultural model that empowers our teams to deliver exceptional customer experiences through discipline, innovation and adopting an AI-first mindset. In the face of unprecedented technological disruption, we are now more connected and innovative than ever before. I’m confident that our enhanced culture and ecosystem approach will fuel our journey to create the next US$100bn in value.”

Nico Marais, Group CFO, Prosus and Naspers, commented: “The Group has delivered a strong financial performance over the past year, with topline growth in our operating businesses at double the rate of our peers. Ecommerce profitability has improved meaningfully from US$24m in FY24, to aEBIT of US$430m. We expect this momentum to continue, and to add at least the same level of incremental aEBIT in FY26. Free cash flow excluding the Tencent dividend improved by US$263m. As our financial position strengthens, we’re able to share more with our shareholders, and have proposed a 100% increase in the Prosus dividend, to €0.20. The Group’s disciplined capital allocation and strong balance sheet positions us well to execute on our ecosystem strategy.”

Includes proposed acquisition of Just Eat Takeaway.com, which has yet to close.

Total capital returned through the open-ended buyback, and the cash buybacks during FY20, FY21 and FY22 of both Prosus and Naspers.

Group performance

Phuthi Mahanyele-Dabengwa, South Africa CEO and Executive Director, Naspers, commented: “Our South African businesses have delivered strong results while making everyday life simpler, more connected, and more accessible. I’m proud of the progress we’ve made in building digital platforms that meet local needs, support small businesses, and create new digital career pathways. This is evident in the continued growth of the Takealot Group, which has grown GMV 26-fold over the past nine years to become South Africa’s leading ecommerce platform. It’s also evident in our two leading classifieds platforms — Property24 and AutoTrader — which continue to serve millions of users with trusted, market-leading services. As South Africa continues its journey of economic renewal, Naspers remains a committed long-term partner in building a more inclusive, innovative digital economy.”

Peer-leading growth and accelerating profitability across Ecommerce portfolio

Food Delivery: iFood delivers world-class performance, exceeding growth and profitability targets and drives innovation and ecosystem expansion

● iFood delivered strong top line growth, with Gross Merchandise Value (GMV) up 32%, orders up 29% and revenue increasing 30%.

● iFood’s core food delivery business grew aEBIT by 71% to US$306m, improving aEBIT margin to 27%; performance driven by higher ad revenues, increased order frequency and retention driven by iFood’s Clube loyalty programme, and investments in its merchant platform.

● iFood’s growth initiatives grew revenue by 34%, driven by strong performance in its groceries marketplace and credit businesses.

● Overall, iFood achieved a record profit, with aEBIT of US$226m, up 178%. ● Delivery Hero grew GMV by 8% for FY24, with revenue up 24%, boosting profitability to an adjusted EBITDA of €693m (from €254m in FY23). ● From January to December 2024, Swiggy grew Gross Order Value (GOV) by 29%, while adjusted EBITDA losses reduced to US$182m, from US$261m in the prior year.

● In Q125, Swiggy delivered GOV growth of 40% year-on-year, and quick commerce GOV growth of 101% year-on-year, with 316 new dark stores added in the quarter.

● OLX consolidated revenue grew 18%, with standout performances by motors and real estate verticals.

● Motors and real estate grew revenue 24% and 23% respectively, through improved monetisation, innovative product development and new trust-building initiatives within motors, and product enhancements within real estate.

● aEBIT accelerated by 61% to US$270m, with aEBIT margin up 10pp, to 35%.

Payments & Fintech – PayU: Strong topline growth and improving profitability, despite challenging market conditions

● India payments TPV5increased by 17%, and revenues by 14%; aEBIT loss of US$12m reflects increased competition, resulting in lower take rates. ● India payments achieved breakeven in H2.

● India credit grew its loan book by 19% and revenues by 63%; aEBIT loss of US$32m impacted by higher costs and increased consumer loan book losses. ● Iyzico grew revenues 87% to US$288m, while aEBIT of US$18m at a margin of 6% reflected rising interest rates and investments in strategic growth initiatives. ● GPO revenues up 23% to US$340m, with aEBIT of US$12m; sale of GPO’s LatAm and Africa operations completed in March 2025, while GPO Europe sale is ongoing. ● Overall, PayU’s aEBIT losses improved by >100% to US$11m.

Etail: eMAG achieved overall profitability target for FY25 and Takealot grew strongly, cementing its leadership position through innovation and customer focus.

● eMAG grew strongly with GMV up 9%, and revenue up 12% to US$2.5bn. ● eMAG aEBIT improved by US$40m to US$14m; includes one-off costs in Hungary in H1.

● eMAG improved performance due to good growth in Romanian etail, and emerging logistics and grocery businesses.

● Takealot Group grew GMV by 13% and revenue by 15%, driven by investments in logistics, enhanced customer offerings and the TakealotMore subscription service. ● Takealot.com: orders increased 15%, GMV up 13% and revenues grew 17%, with growth underpinned by expansion in emerging product categories.

● Mr D: Revenue grew 8%, with an 81% increase in groceries GMV and an improved aEBIT of US$4m, despite tough trading conditions.

| Please note: Group results are shown on a consolidated basis from continuing operations, which reflect all majority owned and managed businesses. All OLX Autos business units are classified as discontinued operations, in line with IFRS disclosures. All growth percentages shown here are in local currency terms, excluding the impact of acquisitions and disposals (M&A), unless otherwise stated. Growth percentages shown here for all non-financial key performance indicators compare FY25 to FY24. |

For full details of the Group’s results, please visit www.naspers.com .