Contrary to sensational headlines that claim South Africans are spending four times more on alcohol than healthcare, more on clothing than education, and about the same on pay-TV as they do on retirement annuities, drilling down into the numbers shows average consumers are spending their money not frivolously, but largely on transport, housing and food.

Research from Eighty20, which provides strategic insights from data, used a range of sources, including figures from Statistics South Africa’s latest Income and Expenditure Survey, to analyse what South Africans spend their money on.

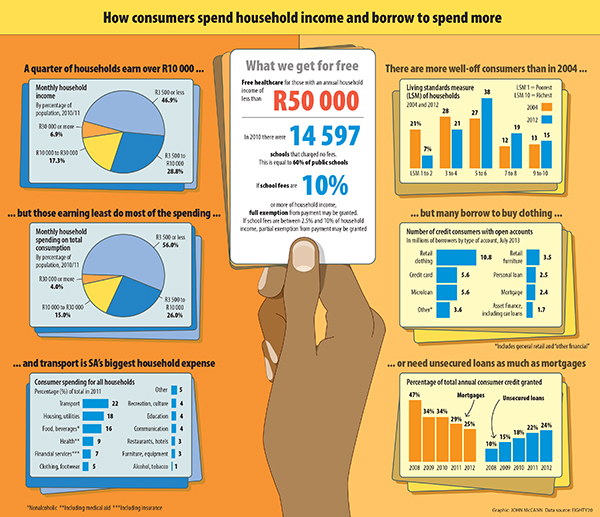

South Africans are moving up in terms of income. In 2004, 49% of households were at the bottom end of the spectrum, but this fell to 28% in 2012.

The number of black households earning R30 000 or more a month doubled between 2006 and 2011.

Still, 46.9% of households have a monthly income of less than R3 500. Those spending less than R3 500 a month accounted for 56% of consumption expenditure in 2011.

Eighty20 project leader Illana Melzer said adjustments to household surveys are often necessary.

"People lie"

“There are gaps in the data, people lie.” This, she said, is clear to see when comparing how much people claim to spend on alcohol, with sales and revenue figures from brewers like SABMiller.

When it comes to spending on clothing, what households reported also did not add up with what clothing retailers earned.

For this reason, Melzer said, StatsSA adjusts the data to line up better with data from suppliers.

Eighty20 further reallocated and adjusted some categories, and the picture it painted was fairly predictable: South Africans spend the bulk of their income on transport (22%), housing and utilities (18%) and food and non-alcoholic beverages (16%).

Health expenditure, which includes medical insurance and medical aid contributions, was about 9% of household expenditure in 2011; insurance and other financial services were 7%; clothing and footwear accounted for 5% of spending; education was 4%; and spending on alcohol was the smallest category, amounting to 1%.

How then did Eighty20 find that South Africans spend four times more on alcohol than healthcare?

Generating headlines

It is because medical insurance and medical aid contributions were stripped out of the equation, Melzer said.

“We have to generate headlines,” she explained.

Asked what the numbers might look like if medical aid contributions were included, Melzer agreed that expenditure on health would be much higher.

Eighty20 also asserted that South Africans spend about as much on DStv as they do on retirement annuities.

This, Melzer said, was ascertained when looking at retirement annuity premiums based on data from the Association of Savings and Investment South Africa, and DStv subscriptions based on MultiChoice revenue, both of which came to about R24-billion a year.

This, she said, did not look at forced pensions, which many South Africans contribute to through their employers.

Among the top in the world

South Africa’s R300-billion plus pension industry ranks as one of the top 15 in the world and, according to recent research conducted by Johann van Tonder, an economist at Unisa’s Bureau of Market Research, total contributions of employers and employees to retirement funds, and consumer contributions to annuities and group pension funds, amounted to about 16% of a household’s disposable income in 2012.

Melzer noted that a forced pension is generally not considered to be enough for a comfortable retirement and that a complementary retirement annuity is important.

The fact that South Africans spend 1.5 times more on clothing than on education, as reported by Eighty20, is not easily disputed and is in sync with other research on household expenditure in South Africa.

Melzer said that spending on education is growing, especially among the emerging middle class.

“If you look at data, investment in private education is growing fast, but it is coming from a very low base.”

According to 2009 data from the United States department of labour, and published on the website theatlantic.com, the average American consumer spends 1.9% of his or her income on education, 5.7% on healthcare and 3.8% on apparel.

Getting marketers thinking differently

The point, however, is to get marketers thinking in a different way about lower income groups.

“For us, the big take away there is discretion around expenditure,” Melzer said.

“People look at low-income households and think they can’t afford it. What we are saying, when people want to buy something and want to do something, they make a plan.”

Though marketers have to be mindful of the ethics of what they do, Melzer said the data presents enormous opportunities, and gap markets identified by the research in areas such as housing, private schooling and medical aid are critical.

She said the expenditure data really highlights the point that private education remains expensive in South Africa and not everyone has even education expenditure.

“When you look at a model C school – the fees are R26 000 a year, that is not really affordable,” she said.

Affordable private school models

For affordable private school models, the cheapest offer schooling at a rate of R10 000 per child per year.

Eighty20 estimated there is a gap in the market here of 3.1-million households, which could have capacity to pay something towards school fees if there was a quality offering available.

Between 2001 and 2011 there were 3.5-million more households living in formal dwellings, but there remains a large gap between RDP and affordable housing segments.