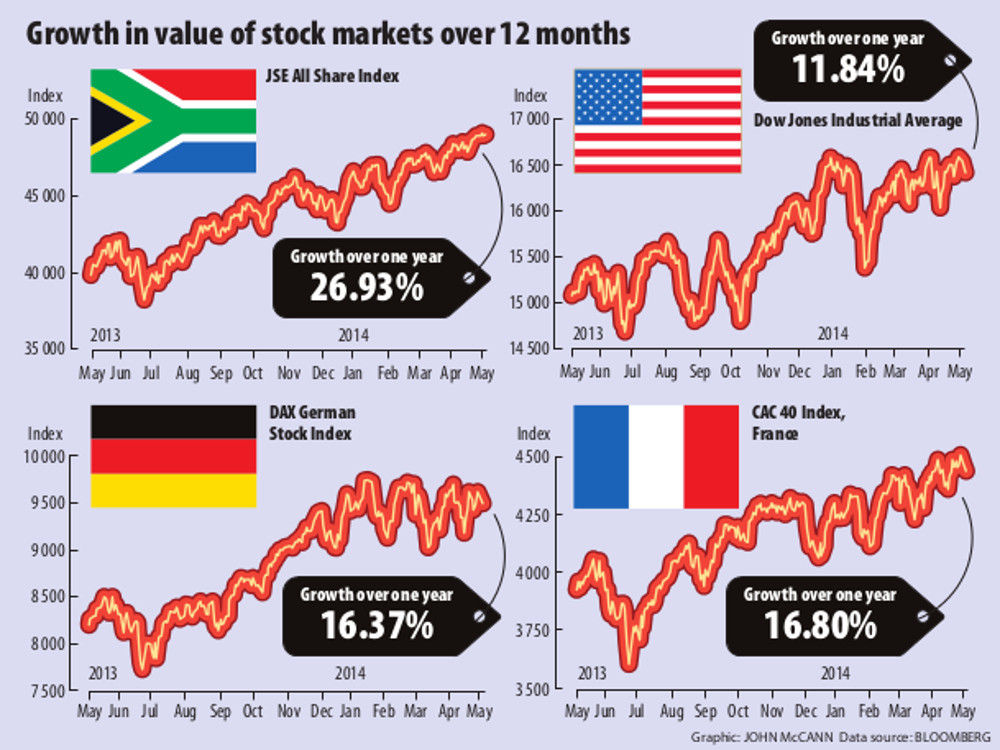

Stocks of companies in developing countries such as South Africa are being snapped up by savvy investors.

The South African market is likely to benefit from growth in the United States and a steady but slow recovery in European markets, and share prices on the JSE should be pushed above its new all-time high of 49 091.16.

But market analysts warn that this should not be a cause for celebration and investors on the JSE should be cautious.

“These are uncertain financial times,” Kevin Lings, a Stanlib economist, said. “While the global economy is stable, the financial environment remains difficult to predict because there are a variety of factors and risks at the moment that need to be considered.”

Growth in South Africa was slow and, if the economy failed to expand, the gap between the share price of top companies and the economy’s performance could widen, making the share price look increasingly more expensive and therefore less attractive, he said.

The concern is that shares are already at relatively demanding price-to-earnings ratios, making the prospects for continued strong profit growth not that good.

Add to this the risk posed to the global economy, and emerging markets in particular, by China’s weaker growth figures, the potential of the Ukraine dispute to escalate into a civil war and draw in Russia, which could put investors off emerging markets, as well as raising the spectre of further interest rate hikes.

But investor sentiment can withstand a great deal of change.

Overpriced

Adrian Saville, the chief investment officer and head of Cannon Asset Managers, said: “Alan Greenspan [the former chairperson of the US Federal Reserve] said the Dow Jones was overpriced at 2 500 points in 1990 and it went on to double again.”

Lings also said that two to three years ago factors such as asset inflation could have seen market analysts take the view that the JSE’s share prices were too high but “they would have been wrong”. The market has continued to grow rapidly.

Both Saville and Lings said the South Africa market was being carried higher on the back of promising world growth, particularly in the US. The South African market tended to move with the US market.

“So if its [JSE] shares are expensive now, it is likely to get more expensive in the future,” Lings said.

Slow growth

Growth has slowed in China, led by a need to spend money on things such as education and environmental protection.

“When a country restructures, growth slows,” said Lings.

But he believes that China is moving towards a new stimulatory phase that will see growth rates pick up.

“What will be different is the difference in the nature of the growth, with China’s economy being more consumption-driven and less commodity- and production-driven, which will benefit South African retailers and companies such as Richmont [that] offers luxury brands.”

Lings said this would mean “a mix of growth rather than absolute growth”.

He believes growth will slow from 7% to settle at 5%.

“There is a lot of conviction among investors about the United States and there is an improvement in Europe, while Greece is looking better. There is less conviction about Japan, which has just increased its value added tax [VAT], while Brazil and Russia are struggling. India is doing better and China is moving sideways.”

Sales tax increase

Japan recently put up its sales tax (its term for VAT) for the first time in 17 years from 5% to 8% in a bid to rein in public debt.

In a note in March this year, Investec said that the United Kingdom was also rallying – it reported the sharpest rise in construction output in January this year since August 2007, and manufacturing output and orders remained well above their respective long-run trends.

Manufacturing in India improved during the same period – at the fastest pace in 10 months – on the back of stronger demand from both domestic and overseas clients.

On the downside, Lings said uncertainty surrounding the situation in the Ukraine could have a negative impact on South Africa, particularly if the unrest developed into a civil war and Russia reacted to Western sanctions by stopping oil exports.

“This would not be a problem for the US, who has access to Canadian stock, but it would be devastating for a country like China.”

Russian manufacturers

Investec also said that the business conditions facing Russian manufacturers were bad, citing the overall deterioration in the sector from the start of 2014 as being the most substantial since June 2009, with “declines for output, new orders, exports and employment, and purchasing inflationary pressures remaining weak”.

But David Mohr, the chief investment strategist for Old Mutual Wealth, is upbeat about the prospects for the emerging markets. He said there appeared to be a shift in sentiment about market equities in emerging markets, which outperformed the developing markets since January this year. Unfortunately it was not enough to make up for the underperformance of the past two years, he said.

Last week, the US released data that showed strong growth in the US job market, which led the JSE to reach a record high, moving up 45% to 49?091.16. The non-farm payroll showed that the US had added 288 000 jobs in April.

Lings said the optimism generated by the US data and its potential for growth in South Africa had driven the markets to the all-time high, but Stanlib was taking a conservative position on South African markets and looking at diversified earnings. He said the company was concerned that the market could be “reaching bubble territory”.

“This does not mean it will burst; some bubbles just go away … But we do keep in mind that South Africa has a number of weak investors who will head to the door if they are not satisfied with the JSE’s performance.”

Good shares

Saville, who also said he believed some shares on the JSE were overpriced, said that there were still good value shares to be found.

“From our assessment, the market appears to be a two-legged animal,” he said.

“On one hand, there is a basket of shares that has been much loved by investors both locally and foreign that has pushed them to elevated multiples, such as Naspers, SABMiller, Aspen and Shoprite.

“The second part of our market that has on the whole been neglected is businesses that tend to be domestically focused – the domestically based industrial or resources businesses.”

He cited Associated One (part of African Rainbow), Pan African Resources, Exxaro and Anglo American as some of the bargains available.

Saville said these companies still offered good value.

“There is a need to revisit the much-loved companies and determine if the multiples they reach are justified and what causes them to be reached.”