Claudia Del Fante

There are a number of unpredictable factors in both local and global markets today. Claudia Del Fante and Radhesen Naidoo discuss how they think about risk at Allan Gray and why a unit trust that is mandated to invest in a variety of assets, such as the Allan Gray Balanced Fund, could be the solution to help most investors navigate the choppy waters.

Where many investors define risk as the volatility of returns, or the risk of looking different, our focus is always on avoiding permanent loss of capital.

The risk of capital loss varies considerably between unit trusts. Generally, the higher the risk of loss, the higher the long-term return you should expect from an investment. When choosing a unit trust, you need to balance the return you require to meet your objectives, the risk of loss you can afford to take, and the risk of loss that you are comfortable with. This may involve a tough trade-off between your objectives and your comfort with risk. But it is best to make a considered decision at the beginning and to stick with it, rather than to be surprised later and shaken into disinvesting at the wrong time.

Once you are invested, your unit trust portfolio managers will be working hard on your behalf to manage risk and return within the fund, and your job is to give your investment the time it needs to deliver on your plan.

The risk and return conundrum

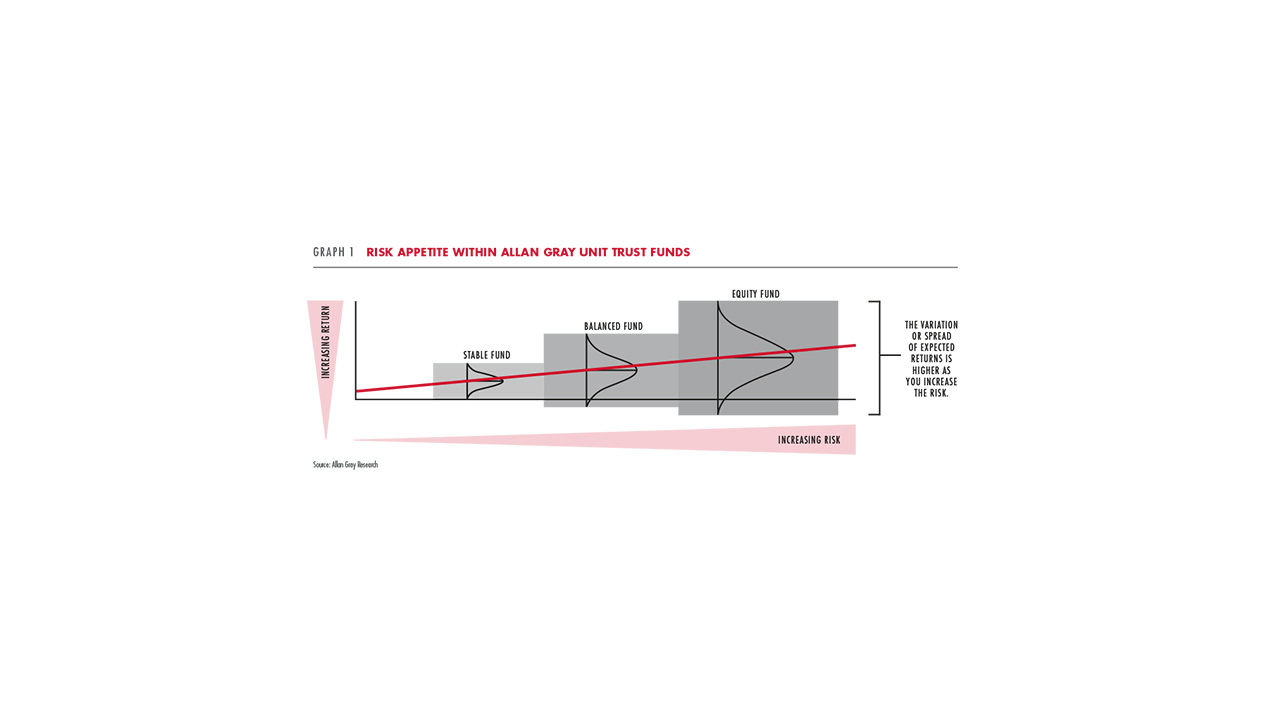

We would all prefer high returns with no risk, but as the economist Milton Friedman famously said: “There is no such thing as a free lunch.” In theory, the more risk an investor assumes, the higher the expected investment return, but more risk also means a wider range of possible outcomes, as shown in Graph 1. The graph illustrates that, as you increase the risk, the expected return increases (red line) but so too does the variation of that expected return (the curved black lines shows the spread of possible returns). Putting this into the context for Allan Gray, an investor in our Equity Fund expects to achieve a higher return than the Balanced and Stable Fund, but must also accept that there are periods when this will not occur.

The first part of the portfolio manager’s job in each of these funds is to invest in securities that individually offer the best trade-offs available between risk and return. Our investment philosophy is to invest in a basket of assets that are trading below what they are intrinsically worth, and to be concerned with the risk of losing capital, not the risk of being different. Portfolio managers combine many of these individual investments, each driven by different risks and opportunities, into unit trusts, managing the overall risk of loss and upside potential in each. Focusing on fundamental business risk and not the latest share price action may result in short-term periods of underperformance, but we believe that excessive focus on short-term volatility can be distracting and ultimately detrimental to long-term investment returns.

The Allan Gray Balanced Fund best illustrates our approach

During times of uncertainty, a unit trust that is mandated to invest in a variety of asset classes can work well for investors, because it is diversified and reduces the risk of being overly exposed to a poorly performing asset class at the wrong time. Let’s take a look at the Allan Gray Balanced Fund (the Fund) to understand how this works.

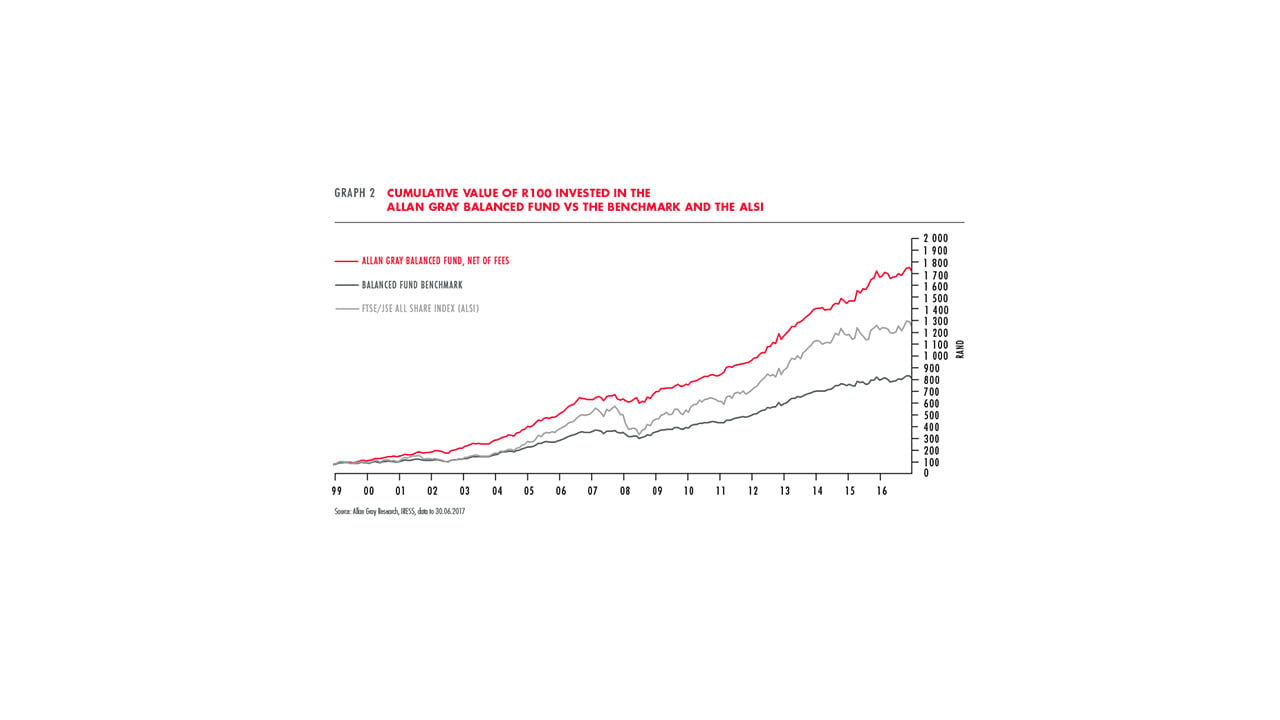

Since the launch of the Fund in October 1999, its goal has been to create steady, long-term wealth for investors by balancing income generation, capital growth and risk of loss. The broad investment mandate gives the Fund’s portfolio managers the discretion and flexibility (within the constraints of the retirement fund regulations) to choose individual securities across various asset classes to achieve its goals. Since inception, the Fund has delivered on these objectives and outperformed its benchmark (the average balanced fund in the South African Multi Asset-High Equity sector) and the South African stock market, as shown in Graph 2, without taking on greater risk of loss.

