Most investors need a percentage of their assets invested into growth assets in order to grow their wealth in real terms. The problem is that most investors can’t stomach the volatility and capital losses associated with equities.This leads to the temptation to invest solely into low volatility assets (ie cash and bonds) which is problematic as these assets won’t give you a real return over the long term after costs and taxes are taken into consideration.

By taking a local portfolio of 50% equity, 10% property, 25% bonds, and 15% cash and rebalancing back to this weighting on a monthly basis, you are able to substantially reduce the volatility of your portfolio, and meaningfully grow your assets.

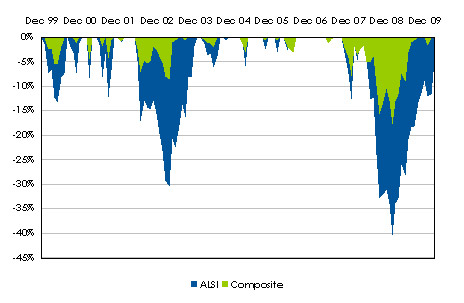

The chart below shows the different return profiles of the diversified portfolio and the stock market since the turn of the century. The JSE all-share index has produced an annual return of 16,1% versus the composite’s 15,6%. However, the portfolio has achieved this return with nearly half the volatility (10,4% vs 19,2%) and with a drawdown (loss) profile that is vastly superior to that of the market.

This graph shows the returns over ten years between the portfolio (green) and the all-share index (blue)

This graph shows the maximum losses during the investment period. As you can see capital was better preserved through diversification

While this analysis is performed on historical data, and we know that the future is never the same as the past, it does give us some indication that you are able to greatly enhance the risk/return profile of your portfolio by diversifying your investments.

The specific mix that you should be invested into will vary from investor to investor. You should have a clearly defined strategy based on your personal circumstances that may change over time.

Mike Browne is the portfolio manager of Seed Investments.