Foreign direct investment in Africa has accelerated as investor perceptions begin to shift, according to Ernst & Young’s second annual attractiveness survey, “Building Bridges”.

Foreign direct investment in Africa has accelerated as investor perceptions begin to shift, according to Ernst & Young’s second annual attractiveness survey, “Building Bridges”.

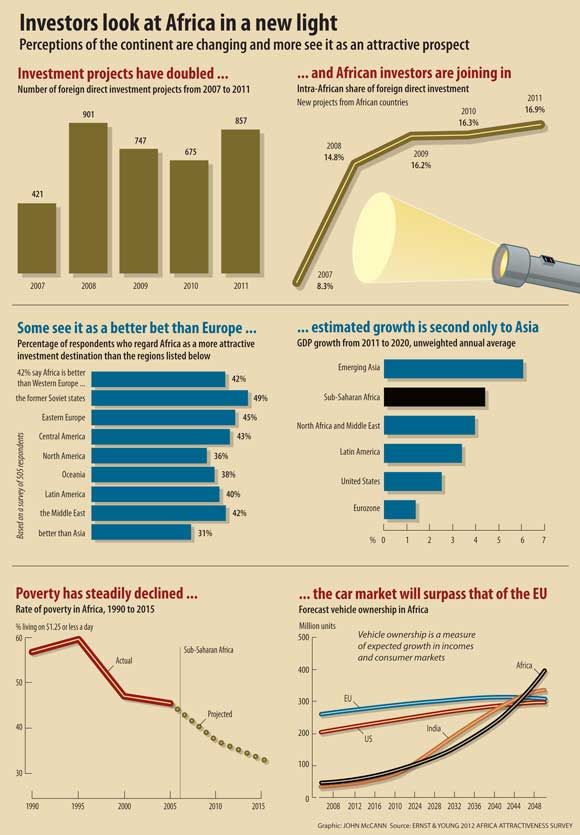

The report, which was released last week, indicates that foreign direct investment projects in Africa has grown at a compound rate of 20% since 2007 and by 153% in absolute terms since 2003. Fifteen African countries account for 82% of foreign direct investment and South Africa boasts the largest share with 16% of the total. Following, at about 10% each, are the North African nations of Egypt and Morocco.

“This broad-based progress is underscored by a substantial shift in mindset and activities among Africans themselves,” the report states. Between 2003 and 2011 there has been 23% compound growth in intra-African investment into new foreign direct improvement projects. “This growth is accelerating; since 2007 the growth rate has been an astonishing 42%.”

In 2011, intra-African investment accounted for 17% of all new foreign direct projects on the continent. Growth in this investment was being led by Kenya, Nigeria and South Africa.

Africa unstable

But global perceptions of Africa as an unattractive investment destination remain. “Africa is still viewed as unstable, corrupt and generally riskier than other regions. Our survey of more than 500 investors and business leaders highlights the stubborn perception gap that continues to hamper efforts to attract investment into the continent,” the report states.

Respondents with no business presence in Africa viewed it as the least attractive investment destination in the world.

But the numbers do not lie and African economic output has more than tripled over the past decade. The report notes that, in eight out of those 10 years, Africa has grown faster than East Asia. Given recent growth, it should be unsurprising that returns on investment in Africa have been among the highest in the world.

Between 2003 and 2011 there have also been greater levels of investment into less capital-intensive sectors. Almost 70% of the capital invested in Africa (and nearly 40% of new foreign direct investment projects) has gone into manufacturing and infrastructure-related activities. But bridging the infrastructure gap will be a key enabler of regional integration, growth and development because poor infrastructure remains a major contributor to Africa’s underdevelopment, Ernst & Young notes.

“Its improvement, through investment in the transport, power and communication networks that physically enable regional integration, will help accelerate and sustain Africa’s growth and development.”