(Graphic: John McCann/M&G)

Think back not too many years and it seems we have floated from bubble to bubble, cases of out-of-whack prices being recorded in eras such as dotcom, subprime and crypto.

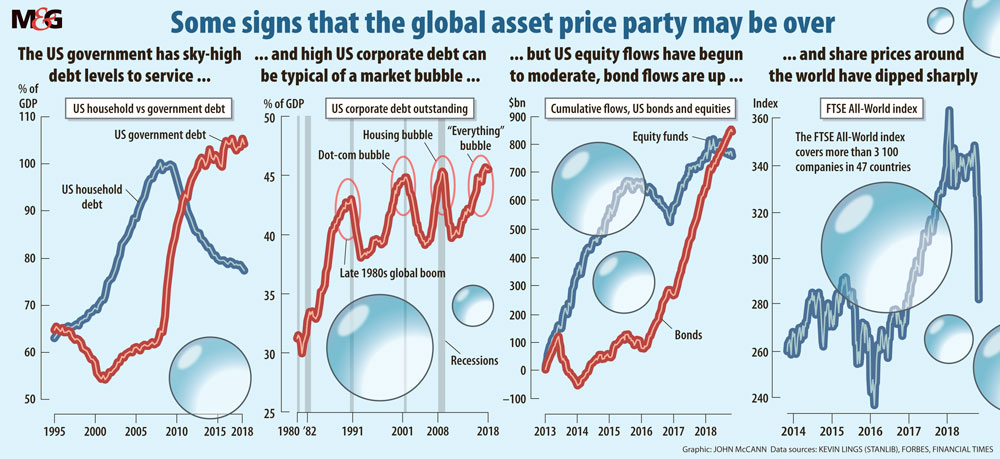

But now there’s a new bubble — the “everything bubble” — with pundits arguing that all major asset classes are overvalued. Web research suggests investment adviser Jesse Felder first coined the term in 2015.

“Everything is overvalued. Stocks are extremely overvalued. An incredible amount of bonds have negative yields; how much more overvalued can they get? Investment-grade and high-yield credit spreads are near all-time lows on top of some of the lowest rates we have ever seen!” Felder wrote on his thefelderreport.com website.

“Prices for high-end real estate, art and other collectibles are off the chart. I have thought of calling this the ‘everything bubble’ because, looking at each one on its own (outside of small cap stocks, which are largely obscured from view), there’s no obvious bubble similar to the dotcom or real-estate bubbles. But, taken together, we have never seen anything like this ever before.”

Forbes columnist Jesse Colombo, in a September article, sees bubbles in the United States stock market, commercial real estate, education loans, auto loans, healthcare, tech startups, ETF/passive indexing investments and emerging markets, to name an incomplete list.

Exhibit one is Wall Street. “Since the great recession low in March 2009, the S&P 500 index has gained over 300%, taking it nearly 80% higher than its 2007 peak,” Colombo says.

This stock market bubble is being led by the FAANG (Facebook, Apple, Amazon, Netflix, and Google) stocks.

“Though the S&P 500 has risen over 300% since March 2009, the FAANGs put the broad market index to shame: Apple is up over 1 000%, Amazon has surged more than 2 000% and Netflix has rocketed over 6 000%,” Colombo writes.

“The US stock market is currently trading at extremely precarious levels and it won’t take much to topple the whole house of cards.”

The fuel for this gravity-defying growth is widely known — ultra-low interest rates. The federal funds rate (our equivalent of the South African Reserve Bank’s repo rate) has remained at record low levels for a record period of time, that is, most of the past decade. Low rates have boosted stocks, causing prices to surge.

Cheap money has also “enabled a corporate borrowing spree, in which total outstanding nonfinancial US corporate debt surged by over $2.5-trillion or 40% from its peak in 2008”, says Colombo.

Besides keeping the fed funds rate ultra-low, quantitative easing (QE) by the Federal Reserve has created new money “out of thin air”, which is used to buy treasury bonds or other assets, pumping liquidity into the financial system.

In a bubble, the stock market becomes overpriced relative to its underlying fundamentals such as earnings, revenues, assets and book value.

“According to the cyclically adjusted price-to-earnings ratio (a smoothed price-to-earnings ratio), the US stock market is more overvalued than it was in 1929, right before the crash and Great Depression,” says Colombo.

The International Monetary Fund (IMF), in its Global Financial Stability Report published in October, addresses the question: A decade after the global financial crisis, are we safer?

“Looking ahead, clouds appear on the horizon. The global economic recovery has been uneven and inequality has risen, fuelling inward-looking policies. Trade tensions have emerged, and a further escalation may damage market sentiment and significantly harm global growth.

“Despite trade tensions and continued monetary policy normalisation in a few advanced economies, global financial markets have remained buoyant and appear complacent about the risk of a sudden, sharp tightening in financial conditions.”

The IMF says “a combination of rising US interest rates, a stronger dollar and the intensification of trade tensions have already led to market pressures and capital outflows in emerging markets.

“The ratio of total non-financial sector debt to GDP [gross domestic product] in jurisdictions with systemically important financial sectors stands at an all-time high of 250%, asset valuations remain stretched across several sectors and regions, and underwriting standards are deteriorating,” the IMF says.

Colombo says the current US stock market bubble will pop when the conditions that created it in the first place — cheap money — end. “The central bank is now raising interest rates and reversing its QE programmes, shrinking its balance sheet. What the Fed giveth, the Fed taketh away.”

The Fed claims to be able to engineer a “soft landing”, he says, but the last two recessions and bubble bursts occurred after rate-hike cycles; a repeat performance is likely once rates are hiked high enough. Because of the record debt burden in the US, interest rates do not have to rise nearly as high as in prior cycles to cause a recession or financial crisis this time around.