Distorted: The JSE Top 40 paints a skewed picture because it is based on what local shareholders own and has been described as ‘parochial’ and ‘inward looking’.

The fortunes of the JSE are significantly more dependent on the number of youngsters playing video games in China than on the value of mineral resources extracted from South African soil — or any other local activity for that matter.

The JSE Top 40, its most popular index, attributes most of its growth to Naspers.

According to Sasfin’s David Shapiro, the Top 40 recorded a capital loss of 1.5% over the past year. Naspers accounted for 3.4% and Richemont, which sees China as a key market for its luxury goods, accounted for 2.2%.

As a result of its 34% stake in Tencent, the biggest gaming company in the world, Naspers’s stocks continue to grow as they track the Tencent share price. The company has recorded a capital gain of 27% since the beginning of the year.

The composition of the Top 40 is partly why Naspers should be the main driver of its performance, said Shapiro. “If you look at the composition of the indexes, they are misleading. The Top 40 is based on a local float, which ranks the stocks according to what local shareholders own.”

This creates distortions. For example, in the Top 40, Anglo American ranks fourth in terms of weighting because of its high local share ownership. But when compared with all companies listed on the stock exchange, it is the 13th largest in terms of market capitalisation.

British American Tobacco has a small weighting and resources behemoth Glencore does not even appear. Nor does AB InBev, even though SABMiller used to appear on the Top 40 with a weighting of 13%.

“I argue against the way the indexes are made up here. It’s parochial and inward-looking,” said Shapiro. “Be that as it may, the consequence of that, Naspers is the market and accounts for about 20% of the Top 40. So we are more reliant on little kids in China playing games than we are on the platinum price.”

Mark Randall, the manager of indices and valuations at the JSE, said the Top 40 is designed for the South African investor and aims to reflect the 40 companies that are held in the largest value in aggregate in the local market. (See “Local shares determine Top 40”.)

For quite some time, the JSE All Share Index has been characterised by its high level of internationalisation. A number of major multinational companies that make most of their money outside South Africa are listed on the exchange, and so the performance of the JSE is more often driven by global developments than by domestic ones.

Even with the growth of Naspers (up by 21% over the past year), Richemont (up by 25%) and British American Tobacco (up by 15%) on the exchange as a whole, a disconnect between the performance of the JSE and other exchanges is showing: those elsewhere are experiencing growth, but the JSE has been flat.

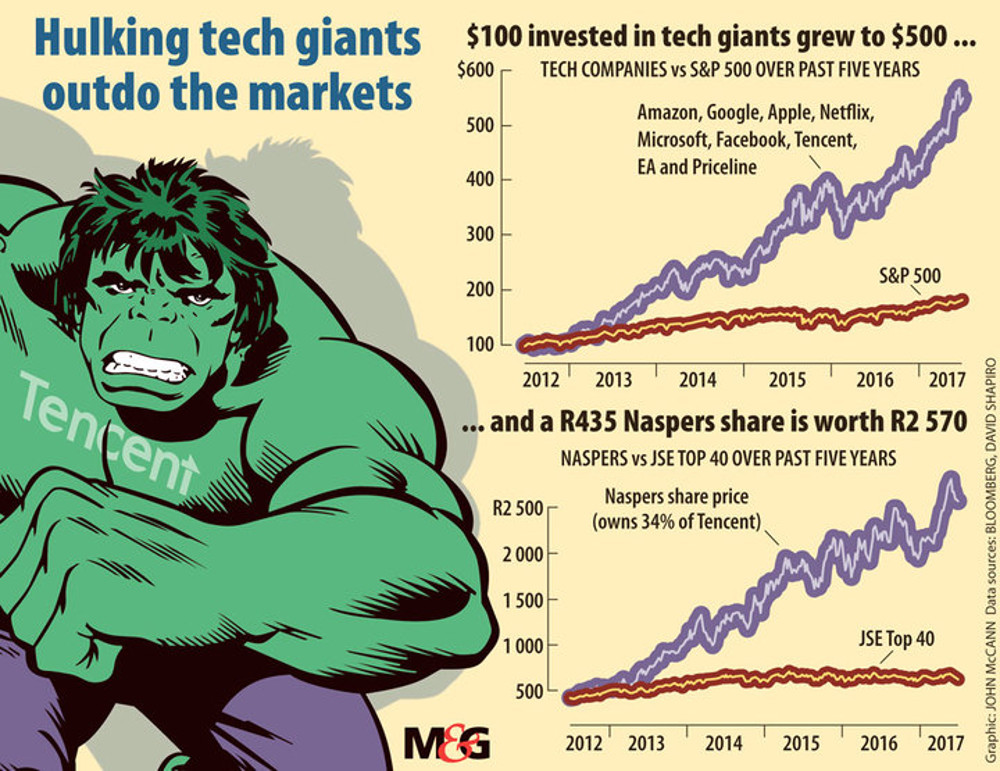

According to Shapiro, as of June 27, the one-year return for the American S&P 500 was 21%, 33% for the American Nasdaq, 31% for the Euro Stoxx 50, 25% for the British FTSE, 35% for the Japanese Nikkei 225, 19% for the Australian ASX 200 and 32% for the Chinese Hang Seng.

