Since the dawn of the “metrosexual” back in 1994, when the phrase was coined, a new, confident male consumer has emerged. Dull colours, straight-leg jeans and rugby jerseys were slowly relegated to the back of the closet. Bold prints, tailored looks and trendy fits took centre stage.

Men are now more willing than ever to spend money on looking good. Internationally, this new market has seen brands moving fast to step up their focus on the male consumer – so much so that the growth in the global menswear market is outstripping that of womenswear.

Luxury brand Prada, for instance, this year laid out plans to double its menswear business to spur growth after posting poor results in the last financial year. They cited menswear as a sector that is “growing rapidly” and the numbers support this. Market research company Marketline predicts that the global market will reach more than $403-billion by the end of this year, marking a 14% growth over the past five years.

This year, almost half of the finalists for the Council of Fashion Designers of America and Vogue‘s fashion fund, which is aimed at nurturing new talent, are menswear designers. Yet not one menswear designer has so far won the annual prize in the fund’s nine years of existence.

On the South African front, Marketline reported last year that the local menswear market was expected to generate more than R20-billion in revenue, representing a compound annual growth of 8.3% between 2009 and 2013.

Luxury brands

Even though growth in South Africa is slower than in other markets, it has favoured large-scale retailers such as the Foschini Group, which acquired Fabiani in 2011. The 36-year-old luxury menswear brand has since seen significant growth. Foschini expanded its Fabiani branches to 12 last year, from seven the previous year.

The brand now has 17 branches across the country, with more openings planned before the end of this year, according to head buyer and designer Nat Iqani.

“It has been an onward and upward progression,” he says. “Fabiani as a brand has evolved and maintained its position at the top of the menswear landscape in South Africa. We have a much stronger presence and image in the eye of the consumer now, stemming from the famous brand heritage.”

