Ajay Gupta (centre) (Delwyn Verasamy/M&G)

Market commentators and competitors argue that the Gupta companies, bereft of their current owners’ political connections, will be a shadow of their former selves.

The Guptas’ “fine, then we’re leaving” announcement has been met with a dramatic fall in the share price of their listed company and a swarm of public attention. But it will also mean a search for buyers who are willing to take on an array of companies with arguable value – and all gathered under the same dark cloud.

The Jacob Zuma-connected family has business interests ranging from gold, coal and uranium mining to broadcasting and newspaper media (the New Age and ANN7), computer retailing (Sahara Computers) and even a luxury lodge.

According to Nazeem Howa, the chief executive of Oakbay Investments, which holds many of the family’s business interests, they have more than 7 000 employees.

But how much worth will be transferred to the new owners, and will the beleaguered Gupta family be able to sell their companies for anything close to market value? Several analysts argue that much of the worth contained in their empire is linked to their political contacts, and that most of their assets will go for a song.

Mining wealth

“Without the Guptas, there’s almost no company,” said one commentator. “Those companies are only worth something with them at the helm, with President [Jacob] Zuma and other MPs in place.”

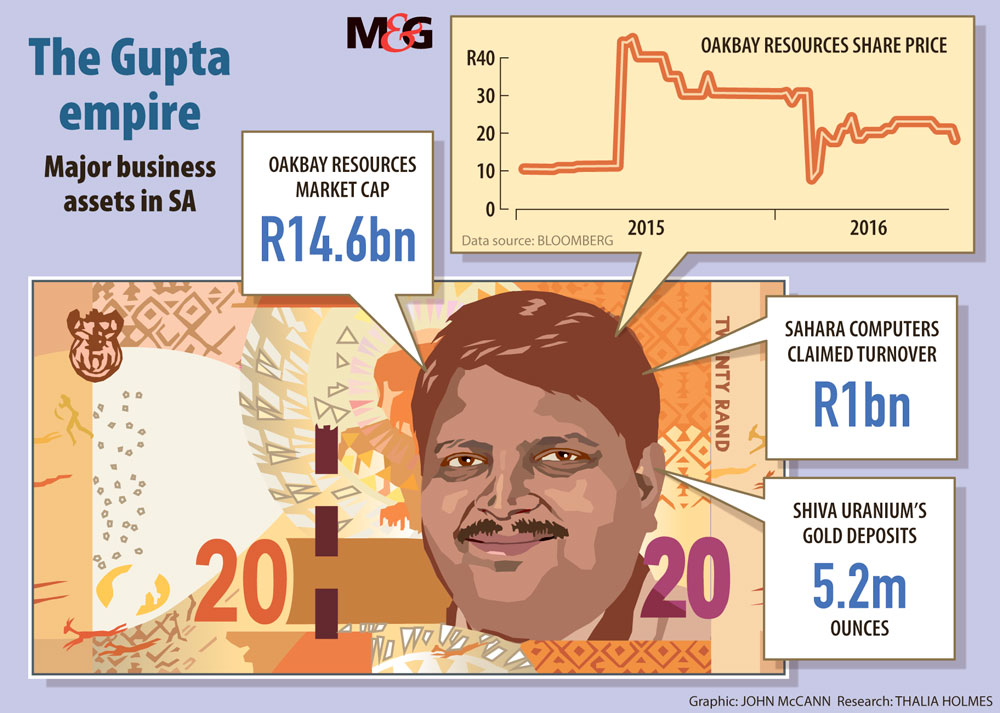

Take Oakbay Resources, the Guptas’ JSE-listed company, whose flagship asset is Shiva Uranium, for example. Oakbay Resources’ market capitalisation is currently R14.6-billion. “So it’s big,” said Vestact portfolio manager Byron Lotter. “Having said that, the market cap is a bit off-key because of liquidity. I mean, how are you going to sell a company no one wants to touch?

Sellers are offering the share at about R20. Buyers are offering R2.63. This suggests a dramatically lower market value than the R14.6-billion imputed from the ruling price. “If you look at those figures, the market cap is probably closer to R2-billion,” said Lotter.

Another analyst said the Guptas will take all of Oakbay’s value with them. “The problem is there was no value in it when they bought it. When they exit the business, the value will probably go back down to zero.”

Only about 2% of the company’s shares are held by the general public, while it is 80% controlled by Oakbay Investments, the company that owns many of the family’s businesses.

