Finance Minister Enoch Godongwana. (David Harrison/M&G)

Finance Minister Enoch Godongwana’s medium-term budget policy statement this week quashed hope that positive sentiment around the new coalition government, and a load-shedding reprieve, would immediately translate into faster economic growth.

The treasury lowered its growth forecast for this year from 1.3% to 1.1% — averaging 1.8% over three years — and increased its budget deficit forecast to 5% of GDP, from the 4.5% predicted in February.

This is due to an expected shortfall of R22 billion in revenue collection; rising debt repayment costs and spending adjustments to pay for disaster relief; African peace mission participation; and bringing the genocide case against Israel before the International Court of Justice.

A further R13 billion will go towards paying the South African National Roads Agency’s debt for the Gauteng Freeway project, while R11 billion is earmarked for the government’s early retirement programme, designed to lower the public wage bill that continues to threaten the fiscal outlook.

Debt this year hit 74.7% of GDP and is expected to reach 75% in 2027-28.

The treasury said that it hoped to stabilise debt by maintaining sufficiently large primary surpluses over the rest of the decade and that a debt-stabilising primary surplus would anchor fiscal policy over the next three years.

The medium–term budget saw a deterioration in the fiscal metrics against expectations, causing the rand to weaken to R17.76 to the dollar from R17.63, while bond yields rose, Investec’s chief economist Annabel Bishop said.

Bishop said the budget is slightly more credit negative on the deterioration in the projected fiscal ratios (debt nears R7 trillion by 2027-28), but unlikely to result in a credit rating downgrade.

Ongoing fiscal slippage would, however, risk negative outlooks for South Africa.

With these indicators, there was no money for lifelines to parastatals, even the desperately debt-ridden Transnet, which has a capital requirement of at least R100 billion, even if Godongwana were inclined to bail them out.

A close reading of the medium-term statement suggests this is not the case, though the main budget in February is bound to revisit the Transnet question, given how intrinsic it is to the efforts, increasingly driven by the presidency, to revive growth through reform of the logistics sector.

Instead, it confirms a shift to seeking private investment to shore up flagging state-owned entities (SOEs) stating that public-private partnerships are “a tried and tested mechanism to deliver infrastructure”.

“In this regard, we are implementing reforms that will create conditions to attract greater private sector participation,” Godongwana told parliament.

The treasury said it had taken lessons from the independent power producer programme about the risks attached to a specific type of public sector infrastructure investment and was working on “a blended financing risk-sharing platform”.

This would include a credit-guarantee vehicle that would mitigate risks — starting with the energy sector — while lowering the state’s contingent liabilities. But these reforms will take time and Transnet’s performance is yet to reflect the rewards of its recent move to open the rail network to private operators.

Asked about an eventual, surely unavoidable capital injection after last year’s R47 billion guarantee, Godongwana told journalists shortly before his speech to parliament that the treasury was still quantifying the value of assets Transnet needs to dispose of before considering financial support.

The treasury proved unmoved by a warning from the SA Post Office’s business rescue practitioners that it would be liquidated if the state did not inject R3.8 billion this week.

Godongwana asked, rhetorically, what dividend the state could hope to reap if it were to find more money somewhere, after ploughing R2.4 billion into the post office a year ago when it went into business rescue.

It would probably only lead to another request in the near future.

“What is the future of the Post Office?”

“What budget statement was it when I said we need to give tough love to these SOEs? We are still committed to that principle,” Godongwana told reporters.

“There is an opportunity cost when you keep putting money into underperforming SOEs because you end up underfunding something else.”

He confirmed that power utility Eskom’s debt-relief allocation for 2025-26 would be cut by R2 billion should it fail to meet a new deadline to dispose of the Eskom Finance Company by the end of March.

The treasury’s progress reports on government departments and state-owned entities suggest that it is watching closely whether money is well-spent and performance targets are met.

“For a couple of years now the government has moved away from simply transferring money for bailouts. Now it demands for the SOE to sort out its own balance sheet and so they have to be more responsible and more accountable.

“That is a tougher stance and a more hardline approach,” Stanlib chief economist Kevin Lings said.

“However, you can’t do that to the extent that it becomes detrimental to the country and, with Eskom, you have to support it. It’s just too big to fail and the feeling is the same with Transnet — the government will have to assist at some point.”

Lings noted that this “tough love” directed towards SOEs does not mean that nothing will be handed to them in future but they needed to demonstrate that they had a turnaround strategy.