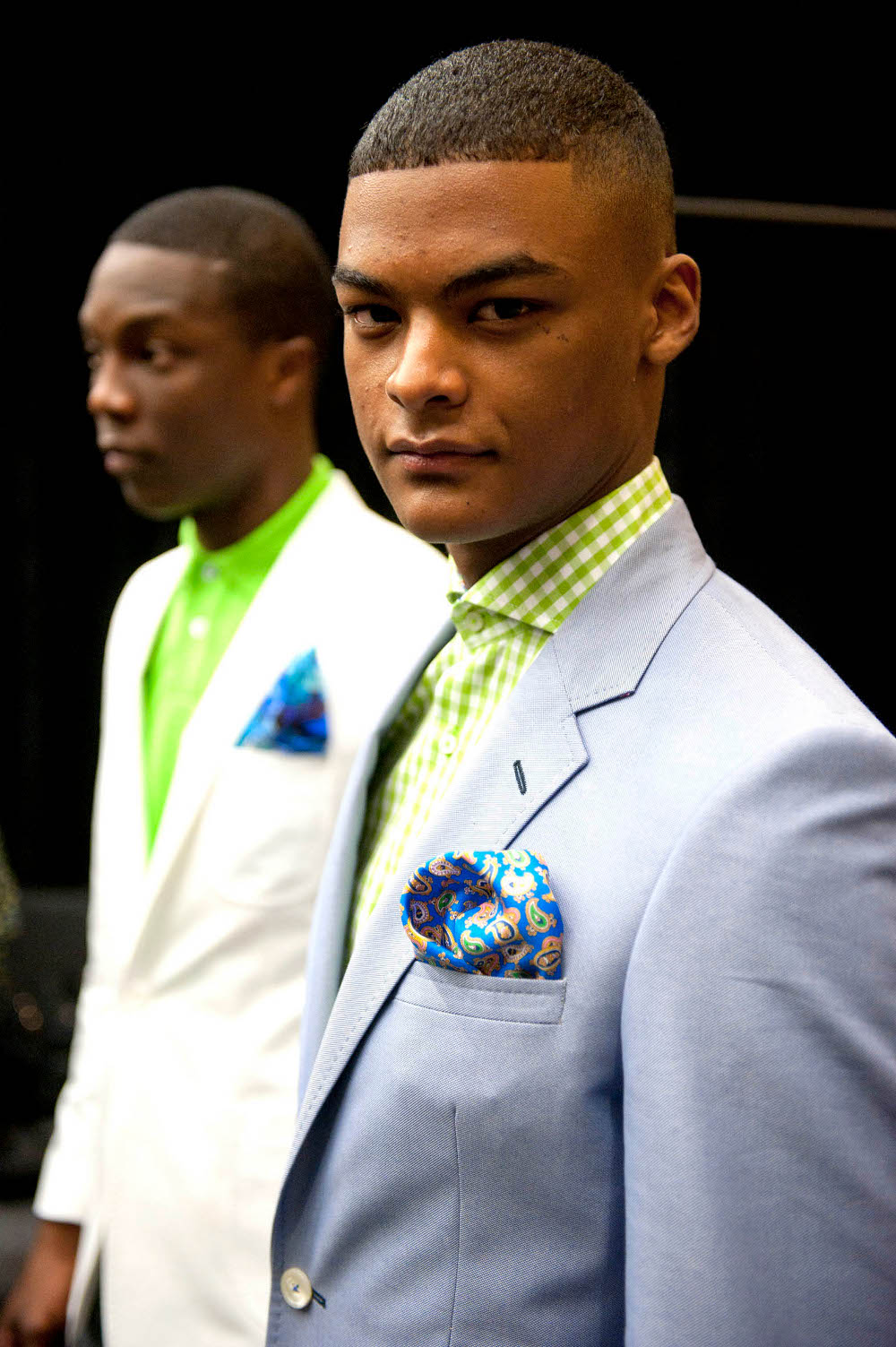

Suitsupply aims to exploit the growing demand in South Africa from fashion-conscious men. (Madelene Cronjé, M&G)

SA Fashion Week convener Lucilla Booyzen, talking of the platform she established 17 years ago, says: “In the beginning South Africa Fashion Week focused on building ladieswear. Currently South African ladieswear designers are supplying over 75 independent boutiques throughout the country.”

This is the success Booyzen says she envisions for menswear as her company moves to focus on a menswear competition for designers in this category who have not been in the industry for more than seven years. Set to be held during the spring/summer shows later in the year, Booyzen says now is the right time to start a competition that can elevate menswear designers and serve as a springboard for them to enter the business and retail platform more aggressively – much as has been done with ladieswear.

Generational shift

Nicola Cooper, head of lifestyle, pop culture and fashion analysis at Flux Trends, says there has been a generational shift in attitude towards menswear coupled with substantial growth in the consumer market owing to designers building confidence. The made-to-measure market also shows huge growth, which will see a very exciting year ahead, she says.

“The womenswear market is reaching trend saturation. Fashion is moving faster than ever and in order for fashion houses, designers and retailers to expand and grow, the male market is the ideal platform.”

Barring the international fashion world’s renewed focus on enticing men to reach deep into their pockets in the name of style, however, many fashion experts say independent menswear in South Africa is yet to benefit from the boom. But this is not because there is no demand, according to buyer Felicity Spies, who owns Egality, a boutique store in Parkhurst, Johannesburg, that stocks predominantly South African labels.

“The male customer is woefully undercatered for in South Africa – we are always looking for new menswear brands to add,” she says. “Last year Egality tripled in size and I knew the only way to sustain that sort of growth was to add menswear. Since we launched our men’s ranges in August 2013 it has more than paid its way in the store. Local brand Sergeant Pepper, in particular, has been incredibly successful. Customers keep coming back for more.”

Slick show

Designer Craig Port’s menswear show takes place at the Mercedes-Benz Fashion Week Cape Town on Saturday July 26 and, as usual, one expects that the acclaimed designers will put on a slick show of edgy designs – something that was not always possible for him. Port, who has been in the fashion game for 24 years, recalls how restricted the menswear market was two decades ago and how his employers were very strict about what the menswear consumer apparently wanted.

“These are the colours that men in South Africa wear. This is what you have to do,” Port recalls them saying. “You had to design within those parameters. Anything you did outside of that box they’d let you know: ‘No, that doesn’t sell.’ There was just so many noes and you had to work with those strict instructions.

“I don’t even think it was the consumer. It was dictated by the clothing industry. I think it was just what the people in charge thought.”

Fokke de Jong founded Suitsupply in 2000. (Madelene Cronjé, M&G)

Port adds that the post-1994 consumer, especially the male one, has changed dramatically. “The shift started happening. The male consumer was more willing to be different and to stand out. We were once again part of the world. The restrictions fell away. As a designer it was once again a pleasure to do one’s work.”

Apartheid’s demise had an indirect effect on fashion as men felt more comfortable with expressing themselves, Port says. Besides, there were other global trends at play. The internet and the exposure it gave consumers to global trends was one of these.

Changed perceptions

The movement toward gay equality has also challenged perceptions of what is now acceptable. “Sexual [orientation] has become unimportant in the world,” Port says. “There’s no longer that sort of judgment that if you wear such and such then you’re gay. What you wear no longer defines what sex you’re attracted to. It instead defines your hipness and coolness.”

Suitsupply, the Dutch menswear brand founded by Fokke de Jong in 2000, recently set up shop in Hyde Park, Johannesburg, as it sought to exploit what it says was demand coming from the male African consumer.

Says the brand’s local managing director, Tania Habimana: “We saw an increasing interest coming from South African men who were looking for high-quality menswear. We had customers coming from all over Africa and waiting to be on vacation or business trips to our New York, London or Amsterdam stores to buy our brand. So we thought, we’ll make it easier for them and we launched our e-commerce site that delivered to South Africa in four business days.”

