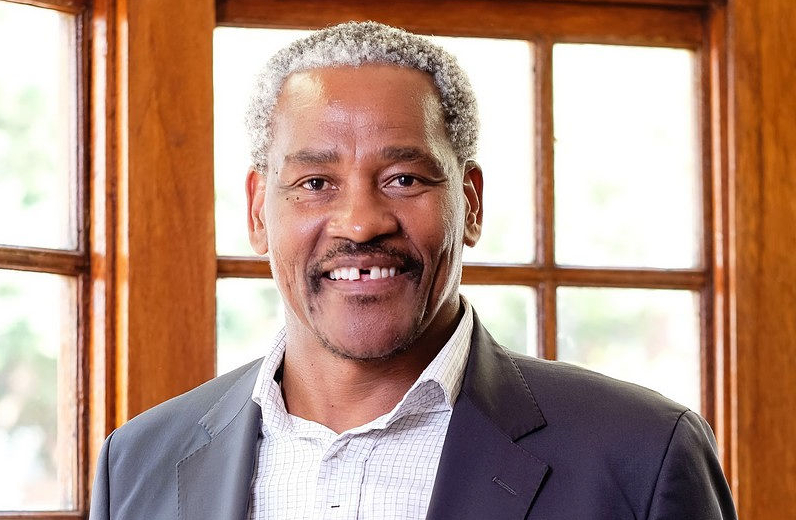

Risenga Maluleke, South African Statistician-General

Power 98.7 in association with Old Mutual and the Mail & Guardian hosted Risenga Maluleke, South African Statistician-General, in a live webcast. Other speakers were Lumkile Mondi, Economist and Senior Lecturer at the School of Economics, University of the Witwatersrand (Wits); Kholiswa Malindini, Statistician and Lecturer at School of Governance, Wits; and Andrew Davison, Head of Advice at Old Mutual Corporate Consultants. The webinar was moderated by Tumisang Ndlovu, Host of Power Business on Power 98.7

What can R150-million buy? It could pay for an uber-luxurious mansion on the Atlantic seaboard, a 12-kilometre stretch of highway, or, according to statistician-general Risenga Maluleke, one of the country’s most important surveys on poverty.

With fiscal finances coming under increasing pressure the past five years, the office of Statistics South Africa (Stats SA) has not been immune to the budget cuts that have affected many government departments.

The upshot of this is further-reaching than one may assume. It’s affecting the data that South Africans — and the government — use to inform their decisions.

Budget constraints have meant that Stats SA has had to park the Income and Expenditure Survey since 2015, Maluleke told viewers of a webinar hosted by Power FM and the Mail & Guardian.

This survey costs R150-million to conduct. But it provides the country with vital information about the wellbeing of its citizens. “The income and expenditure survey tells us about poverty. In this country since 2015, we haven’t been able to go and get information that helps us to measure money-metric poverty. So we don’t know how many people are poor in South Africa since 2015.”

Kholiswa Malindini, Statistician and Lecturer at School of Governance, Wits

Kholiswa Malindini, Statistician and Lecturer at School of Governance, WitsThe Stats SA office has lost between 116 and 118 staff members each year in recent times, and budget constraints have meant that it hasn’t been able to replace the positions, he says. “Since October 2016 we haven’t been able to hire a single staff member, owing to the lack of financial resources,” said Maluleke. “When you remain with a smaller amount of staff members you have to stretch them beyond the limits.”

Some staff members are performing two or three roles, he said, adding his office needs another R300-million “at the bare minimum” in order to function better. “For now, we will continue to do the work of Stats SA the best we can. But in the long run there will be challenges.”

Kholiswa Malindini, an economics and quantitative methods lecturer at Wits University, said that underfunding and understaffing at Stats SA could have serious implications on the country and South Africans as individuals. “If we are to really have timely data that’s accurate and remains relevant then we need to make sure that the institution is strengthened,” she said.

Lumkile Mondi, Economist and Senior Lecturer at the School of Economics, University of the Witwatersrand

Lumkile Mondi, Economist and Senior Lecturer at the School of Economics, University of the Witwatersrand Dr Lumkile Mondi, a lecturer at the school of economics and finance at Wits University, said that weakening the national statistics office has an impact on voting decisions. “The policy makers have told us about poverty, inequality and unemployment,” he said. “How are you going to resolve them when you’re killing the institution that makes us voters to be cleverer … [and] more importantly [helps us] make that important voter decision when election comes?”

National data informs decision-making not only on a voter level, but on a policy level too, Maluleke pointed out. Data should inform policy decisions, but in order to do that, it needs to be timely and credible.

“In the olden days we used to have what we call a supply driven approach, where we take the numbers to policy makers, and you flood the markets and they sometimes got overwhelmed,” he said.

“But now we want a culture of demand-driven [data]. So we have to create value in the numbers. And to create value is to always be knocking at the door and saying ‘these are the numbers that will actually address your problems’.”

If policy matures faster than good data is produced, “you end up with what we call evidence-influenced policy,” which is something that we want to avoid, said the statistician-general. He argued that good quality data should inform policy rather than bolster it.

Andrew Davison, Head of Advice at Old Mutual Corporate Consultants

Andrew Davison, Head of Advice at Old Mutual Corporate ConsultantsThe pandemic is a good example of where decisions were made in reaction to timely data. Countries that have made progress in the fight against the pandemic have done so on the basis of numbers being used, he said. “We have seen the value of numbers.”

This illustrated how national data is used in a corporate environment. “For us the data is so important: we use it to try to ensure the products we make available are addressing the needs that people have.”

But in order for the numbers to play their intended role for the various stakeholders in our democracy, Maluleke said it’s imperative that his office stays completely impartial.

“As chief statistician, you need to know and understand where to stand your ground, including in the face of politics. That is done with a lot of respect, but we have work to do,” said Maluleke. “The statistics must always maintain their independence.”

And then there’s a third social mandate carried by his team: to educate the public. Stats SA needs to explain the numbers to South Africans, what they mean and why they matter. There’s also a responsibility to indicate the level of confidence with which their calculations can be expected to reflect the reality within the population as a whole, said Maluleke.

For Malindini and Mondi, an understanding of statistics should be embedded in the formal education process. Malindini called for nation-wide education about “the basics”.

“We are talking about people who understand nothing about how these things are compiled and their effect in their daily lives,” she said. “Financial education for me is important and that begins with understanding simple data.”

Mondi said that people need to be taught statistical and financial concepts in their own language in order for the ideas to really resonate.

“We have to go back and teach these [foreign ideas] to people in their own languages,” he said. “That’s the structural thing that needs to change now.”

Tumisang Ndlovu, Host of Power Business on Power 98.7

Tumisang Ndlovu, Host of Power Business on Power 98.7Head of Advice at Old Mutual, Andrew Davison, said that an important component of that education should be around interest rates. “People should come out of school an expert on interest rates,” he said. “If you don’t understand interest, your life is going to be difficult.”

The financial products market needs to assist in the process by empowering its customers with understanding. “A person needs to understand what their need is,” he said. “We need to help them understand that need, then we need to work out which product makes most sense for that need.”

To view the webinar, click on the YouTube video link below: