The outcome of the ANCs long-awaited KwaZulu-Natal conference was a win for the Thuma Mina crowd. (Delwyn Verasamy/M&G)

Costs are up, demand is down and South Africa’s economic growth slowed to an annual rate of 0.9% in the first quarter of 2013, highlighting the important role that small business has in creating employment and boosting the economy.

As a supporter of small business, Nedbank realised a need for a comprehensive and accessible index that provides meaningful trends and insights for small businesses and stakeholders to truly understand what they are up against and how they can reach their full potential.

“We hope that this index will become the main reference point for leaders in the private and public sectors to engage on issues pertaining to small business. Notably, this can serve as an enabling tool for small business to guide their business decisions,” says Ingrid Johnson, Nedbank group managing executive of retail and business banking.

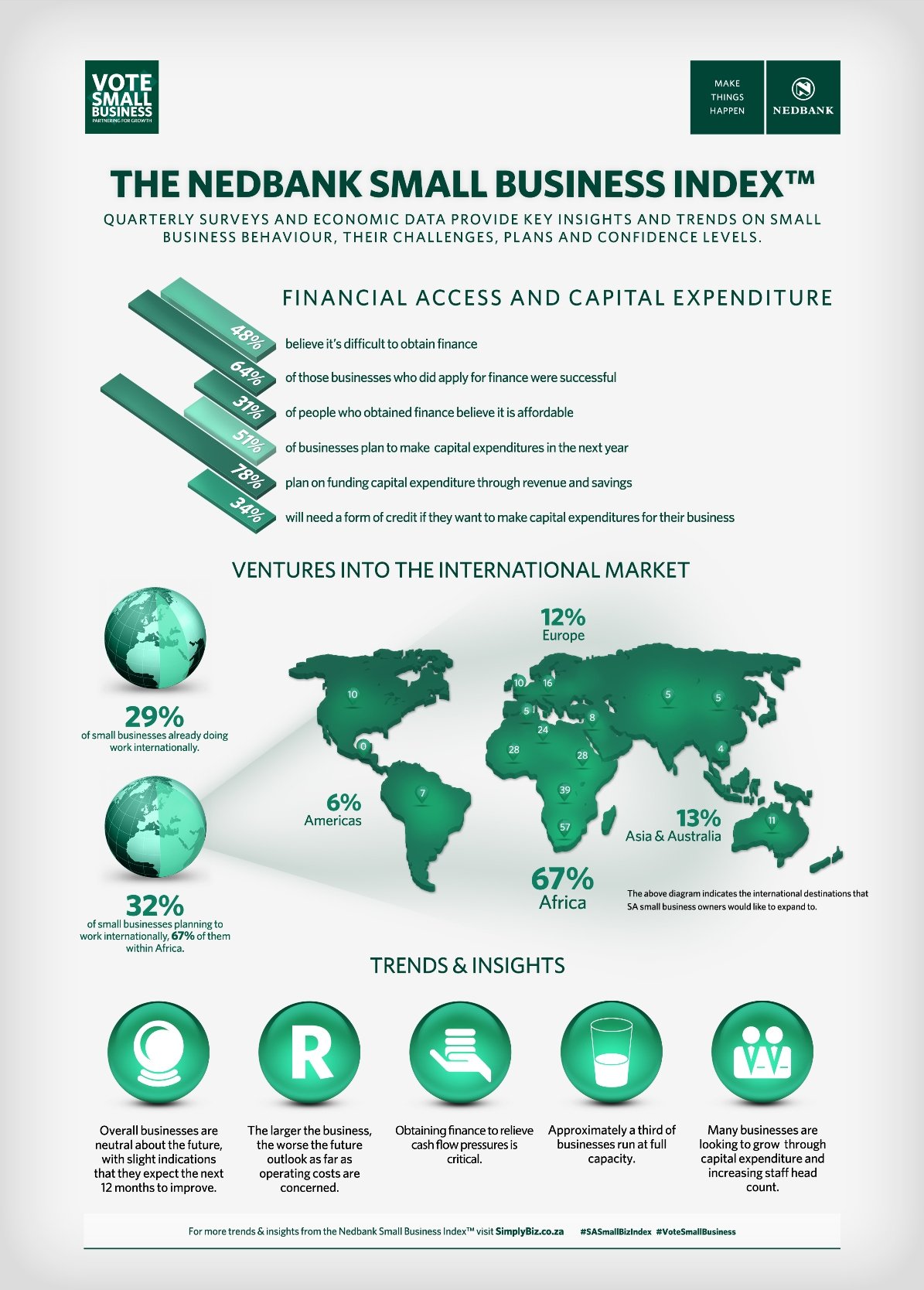

Quarterly surveys conducted with over 1300 small business owners and decision makers in different sectors provide information on small business behaviour, their challenges, plans and overall confidence levels. These findings, combined with other economic data will be translated into a complete index from February 2014

According to Professor Adré Schreuder of Consulta Research and professor of marketing research at the University of Pretoria, the Small Business Index™ adheres to world class standards of scientific rigor and model-development: “It is truly unique in that it combines a survey-based confidence index with key economic indicators.”

The first two rounds of fieldwork have already provided some interesting insights into top-of-mind issues for small businesses. Overall business owners are neutral about the future with only slight indications that they expect their financial positions to improve. Cash flow, budget constraints, changes in the economy and rising costs have been highlighted as the main hurdles to business growth.

While the country is pinning its hope for job creation on the small business sector, the index revealed that fewer business owners plan to hire more people, and 15% intend shedding staff. Most business owners cited the affordability of salaries and wages followed by changes in the economy as reasons for anticipated layoffs.

Support from the public and private sector was also found to be inadequate with support for the government being worse than expected and significantly declined over the first quarter of 2013. The main reasons related to legislation, bureaucracy in acquiring state finance and the government’s failure to improve the economy.

The sector’s plans, however, around capital expenditure and expansion provide some encouragement. With only a third of the businesses running at full capacity, as much as 50% are looking to make some form of capital expenditure in the coming year. 53% of businesses stated that they had already made the investments in the past 12 months. It is interesting to note that significantly more business owners said they planned to use their own business revenue to fund expansion plans rather than outside finance. Just 34% planned to use bank or government finance. Almost half of the respondents felt that obtaining finance was extremely difficult even though 64% of those who did apply were in fact successful.

As the South African economy contracts, business owners are looking at expanding into international markets, especially the rest of Africa. This is an encouraging trend which looks set to continue.

For more trends and insights, visit www.SimplyBiz.co.za, or join the conversations on Twitter and Facebook using the hashtag #SASmallBusinessIndex.