Money guzzler: Cost overruns on the Lake Charles chemical plant in the United States has caused Sasol’s debt levels to rise. The company hopes to find a willing partner for the plant which could help it recover from the ‘disastrous situation’ it finds itself in. (Sasol)

This week Sasol sought to assure investors that the murky waters that the company finds itself in are temporary and that the company is dealing with the effects of the bloodbath that was seen in the markets last week.

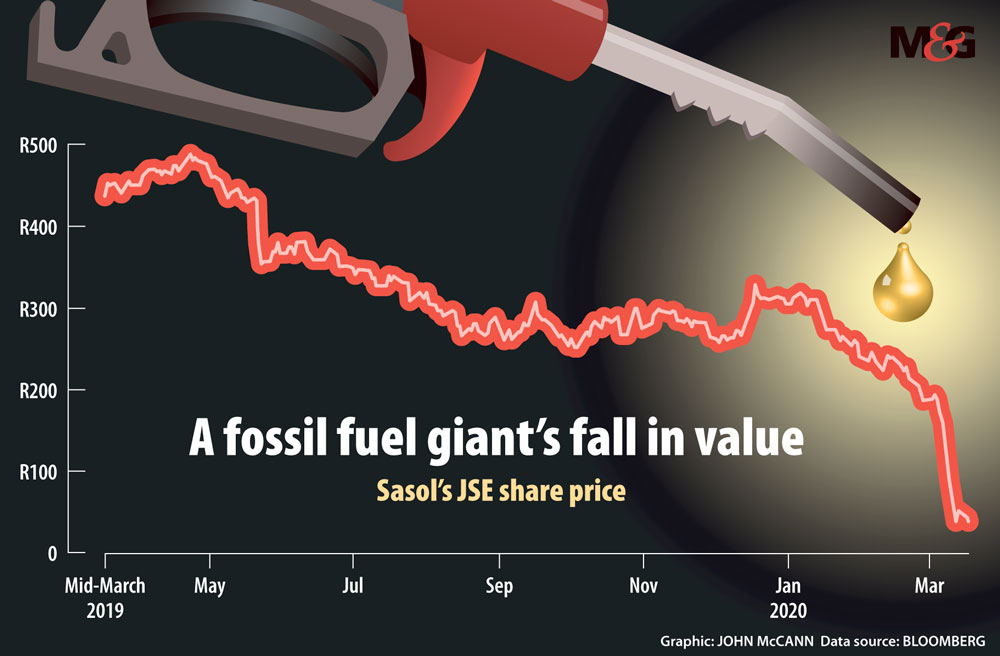

The petrochemicals company was not spared when fears about the coronavirus (Covid-19), coupled with the fall in the oil price gripped investors across the globe. On March 9 the oil price fell by 30% and Sasol share price lost 50%, reaching its lowest levels since 2004.

This week’s announcement by Sasol outlined the company’s plans to strengthen its balance sheet by listing various cost-saving measures, asset disposal and a potential rights issue. Through these measures, chief executive Fleetwood Grobler said the company would be able to reset its capital structure in order for the company to operate efficiently in a low oil price environment.

(Graphic: John McCann)

(Graphic: John McCann)

“In this dynamic and challenging environment, it’s critical that we tighten control on what we can, acting both swiftly and decisively… Sasol has a strong underlying business and all efforts are being made to enhance EBITDA [earnings before interest, taxes, depreciation and amortisation] in a sustained, low oil-price environment,” he said

Sasol is targeting cash savings of US$1-billion by June this year in a bid to “help Sasol end the year with net debt to EBITDA within its covenant levels, as well as help the group’s liquidity position,” said spokesperson Matebello Motloung.

Cost-saving measures include a freeze in headcount, only paying short-term incentives (annual bonuses) for this year to employees in lower role categories; and discontinuing funding for noncritical external training, conferences and travel.

Over the past few years, shareholders have seen their holdings shrink by 90% as the company grapples with, among other things, its increasing debt levels while completing its US Lake Charles chemicals project. The project consists of a 1.5-million tonne per year ethane cracker, and six downstream chemical units and is currently under construction near Lake Charles, Louisiana, adjacent to Sasol’s existing chemical operations. Once completed the project will increase Sasol’s capacity for chemical production in the US.

The project has incurred cost overruns of 50% more than the initial estimates. Last year, following external investigations into the company’s investment into the project, Sasol’s joint chief executives, Bongani Nqwababa and Stephen Cornell resigned.

Sasol says it is planning to reduce its debt by $6-billion from $10-billion by the end of the 2021 financial year.

The group is planning to accelerate its asset disposals by the end of 2021. These are expected to raise more than $2-billion, some of which have already been realised. Sasol is also looking for potential partners for the Lake Charles project, which is 95% complete.

Equity analyst at Sentio Capital, Andile Buthelezi, says despite the group’s plan to dispose of its assets, it might not be able to because it could be viewed by buyers as a “distressed seller”.

Buyers view distressed sellers as risky because these sales often occur only when a company needs to raise cash urgently to cover its debts. This, combined with the macro-economic uncertainty will likely result in offers that are below what the company believes is fair value for its assets.

“In theory, they should be able to withstand the volatile market if they execute on their response plan accordingly, however, one cannot ignore just how difficult this will be for them,” he said.

Buthelezi says that because the Lake Charles Project is near completion, the sale of the asset could be used to bolster the company’s balance sheet by reducing its debt levels. It will, however, be challenging for Sasol to find a buyer that is willing to meet its price, he said.

A call by the Organisation for the Petroleum Exporting Countries (OPEC) for its members to cut production was ignored by Russia, prompting what is widely seen by the market as an all-out oil price war between the eastern European nation and Saudi Arabia.

The Saudis ramped up their production of oil to above 12-million barrels per day when global demand was nearly four times that level. The combination of increased supply and lower demand plunged the oil price by 30%, the biggest fall since the 1991 Gulf War.

At $25 a barrel for oil, Sasol believes that it can maintain cash reserves of above $1-billion over the next 12-18 months. Additionally the company has an estimated liquidity of $2.5-billion with no immediate debt maturing until May next year. The company is also still managing to service its debts and the company does not expect “lenders to be knocking at [it’s] door”.

This could provide the cushion for the company, said chief financial officer at Makwe Fund Managers, Makwe Masilela.

There is also a potential rights issue of up to $2-billion which the company expects to execute after the 2020 financial year results. This would allow the company’s shareholders to purchase additional shares in Sasol in a bid to inject more capital in the company.

The rights issue is subject to the success of its asset disposals and cost-savings measures.

“The size of the rights issue may be reduced subject to the progress made on the other elements of the response strategy,” the company said.

The rights issue is unlikely to find favour with shareholders when the company convenes a general meeting this July, said Wayne McCurrie, portfolio manager at FNB Wealth and Investment.

“A rights issue at current prices is very expensive and is clearly a last resort by Sasol because of the disastrous situation that they find themselves in, but shareholders will most likely follow their rights because if they do not, they will be materially diluted,” he said.

Chief investment officer at Benguela Global Fund Managers, Zwelakhe Mnguni says a rights issue would remove risks from Sasol “given that we are in uncharted territory with this Covid-19”.

“What is certain is that if the current situation persists for much longer, [a] small decline in the oil price would increase the vulnerability of the company,” he said.

Thando Maeko is an Adamela Trust business reporter at the Mail & Guardian