“If the JSE is so internationalised, why have the S&P and others outperformed it by such a huge margin?” Shapiro asked.

“Anglo is down 14%, Billiton is down 11%, MTN is down 19%, and Sasol is down 7%. If it weren’t for the other offshore stock it would be worse. I’m deeply concerned.”

“If you’d put $100 in S&P five years ago it would be worth $182. If you had put $100 in the JSE Top 40 it would now be worth $101,” said Shapiro. “If the JSE is so international, why has the S&P outperformed it by such a huge amount?”

Political events are partly to blame, he said, noting how the recent release of the new mining charter has hurt local mining stocks. But more important, he said, is that the big players on the exchange are from old industries. “The JSE is very old, it’s old economy stocks, even if they are international. Naspers is the only modern stock.”

The S&P has a bunch of tech stocks in its Top 10, such as Apple, Google parent company Alphabet, Microsoft, Amazon and Facebook.

Shapiro said that if people had gone into those stocks five years ago they would have made a good return — $100 in Alphabet would be worth $336 today. “These companies are earning, therein lies the answer.”

Market commentator and Vestact director Sasha Naryshkine concurred. “Big tech stocks in the US have been up, some in excess of 30% year to date. Tencent follows that price trajectory and so Naspers has done the same. Meanwhile, mining shares have done worse.

“The Public Investment Corporation [a quasi-public investment company] and institutional funds are natural buyers. The prices haven’t really budged, even though foreigners have been net sellers.

“What you are seeing now is a confidence crisis,” said Naryshkine.

Retailers have iffy numbers and local industrial Bidvest has seen stock prices remain at similar levels since it unbundled from Bid Corp last year. This, Naryshkine said, was one proxy for the South African economy.

Bid Corp, which has food assets around the world, has experienced share price growth of 20% over the same period.

Local shares determine Top 40

It’s often thought that the JSE Top 40 is made up of the 40 largest firms listed on it. But it is, in fact, the size of its local share ownership that determines whether a company makes the cut.

Mark Randall, the manager of indices and valuations at the JSE, said the first criteria to be included in the Top 40 is that the company must be listed on the All Share Index. This index is reviewed in March and September annually and qualifying firms must meet the eligibility criteria.

Broadly speaking, the rules include:

• The company must be listed on the main board of the JSE.

• The firm must trade 0.5% of its investable market capitalisation on the JSE each month.

• At least 15% of the company’s global issued shares must be available to trade.

• Foreign firms must have a minimum of 1% of their total issued share capital held in South Africa.

Anheuser-Busch InBev, which acquired SABMiller, does not appear on the All Share because it doesn’t have that 1%. “Despite AB InBev having a market capitalisation of nearly R2.5-trillion, less than R25-billion is held in South Africa,” said Randall.

Once the All Share is selected, it is used to select the Top 40. The latter is reviewed quarterly and ranks companies on “free float adjusted market capitalisation” rather than “gross market capitalisation”. The free float adjustment excludes numerous types of shareholdings that are deemed to be not freely available, such as director holdings, strategic holdings, holdings subject to a lock-in clause and holdings on a foreign share register.

“Glencore is a top five company in terms of market capitalisation, putting it near the top of the All Share Index, and Large Cap Index for that matter. However, only about 3% of its shares are held in South Africa, so when we get to the Top 40 space, we only include this fraction of its total market capitalisation,” said Randall.

“Using this investable market capitalisation measure, Glencore ranks near position 60 in terms of investable companies in South Africa. As such, it is not added to the Top 40.”

Randall said the Top 40 is designed for local investors and aims to capture the 40 firms that are held in the largest value in aggregate in the local market.

“As a result, we see that a company like Truworths, with a market cap of R33.7-billion, is included over a company like Glencore, with a market cap of R742.7-billion, because Truworths is held in greater value in South Africa [with a local shareholding of R32.7-billlion compared with Glencore’s R22-billion],” he said. “Similarly, a company like Anglo American Platinum ranks at number 27 in the All Share and Large Cap space, but at 61 in the Top 40 space, due to the Anglo American holding, which is excluded from the free float.”