WeBuyCars is still a good business despite being embroiled in Transaction Capital’s woes, analysts say. (Photo by Gallo Images/Papi Morake)

Transaction Capital has had one hell of a ride these past couple of years.

After going on a hot streak in the pandemic’s wake, almost exactly two years ago, the company’s share price started to run out of gas. Then, after another year or so, the wheels came off.

Through these twists and turns, Transaction Capital has found an old faithful in WeBuyCars, which it is separately listing on the JSE next week. The question is — given the firm’s track record for making high-risk business bets — will WeBuyCars shareholders be cruising or cruising for a bruising?

In March last year, Transaction Capital endured a brutal sell-off after it warned shareholders that it expected its interim earnings to fall by more than a fifth.

At the time, the company noted that some parts of the group — namely minibus financier SA Taxi — had been dealt a significant blow by macro-economic headwinds.

WeBuyCars, which Transaction Capital acquired in the thick of the pandemic, also experienced some margin pressure amid higher interest rates, though the group maintained its confidence in the business.

The unbundling gets WeBuyCars out of Transaction Capital’s mess, according to independent analyst Simon Brown.

“From an investor perspective, people are shying away from Transaction Capital and that would ultimately sink WeBuyCars,” he said, adding that the unbundling will generate some cash to put back into the beleaguered group.

Bt, because WeBuyCars is a solid business, Transaction Capital is begrudgingly listing it to save itself.

“They would have kept it had SA Taxi not had problems,” Brown said.

“WeBuyCars is a good business. It’s doing well. It’s currently a tough environment but they are gaining market share and growing volumes.”

Wayne McCurrie of FNB Wealth and Investments agreed that the unbundling is not about saving WeBuyCars but about rescuing the parent company.

When a company is selling part of its good assets, the rest of the business is usually in trouble, he said.

Economic conditions conspired to make WeBuyCars an attractive business in Covid-19’s immediate aftermath.

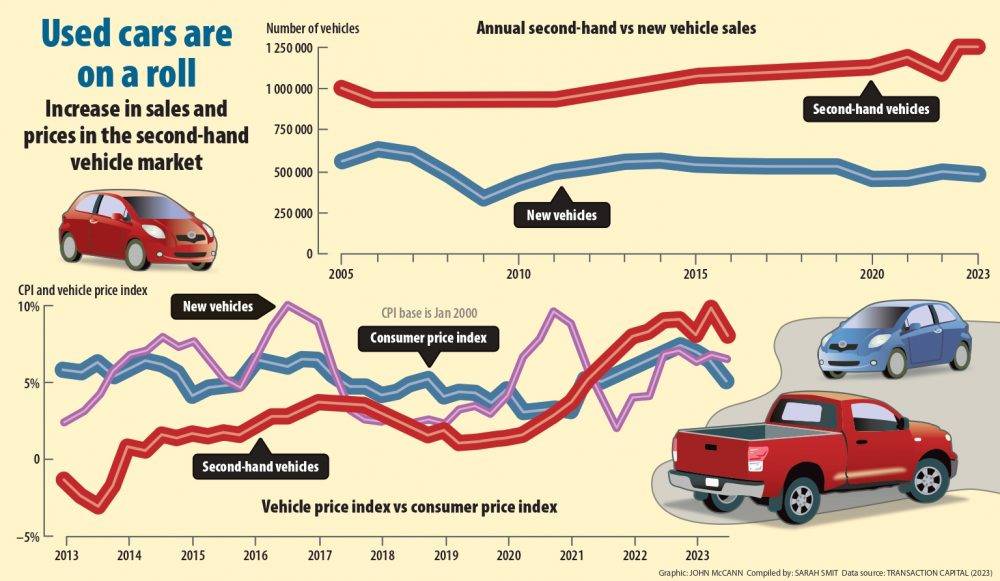

When Transaction Capital announced its initial investment in WeBuyCars in September 2020, it flagged growth in the used car market, which over the five years prior had experienced a compound annual growth rate of 1.7%.

At the time, WeBuyCars was selling about 6 000 cars every month, slightly more than in the months before the pandemic hit South Africa. During the year ending September 2022, WeBuyCars was selling about 12 000 cars a month.

The upturn in the used car market coincided with pandemic-related supply-chain constraints, which caused bottlenecks in the new car market, motivating some to buy second-hand.

By the fourth quarter of 2020, used car prices began to increase at a faster rate than inflation amid inventory shortages. The used vehicle price index was 9.1% in the fourth quarter of 2022, compared with a consumer price index of 7.4%, according to credit reporting agency TransUnion Africa.

Towards the end of 2021, the South African Reserve Bank started to raise interest rates from their Covid-era lows. By the end of 2022, the cost of borrowing was already higher than it was before the pandemic.

Interest rates are currently higher than they have been in 15 years — much to the chagrin of borrowers.

According to TransUnion’s most recent vehicle pricing index report, there was a more than 8.4% decrease in vehicles financed between the third quarter of 2022 and the third quarter of last year, by which time interest rates had settled into restrictive territory.

On new vehicle sales, the Automobile Business Council noted last month: “The persisting economic strain remains a real concern for household income and the weak new vehicle market reflects that middle-income households are restricting big financial commitments for items such as vehicles at present.”

Lower new car sales, linked to constrained GDP growth, puts pressure on used car volumes. This could have a knock-on effect on WeBuyCars.

McCurrie noted the recent interest rate hikes are cyclical. Borrowing costs will eventually fall and people will start buying cars on credit again.

“It’s not a good time to sell now for Transaction Capital but they have no option,” he added.

Brown said the used car market was not growing because South Africans are getting poorer, due to high interest rates. But, the WeBuyCars business model is sustainable because the second-hand car market is big.

“A lot of consumers are buying second-hand cars. And even under the tough conditions we see now, that number is increasing,” he said.

The WeBuyCars business model is very attractive because the buyer immediately gets a cash offer, Brown added, whereas the standard process of selling is usually more taxing.

“It’s a good business segment and they have good market share, which they should be able to grow.”

Anchor Capital chief executive Peter Armitage was similarly bullish on WeBuyCars.

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)

“It’s an interesting and exciting business … There was an established market for used cars in the country and they have basically turned that upside down,” he said, noting that the company already has about 12% market share.

Armitage added that, whereas new car sales are extremely cyclical, the used vehicle market tends to be more resilient in the wake of economic headwinds.

“They are much less exposed to the cycle for two reasons. One is they are buying or selling a car within 30 to 45 days. So, if the market is under some pressure, they can pull back on buying and reduce their stock pretty quickly,” he said.

“And they can re-price their stock very quickly. So if the market price is coming down, they can start offering less for cars.”

Armitage noted WeBuyCars is looking to expand its market share to about 24% by 2028.

“It’s dramatic. I think it will be very challenging to get there. But it’s nice to have a business that has some big growth objectives.”

Being a volume business, a constrained car market does stand to hamstring WeBuyCars’ growth.

“They’ve put down a challenge for them to reach. I think if they could get halfway there, it would be a pretty good achievement,” Armitage added.

Transaction Capital has been selling some shares in the background ahead of the WeBuyCars listing, Brown noted.

Coronation Fund Managers has bought R760 million in new shares, which adds to about 11.3% of the issued share capital of WeBuyCars. Meanwhile, existing Transaction Capital shareholders will get some WeBuyCars shares.

“So, there will be a lot of shareholders who already hold the shares come the morning of 11 April. At 9am, under the ticker WBC, the company will start trading and immediately there will be buyers and sellers in the market,” Brown said.