“It’s a tightly held, thus fairly easy to manipulate share,” said Peter Major, director of mining at Cadiz Corporate Solutions. “No one knows what was holding the share price up. But it has never been a liquid stock, so it never reflected reality.”

The Shiva Uranium site boasts 89-million kilograms of uranium and 147-million grams of gold, with a world-class uranium processing plant. But, with uranium prices at a historical low, (currently trading at $226 pound spot) “you’re almost lucky if you can ‘give’ uranium mines away”, said Major. “There are only a few of them in the whole world that are making any money at current uranium prices.”

The Industrial Development Corporation (IDC) stands to lose on the transaction. When Oakbay Resources listed near the end of 2014, the IDC converted approximately R256-million (fair value: R225-million) of debt to equity. That part of the loan was converted into ordinary shares, with the IDC paying roughly R9 a share. On Wednesday, the share price was hovering at about R18. However, with it being as arbitrary and volatile as it is currently – it lost 28% in one day when news of the Guptas’ exit broke – “I think the IDC is going to take a knock,” said René Hochreiter, a mining analyst at Noah Capital Markets.

In addition to Shiva, the Guptas own majority stakes in JIC Mining, which provides mining services to large mining houses, and Tegeta Resources, which is currently being investigated by the treasury for its extensive coal contracts with state-owned power utility Eskom.

According to Major, “JIC Mining is a reputable company that is more than covering its costs and probably making a decent ‘contractors’ margin.” But the Guptas’ real mining money currently lies with Tegeta.

Tegeta has publicly defended its relationship with Eskom. “We strongly believe we have done nothing wrong and have followed every policy and process correctly and have no issue with government or a regulatory body reviewing our activity,” the company said in a statement last week.

Eskom and the treasury are currently embroiled in a public spat over the matter, with the treasury claiming that Eskom has resisted its efforts to investigate the deal and the electricity provider saying that it has co-operated in full.

“I don’t think treasury will allow the Tegeta contracts to continue,” said Hochreiter, “unless [Finance Minister Pravin] Gordhan gets fired.”

But even if the Tegeta business dries up, Major believes that the uranium mine still retains some worth. “I don’t think Shiva has lost everything; there’s gold on that property as well,” he said. “If the uranium price goes back up, it will be worth many multiples of what it is now.

“But there have been so many stories in the news. If anyone’s going to buy [the Guptas’ mining companies], they’re going to ask for a big discount and a lot of guarantees.”

IT interests

The family founded Sahara Computers in 1997, and its website claims that it has a R1-billion turn-over and 210 employees. It distributes information technology products for resellers in South Africa, rivalling such companies as Pinnacle, Rectron and Tarsus.

Little is known about their profit margins but competitors say the company enjoys public patronage. “They get a huge amount of business from the state,” said one competitor. “If the Guptas were to leave, many of those contracts could dry up.”

Howa said this week the family is already in talks with potential international investors. But if foreign stakeholders took over the Guptas’ shares, this would negatively affect Sahara’s black economic empowerment ratings, said the competitor.

The company’s most recent BEE certificate reflects 22% black ownership, which puts it in a fairly strong position for winning government tenders.

Media

Perhaps the Guptas’ most-discussed assets are their media interests, which include the New Age newspaper and ANN7, a 24-hour television news channel. Roundly accused of being propaganda arms for the government, the companies receive huge amounts of government business by way of advertising and the sponsorship of events such as the New Age business breakfasts, which often feature senior ANC officials.

In the 2014 financial year, the New Age newspaper received more than R10-million in government advertising, and a reported R75-million from various government departments the year before. Other publications with comparative readership received less than a tenth of that amount. With no more Guptas, government funding would almost certainly slow and some argue that the reason for the media companies would cease to exist.

Nevertheless, the media expert said, the family’s broadcast asset offers some intrinsic value.

“ANN7 is slightly different. They have got existing infrastructure, staff and relationships with an Indian broadcaster with whom they share resources,” he said. “I think it’s actually quite valuable. It would allow another media company with broadcasting ambitions to leapfrog.

“But it wouldn’t fetch anywhere near the price of a fully functioning reputational broadcaster. It would go for a steal, let’s put it that way.”

No matter which asset is under discussion, the family, which says it has become the victim of a toxic discourse created by the media, faces a universal challenge.

“Everything the Guptas have touched is tainted, because people suspect there’s some kind of underhand or dodgy activity involved,” said Lotter. “I’m not saying it’s true; people are sometimes looking for a scapegoat. But they are going to struggle to find any buyers – except for that nice house by the zoo. I’m sure that will sell.”