After a series of meetings between the treasury and the International Monetary Fund (IMF) earlier this month, staff from the latter institution concluded that South Africa’s growth would sharply deteriorate to just 0.1% in 2023.

South Africa has not begun any discussions with the International Monetary Fund (IMF) for emergency funding. The country is grappling with the health and economic blow dealt by Covid-19.

The IMF’s senior resident representative in South Africa, Montfort Mlachila, said the country has not made a request for funding.

Earlier this week, Finance Minister Tito Mboweni said the country would consider various funding avenues, including local and global finance institutions such as the IMF, the African Development Bank, the World Bank and the New Development Bank (formerly the Brics bank).

Mboweni stressed that any funding request would not support budget items but rather “Covid-19 specific packages”. Mboweni, and the ANC, have been loath to approach lending institutions that might demand harsh terms for their loans.

Mboweni reiterated: “We are looking at programmes that will not be accompanied by any structural adjustment programmes.” Those adjustment programmes are some of the main conditions for loans from the IMF, where it demands changes in how an economy works in return for its money.

Under the IMF’s Rapid Financing Instrument (RFI), countries are eligible for aid to deal with natural disasters. Last week the IMF executive board announced that the emergency lending facility would be doubled to $100-billion to meet the expected demand. The emergency funding is not subject to traditional conditions by the IMF; there is virtually no conditionally and all the money is available upfront.

Mlachila said the RFI is available for South Africa should the country require it but that it’s up to the government to decide what funding is most appropriate as it deals with the pandemic.

The country’s economy was in recession before the coronavirus outbreak and the pandemic will result in further contraction of the country’s gross domestic product (GDP). This week the South African Reserve Bank said it expects the country’s GDP to contract in 2020 by 6.1%, compared with the -0.2% estimated just three weeks ago when the bank’s Monetary Policy Committee last met.

The GDP is then expected to grow by 2.2% in 2021 and by 2.7% in 2022.

(John McCann/M&G)

(John McCann/M&G)

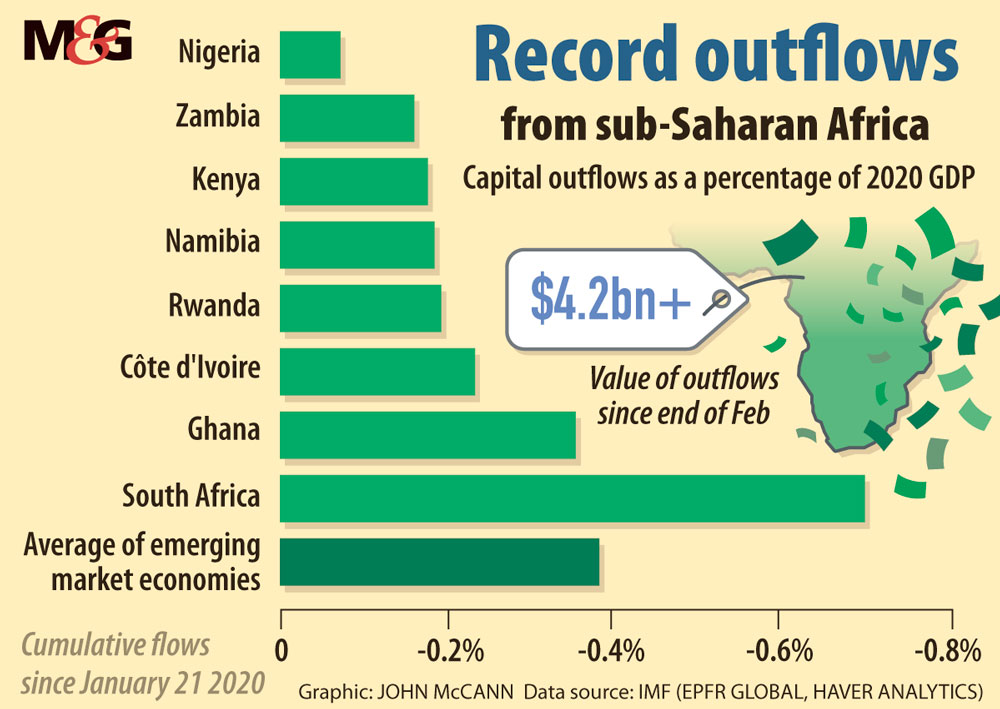

The IMF estimates a -5.8% contraction in the country’s GDP in 2020 and a 4.0% recovery in 2021. The steep contraction is in line with the IMF’s projections for the Sub-Saharan region, which is expected to contract by 1.6% this year.

Governments in the region are seeing their economy being ravaged by the pandemic and have turned to the IMF for support. This week the

IMF approved immediate debt service relief to 25 countries, 19 of them in Sub-Saharan Africa. This debt relief programme provides grants to the poorest nations to cover their debt obligations to the IMF for an initial phase over the next six months.

This week saw Ghana and Senegal being approved for the disbursement of $1-billion and $442-million respectively under the IMF’s Rapid Credit Facility and the Rapid Financing Instrument.

“This is unprecedented in IMF history to have so many countries ask for financial assistance at the same time and IMF has to make sure that requests are addressed,” Mlachila said.

Globally more than 90 countries have approached the IMF for emergency funding as the pandemic rips through economies. The lending institution projects global growth in 2020 to fall to -3%, revised from 6.3% in from January.

Assuming that the various policy and virus containment measures by governments are successful and the pandemic fades by the second half of the year, the IMF expects global growth in 2021 to rebound to 5.8% in 2021.

Thando Maeko is an Adamela Trust business reporter at the Mail & Guardian