Managing risk in the Balanced Fund

The Fund is constructed using a bottom-up investment process. The portfolio managers build the portfolio from a blank sheet of paper, based on the relative attractiveness of individual securities across various asset classes. Each individual security is put through an extensive research process to assess the expected return over a minimum four-year term, relative to downside risk. Every individual investment idea — e.g. a South African government bond, a commodity ETF (exchange-traded fund) or a Sasol share — is competing for a place in the portfolio. The asset allocation is the result of the extent to which individual securities are found most attractive relative to one another. During periods where valuations move to extremes, such as the 2008 Global Financial Crisis, the asset allocation can be more dynamic to protect investors and take advantage of the opportunities presented.

While savvy investors with the time and appetite to do their own risk assessment could put together their own portfolio of assets, investing in our Balanced Fund hands over the responsibility to experienced professionals who have a deep understanding of each of the available instruments and the risks faced at a given point in time. The Fund is very carefully constructed considering the individual risks of each security, as well as the correlated risks across holdings. For instance, when considering the impact of an exchange rate move on a portfolio, one needs to consider exposure to offshore assets as well as holdings in rand-hedge South African shares, local counters such as retailers that need to import goods, and mining firms, which export commodities.

A practical example was during the “Nene-gate” debacle in December 2015, when South African banking shares sold off sharply while rand-hedge shares, such as British American Tobacco (BAT), performed relatively well. We had to decide whether to reduce exposure to the rand hedges and take advantage of the cheaper price of banks. Meanwhile, selected resource shares had also become attractive as their prices fell in rand and dollar terms, as commodity prices and the rand weakened. At the same time, investing in government bonds offered investors a guaranteed nominal return of 9% over 10 years. This gives one a sense of the complex decisions investors face.

Purchasing assets at prices below their true value provides a built-in level of capital protection for long-term investors, as bad news is already priced in. This approach increases the potential for future returns, as asset prices move towards their true value over time. To illustrate what we mean by protecting clients’ capital, Graph 3shows the average monthly return since inception (213 months in total) of the Fund relative to the FTSE/JSE All Share Index (Alsi). We also compare the average returns during the months where the AIsi generated positive (128 up months) and negative returns (85 down months). During up-months, the Fund’s performance has been in line with the benchmark and underperformed the Alsi. However, the Fund has outperformed both the benchmark and the Alsi over the long term by protecting our clients’ capital to a much greater extent in down-months. Focusing on absolute risk and protecting capital has enabled us to grow our clients’ money from a higher starting point; this is where the power of compounding truly benefits our clients.

How is the Balanced Fund currently positioned?

Approximately 50% of the Fund is currently invested in South African listed shares, 18% in fixed income, just under 5% in commodities and the balance in offshore investments (via our offshore partner Orbis and our Africa ex-SA Funds). Refer to Table 1.

The Fund’s top 10 shareholdings contain several well-diversified businesses that generate a significant portion of their earnings outside of South Africa’s borders, as well as some solid local businesses — all trading at meaningful discounts to our assessment of their respective intrinsic values. We believe these companies offer downside protection, in addition to unique opportunities to unlock further value. An example is BAT, which, given the favourable economics of the tobacco industry, generates stable revenues and pays out a large proportion of earnings to shareholders. BAT also has some upside from growth in emerging markets and the recent $50-billion acquisition of Reynolds American, which should enhance earnings over time.

Standard Bank, on the other hand, trades on an undemanding 10 times earnings multiple and a 5.5% dividend yield, with upside from increased efficiencies and lower costs from massive IT investment, in addition to the growth potential of their African business. The risks and opportunities these two companies face are fundamentally different. It is this diversity of economic drivers that helps to reduce the underlying risk of loss in the Fund, though the prices of shares can sometimes move together for short periods.

We continue to maintain the maximum foreign exposure within the Fund, considering both the opportunities Orbis is currently finding globally and the prevailing exchange rate. The global investable universe is about 100 times larger than our local market and provides increased opportunities to find mispriced shares and to diversify.

Lastly, the fixed interest component of the Fund has low duration, which means it is less sensitive to interest rate changes than the broader bond market. Maintaining a relatively larger portion of the Fund in cash allows us to invest if opportunities arise on the back of further uncertainty.

Stay the course

It is especially important to stay focused on your long-term investment goals and not to become distracted by short-term noise when things are uncertain, as they are now. Avoid the temptation to try and time markets, as this increases the likelihood of permanently destroying value.

The Allan Gray Balanced Fund has a number of different levers it can use to balance the relationship between long-term future returns and risk of loss. Our investment philosophy has served us well in protecting our clients’ wealth during periods of uncertainty in the past, and we believe it will continue to do so in future.

Allan Gray is presenting at the Allan Gray investment Summit on August 31 at the Sandton Convention Centre.

www.investmentsummit.co.za