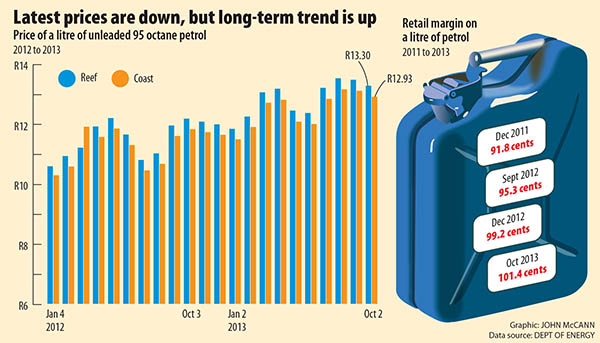

October's fuel price decrease is a bittersweet arrangement.

Although it signals some reprieve for consumers (the petrol price dropped by 20 cents a litre), it is still five cents higher than it would have been, thanks to wage negotiations in the fuel retailer sector.

The increase is also indicative of a trend: the portion of the petrol price taken by fuel retailers has increased by more than 13% in the past year.

Following the negotiations, the dealers' margin of the petrol price (the margin taken by the petrol station providing the fuel) increased from 99.2 cents a litre to 104.1 cents a litre on October 2.

In September last year, the retail margin increased from 91.8 cents a litre to 95.3 cents a litre, meaning that the retail margin has increased by 13.3% over the space of a year.

Minister of Energy Ben Martins approved an increase of 4.9c a litre on the retail margin on all grades of petrol "to accommodate the salary increase for the forecourt attendants", a statement issued by the department said.

The settlement

The increase "will be ring-fenced to pay the wages", it said.

This follows the settlement of wage price increases in the fuel and motor retail sectors between the National Union of Metalworkers (Numsa), the Retail Motor Industry and the Fuel Retailers Association, bringing an end to a three-week long strike.

On September 27, Numsa signed off on a wage deal securing an 11.6% wage increase for forecourt attendants this year, and a 9% increase for the next two consecutive years.

Work stoppages at the behest of the same union in the automotive components sector continues into its fourth week, with work at all seven major car manufacturing plants having ground to a halt as a result.

The wage increase for fuel retailers translates into about R2 an hour more for petrol attendants, who will now be earning R19.15 a hour, according to the Motor Industry Bargaining Council.

Mike Schussler, an economist at economists.co.za, said such an increase takes place almost annually during the wage negotiation period.

Main driving factors

"The oil price and the rand exchange rate will always be the main driving factors in the fuel price," he said.

"Three or four times a year there are increases in local margins. And then once a year, around this time, there will be an increase in the retail price due to wage negotiations."

This year's increase is indicative of a trend, said Schussler. Along with overall higher petrol prices, the slice of the pie taken by fuel retailers is becoming larger.

"There's no doubt about it; the internal prices of things have been going up over time as well," he said.

"We have higher internal prices, not just higher petrol prices."

The adjustment means that the fuel price decrease is lower than expected.

General expectation

"The [general expectation] was that it would decrease by at least 23 cents," said Merina Willemse, an economist at Efficient Group.

However, it is not unusual for petrol price decreases to be lower than expected, she said.

Nevertheless, there is hope in sight for the consumer, said Schussler.

The muted price decrease means there is space for another decrease.

"It gives us a good chance to have another decrease [near year-end]," he said.