MTN 'made a bold move into Nigeria when Western carriers were holding back'.

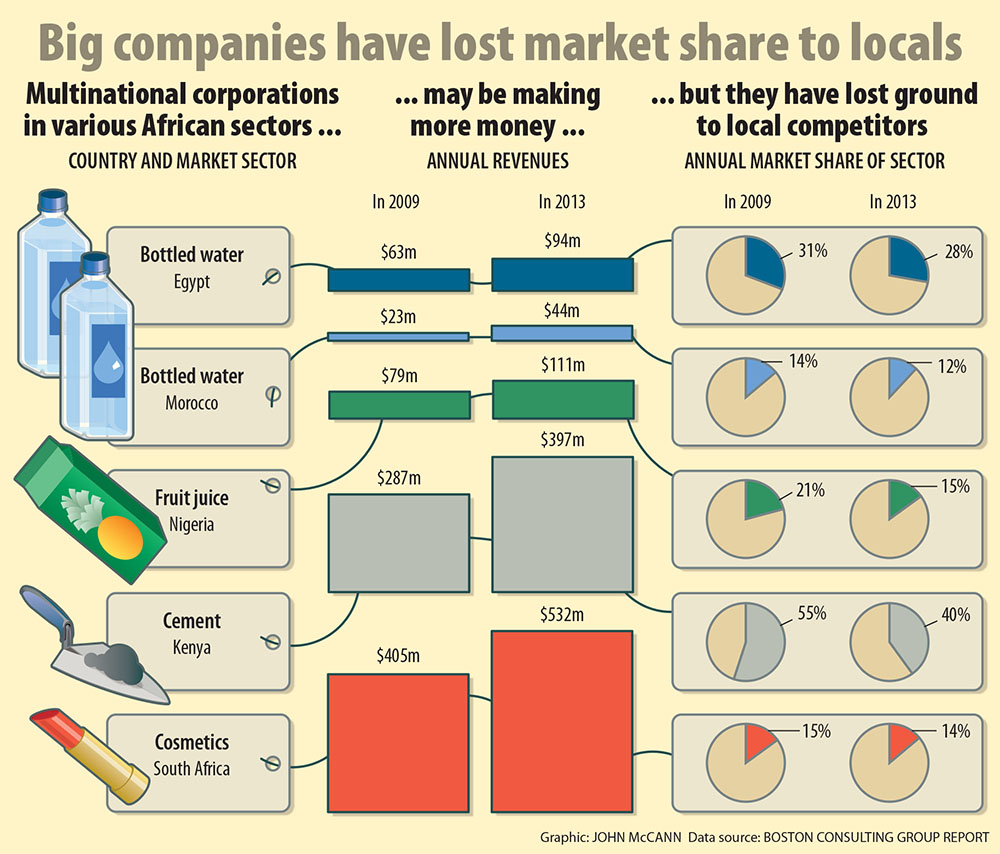

Multinationals’ revenues in Africa might be growing, but they are losing market share to African businesses, which are proving to be formidable competitors and enjoy many home-ground advantages.

According to a recent report by the Boston Consulting Group, Duelling with Lions: Playing the New Game of Business Success in Africa, multinational corporations have met their match in African economies, where resident companies are becoming dominant.

“Local African companies have made investments and expanded their offerings, in many cases taking business away from multinational incumbents,” the report says. “The multinationals are rethinking their positions on the continent and contemplating additional investments of their own.”

African companies are quickly overcoming historical disadvantages when it comes to conducting business, the report says.

Increased access to debt and equity has narrowed the “capital access gap”, and the buying in of expertise means African business can now compete with multinationals in terms of technology and know-how.

This is helped by the fact that highly skilled Africans are increasingly returning home after qualifying abroad. The growth and expansion of African companies also means scale is no longer strictly the advantage of the foreign companies operating in Africa, the report says.

Several African pioneers have beaten multinationals in entering African markets, resulting in huge market-share leads and broad name recognition.

The report offers MTN as one example, “which made a bold move into Nigeria when Western carriers were holding back”. Another is the cosmetics company Biopharma Laboratories, which is strong in Cameroon and Côte d’Ivoire, and which “through deft early moves has increased the cost of entry for international rivals in several other African nations”.

The report says three Moroccan banks – Attijariwafa, BMCE and Banque Populaire – continue to beat international banks at home and have quickly expanded across Francophone Africa.

In other cases, African companies have taken over markets from multinationals, the report says. The food company Bidco has grabbed a majority share of the edible oils market in Kenya, and the entry of Mombasa Cement in 2009 has altered the competitive dynamics of the Kenyan market.

The beverage producer and distributor Refriango introduced its top soda brand, Blue, to the Angolan market in 2005, where today it is the leading soft drink.

But their biggest advantage is their adaptive nature and their commitment to their local markets, the report says.

African companies are dependent on local markets for success, which makes them more committed, whereas multinationals are increasingly spreading themselves too thin in trying to take advantage of several opportunities around the globe. Their home-ground focus means, for example, that African companies can develop products specifically for their markets, whereas multinationals can seldom justify developing new products to compete with an offering made for Westerners.

Another home-grown advantage is extensive on-the-ground experience and the close proximity of decision-makers. “In many parts of the continent, success depends on strong personal relationships, and verbal agreements are often more important than written contracts,” the report says.

African businesses also have a superior grasp of information relevant to local markets. As the report puts it, “to executives in Western companies used to reliable data, Africa can comes as a bit of a shock … Africa-based companies and executives who know the continent well and have adapted to the information gap by cultivating their own sources and relying on their own judgment.”

Flexibility is a key advantage in doing business successfully in Africa, the report says. “To be sure, rules and structure have their place. Some African companies that don’t have enough of them have gone out of business. Still, when you hear about a deal in Africa that succeeded because of a flexible approach, it usually involves an African lion. When you hear of one that failed because of its excessive rigidity, it’s usually a Western multinational corporation that paid the price.”

An analysis by the Boston Consulting Group found that almost nine in 10 multinational chief executives visited Africa in 2013, compared with fewer than one in 10 in 2000.

But “for most Western companies, success in Africa has been elusive. Multinational corporations’ difficulty holding on to market-share profitability has led some executives to wonder if the African economic boom is actually a mirage,” the report says.

That oil prices have not rebounded has added to the concerns.

But the long-term potential cannot be overlooked, the report says. The continent’s gross domestic product may have been revised downwards, but it is still growing. Africa is also considered more politically stable that it was, as 54 countries now hold democratic elections compared with fewer than 10 in 1990.

Demographics are working in the continent’s favour, it says. Africa has a large working-class population and, according to the United Nations, its workforce will soon exceed those of the Europeans and Asians.

The report says businesses should stay the course. “No company, whether a lion or a multinational corporation, is guaranteed to win on the continent. But those that stick it out – and make the right moves – will have an excellent chance of succeeding in an economic frontier that, in many ways, is just opening up.”