Golden opportunity? AngloGold Ashanti has recently sold the Mponeng mine (pictured) to Harmony Gold. (Chris Wessels/Anglogold Ashanti)

AngloGold Ashanti chief executive, Kelvin Dushnisky, says that the likelihood of the closure of the Mponeng mine within this decade would have been high had the company not invested more in it.

This comes as the global mining house recently announced it is selling the last of its South African operations, including Mponeng, to mining company Harmony Gold. The R4.4-billion transaction, which is expected to be concluded in several months, will see Harmony becoming South Africa’s primary gold producer.

Harmony will take over AngloGold’s Mponeng well as other AngloGold assets, including its Mine Waste Solutions business — a mining-waste treatment operation.

Dushnisky has spearheaded the company’s shift towards its more profitable mines in other parts of Africa, Australia and the Americas. The company, however, has down-played suggestions that the sale represents the “end of an era” for a century-old global mining house, saying that, despite exiting its South African operations, it will continue to maintain a presence in the country through its Johannesburg office.

“This has been the base from where the company’s global footprint has been run for more than two decades and will continue to be a centre of excellence for our current and future operations and projects,” says Dushnisky.

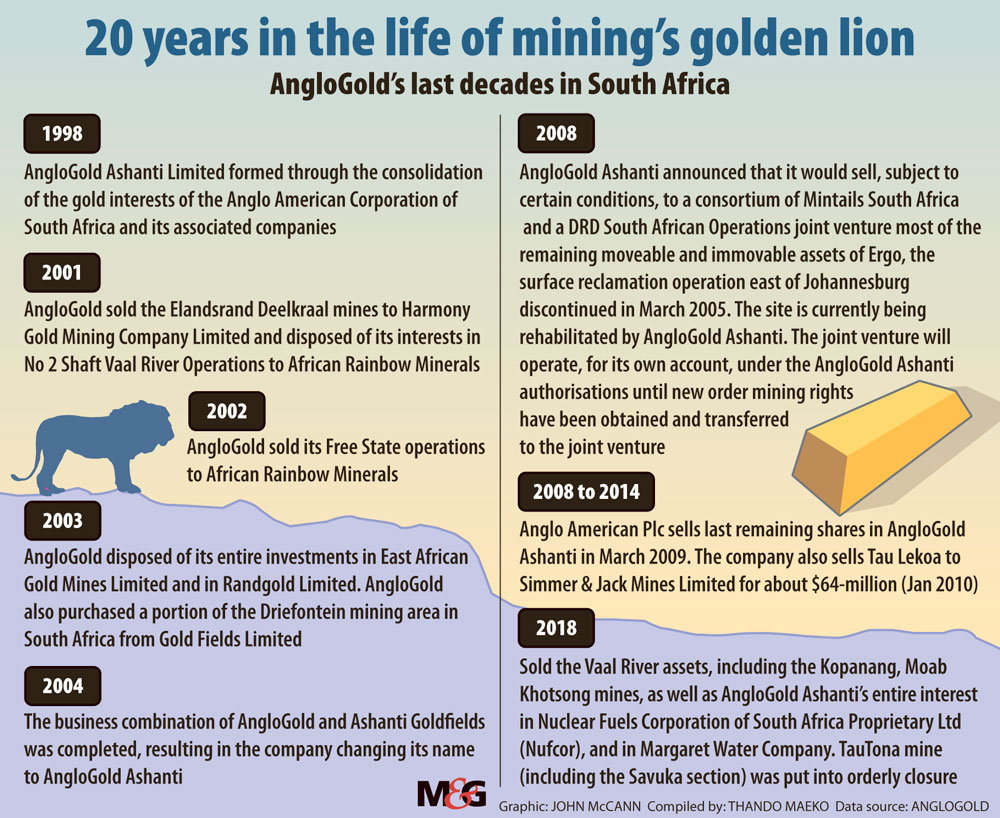

AngloGold has its foundations in the Oppenheimer-family-owned mining company, Anglo American, and has been the country’s leading gold mining house until its recent decision to sell its remaining South African assets.

Dushnisky says the decision to sell the last of its local assets to Harmony is based on its plans to invest in its operations that deliver higher returns compared to those in South Africa.

In 2018, AngloGold Ashanti produced about 3.4-million ounces of gold. The company’s South African operation accounted for only 13% of the total global production for that year. Dushnisky says while assessing where the company should allocate its investments, the South African operations did not make the cut compared to its wide range of global assets.

“Using our criteria and planning assumptions, an investment in the life extension of our Mponeng mine would rank below the other, higher-returning operations available to us across our global portfolio,” he says.

Dushnisky adds that: “Harmony Gold has made clear it will look to make a success of this asset over the longest possible period of time.”

The trip from the surface to the bottom of the 4km-deep Mponeng mine takes more than an hour. The mine, which is situated in Carletonville, southwest of Johannesburg, is one of the world’s deepest and oldest gold mines.

For Harmony, the acquisition of AngloGold’s Mponeng mine and surface assets will boost the company’s gold production by 350 000 ounces a year, as well as increasing Harmony’s South African gold reserves by 8.27-million ounces.

AngloGold says that Harmony was an obvious choice for the sale, given its financial capacity and track record of operating deep mining assets in South Africa.

Harmony chief executive, Peter Steenkamp, has brushed off concerns about the company’s increased investment in the notoriously expensive and dangerous gold-mining territory. Steenkamp told the Mail & Guardian that despite the mounting challenges that come with extracting gold from the world’s deepest mine, the company believes that the investment is a “strategic fit” for Harmony’s portfolio.

All the mines that are owned by Harmony, including the recently acquired Moab Khotsong gold mine, were previously owned by AngloGold. Steenkamp says this has made the company understand the risks associated with the sale of Mponeng “quite well”.

“The mine that we bought from Anglo a year-and-a-half ago has done very well and we have had a full calendar year without a fatality on the mine, so we believe that we can mine those operations safely. We obviously have the right management of risk,” he says.

(John McCann/M&G)

(John McCann/M&G)

Harmony has already invested $600-million into its assets that were previously owned by AngloGold and Steenkamp says that, of those assets, the Mponeng mine is the best quality.

Mponeng and the other assets sold to Harmony, including the TauTona and Savuka mines, produced combined revenue of R8.047-billion and profit after tax of R331-million for the year ended December 31 2019. The book value of these assets at the time was R9.901-billion.

“It [the acquisition] is a calculated gamble for Harmony,” says director of mining at Mergence Corporate Solutions, Peter Major.

“The company would’ve not probably taken Mponeng on its own without Mine Waste Solutions because it’s a pretty easy to run operation and it’s profitable. Without a doubt, Harmony got a good deal because those are huge assets,” he said.

Mining analyst at Noah Capital Markets, René Hochreite, says Harmony has short-life assets with a life average of eight years and has relatively low grades of gold. He says Mponeng would raise Harmony’s grade levels, which would likely boost the company’s profits.

“Harmony can also cut costs better than anyone else in the gold industry and will likely run Mponeng at a profit, compared to AngloGold, which had a high cost structure historically,” he says.