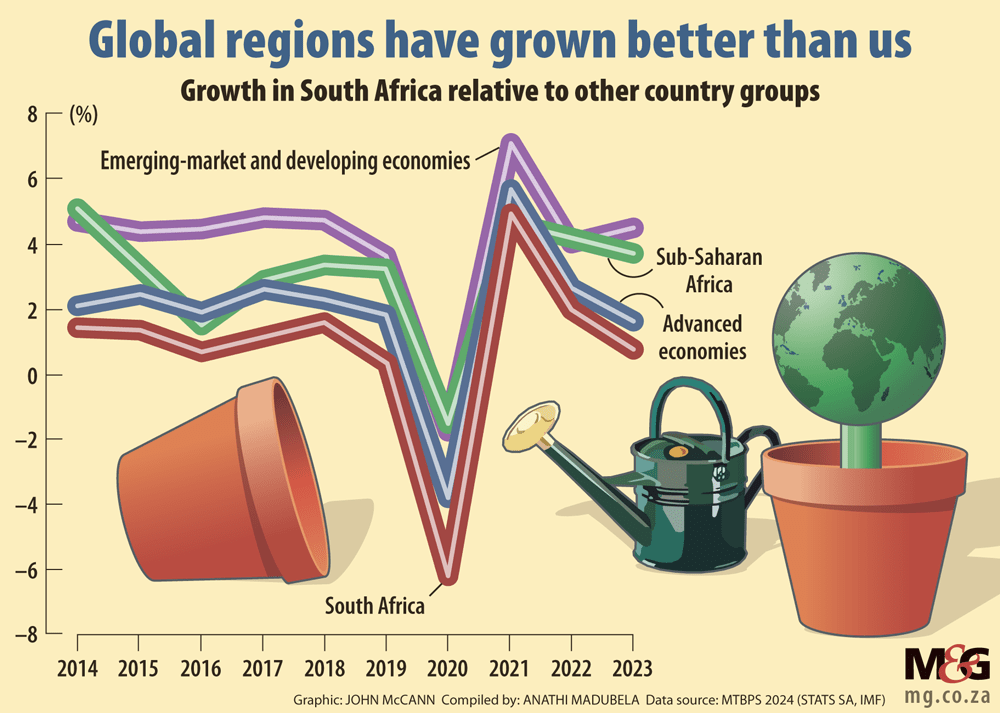

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)

In short, the medium-term budget shows Godongwana sticking to a path of fiscal consolidation — the same one walked by his predecessors Pravin Gordhan and Tito Mboweni, to whom he paid tribute in his speech after their recent deaths.

Economist Sifiso Skenjana said the emphasis on fiscal consolidation was the result of previous budgetary decisions made by the finance minister’s predecessors, implying that the lingering effects of those earlier austerity policies are shaping current fiscal strategies, potentially limiting options for economic growth and social spending.

“Economists from the IMF have spoken about this, saying developing countries who are in a low-growth environment must not go into austerity because it results in negative growth and this is what we are seeing right now,” Skenjana said.

Lings said the mini-budget was a reality check about the limited scope the government has to move because the budget is too constrained.

“The reality check is coming about because the tax base is just not growing fast enough, it’s fairly stagnant and that’s because the growth rate is stagnant and so is employment.”

Lings said the projected annual average of 1.8% in GDP expansion over the next three years is not enough for an economy such as South Africa’s.

“India grows at 7% and that’s the sort of numbers you need, but are not able to generate, despite the government of national unity, despite a focus on infrastructure and despite better sentiment.

“Those are the reality checks from this budget,” he said.

According to Statistics South Africa, GDP expanded by 0.4% in the second quarter of the year after failing to grow in the first three months.

The Institute for Race Relations accused the government of tinkering on economic policy, rather than aggressively chasing growth approaching 6.5% — the rate at which the global economy is forecast to expand in the next two years.

“We do not see evidence that the government is thinking seriously about how to achieve this. The changes it is proposing — making government work a little better, getting the private sector to help pay for infrastructure reforms and fiddling with regulations here and there — is not enough,” it said.

The medium-term review provided an update on efforts to correct the weaknesses that landed South Africa on the Financial Action Task Force’s grey list in February last year.

The National Prosecuting Authority is under pressure to implement steps by January to persuade the Paris-based money-laundering and terror-financing watchdog to remove the country from its caution list.

It had, as of August, met two of the task force’s three targeted deliverables but more work was needed to allow authorities ready access to accurate beneficial ownership information of legal persons and arrangements.

“The beneficial ownership register for trusts shows a low number of filings, highlighting the need for further effort,” the treasury said, adding it would closely monitor progress.