The brand arrives in South Africa at a time when many international brands are investing in the market. Zara, Top Man and now Suitsupply are closing what Habimana says they saw as a gap in the local market. “There are options within the high-luxury segment and then there are entry-level, lower-quality suiting and menswear companies – but nothing in between,” she says.

“I think that’s what people were drawn to. It was really for the man who puts enough emphasis on quality and cares enough not to wear polyester- fused suits that will last six months, but is smart with his money and refuses to overpay.”

International labels

Rather than being a disadvantage for local independent brands, the entrance of international brands into the market is something Port says only helps to strengthen the industry.

“The more people are exposed to fashion and the more accessible things become, the more educated your consumer becomes and it affects your business all around. It pushes you to do more and be more creative. I think the arrival of international brands has only pushed local designers to do better work.”

Fabiani’s Iqani agrees, saying it gives the consumer more options and designers the opportunity to improve their own product. “The entrance of the more mainstream international brands has really only offered the SA market more affordable fast fashion.

Dutch menswear brand Suitsupply is available online or from the retail store in Hyde Park, Johannesburg. (Madelene Cronjé, M&G)

“This means that you need to play on an international level and ensure that our standards do not drop. We continually provide the best customer service, product offering and store experience in South Africa. What it means is that you can’t afford to snooze or consumers will go elsewhere.”

The challenge, says Naked Ape founder and designer Shaldon Kopman, is that the consumers, for the most part, believe local fashion is inferior. Kopman, who is currently one of the country’s most critically acclaimed menswear designers, has often lamented the complexities and expenses involved in trying to establish a brand that is 100% locally produced.

Local is lekker

He also emphasises the importance of educating consumers to take pride in local fashion.

“When you buy a can of tomatoes at Woolworths, you don’t look to see where that product is coming from,” he says, adding that, unfortunately, when it comes to fashion, people still pander to the stereotype that anything “made in Italy” or elsewhere – other than at home – is of a superior quality.

“We don’t have much support within the country. We have so much identity but try to produce a garment right here in Johannesburg – it’s going to cost you a lot if you want it done right.”

Kopman says manufacturers themselves need some education on issues such as quality versus quantity. “They often want to sway you to say, just do it this way because it’s cheaper. There’s very little understanding of quality. We need help, not just from within the industry, but from government too.”

Kopman says there is a need to create strong South African brands. “Let’s have local brands that we can be proud of. We need to put kasi culture at the forefront,” he says, naming the dapper pantsula of yesteryear as an example of how the tastes of South African men have always been of a high standard.

Booyzen counts Kopman among the most consistent menswear designers to have showcased on her platform over the years. His spring/summer 2014 collection will be in collaboration with the Jonathan D brand, which is a boon for Kopman’s Naked Ape as it will allow his brand to tap into a market it doesn’t yet cater to.

“Both brands have walked very different paths,” Kopman said on announcing the collaboration. “We wanted to bring these paths together by creating a line of fashionable menswear. It’s not high fashion. It’s a practical collection that focuses on shape, style, functionality, trim and overall identity. It’s affordable, which is something the market needs now, and will offer men the ability to embrace a modern identity through fashion.”

Fashion Week successes

Other menswear designers Booyzen rates as having been successful under the SA Fashion Week umbrella include Ole Ledimo of House of Ole and Ephraim Molingoana, who is behind the Ephymol label.

Booyzen says the growth of menswear both internationally and locally is an indicator that the market is ready for a new emphasis on the development of independent South African menswear.

The Foschini Group acquired luxury menswear label Fabiani in 2011. (David Harrison, M&G)

Even though the category has not attracted the same kind of support and attention as womenswear over the years, several younger labels have sprung up and stand to benefit from the growth.

These include Keith Henning, who showcased his Adriaan Kuiters label for the first time at Mercedes-Benz Fashion Week Cape Town in 2012, Zano Sithetho who won the 2012 SA Fashion Week/Renault New Talent competition and Kim Gush, whose Goth aesthetic challenges the very notion of conservatism. As small-scale as many are, labels such as Simon Deporres in Cape Town are proving successful at servicing the market.

And renowned designer David Tlale last year chose to showcase a full menswear range during Mercedes-Benz Fashion Week Cape Town after several years of only featuring a few menswear looks in his womenswear shows. Spies stocked the collection exclusively at her Egality store. Tlale says, although many concerns still plague the local menswear industry, there is no doubt that the category is mirroring global growth.

“As with all young categories, menswear still has some way to go with fit and style. Our male customers often find local menswear too small and not sufficiently comfortable. This is changing rapidly and soon local menswear will be just as good as our ladieswear.

“Currently, men in general are not as interested in taking risks with their look. They are more interested in comfort and functionality. However, every month we see more male customers looking for something different that can define them better. Menswear is definitely on the rise.”