The Standard Bank’s Wealth Report for Africa for 2020 shows that the continent’s wealthiest individuals worry about what impact volatile political environments will have on their wealth. (John McCann/M&G)

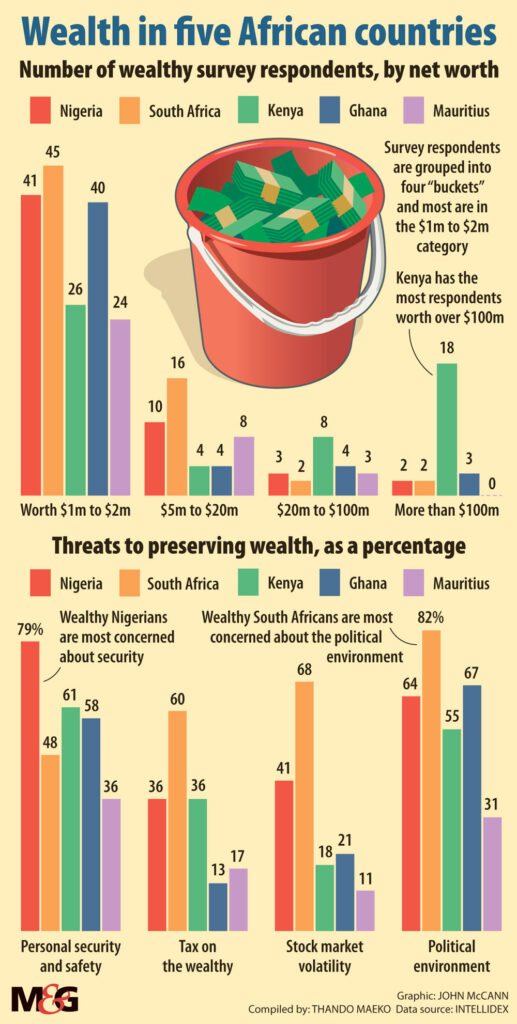

Nearly all of the high-net-worth individuals in South Africa are concerned about the country’s political environment as they look to create, preserve and spend their wealth. This is according to Standard Bank’s African Wealth Report 2020, released on Wednesday. In Ghana, 67% of the highest earners share this sentiment while in Nigeria and Kenya 64% and 55%, respectively, of high-net-worth individuals are concerned about the politics in their country.

Unlike the respondents in the other four countries, only 31% of wealthy individuals in Mauritius view the political environment as a threat to their wealth. Standard Bank economist Simon Freemantle said this could point to the country’s popularity and appeal as an offshore investment destination.

Political instability refers to a wide range of policy changes or unexpected challenges in the political environment of a country.

“It can fundamentally constrain economic growth and institutional reform, deter investment, and compound already pressing welfare and humanitarian challenges,” Freemantle said.

About 260 high-net-worth Africans completed the survey and 75 completed further in-depth interviews. About 170 of the respondents have a net worth of between $1-million and $5-million. In contrast, about 40 of the respondents had an estimated net worth of $5-million to $20-million. The researchers also canvassed those with a net worth of between $20-million to more than $100-million.

Based on the global property consultancy group Knight Frank, South Africa has more than 1 000 ultra-high-net-worth individuals with net worths of more than $30-million.

The Standard Bank report tracked high-net-worth individuals in South Africa, Nigeria, Ghana, Kenya and Mauritius. These five countries collectively account for 58% of GDP in sub-Saharan Africa at $1.01-trillion, and have a combined population of 327-million people, or 31% of all the people of the region.

On Wednesday, finance research firm Intellidex’s chairperson Stuart Theobald said although compiling the report had some challenges, it presents a broad overview of the wealth of the continent. Wealthy individuals do not reveal their riches regularly and are often reluctant to reveal their finances to the public, making information on them in many African countries challenging to find.

The patterns of wealth creation, however, have emerged from the survey. Most wealthy individuals on the continent are entrepreneurs with interests in real estate, financial services, manufacturing, construction and trade. In Nigeria, 13% of respondents are entrepreneurs in oil and gas, reflecting the established hydrocarbons industry. South Africa and Kenya were the only countries where entrepreneurs named manufacturing among the top four industries for wealth creation.

(John McCann/M&G)

(John McCann/M&G)

High-net-worth individuals on the continent are shown in the survey to prefer a mix of investments in asset classes to create and preserve their wealth. But there are regional variations which reflect the development of the respective countries’ markets. For instance, 51% of these individuals in South Africa prefer to invest their wealth in stocks or equities.

By contrast, eight out of 10 respondents in the other four countries surveyed preferred to preserve their wealth in a combination of tangible assets, investments in their businesses, cash or bank deposits and stocks or equities.

Other concerns related to the preservation of the wealth of high-net-worth individuals include personal security and safety, global economic changes, and succession and inheritance issues. Security concerns were most cited in Nigeria (79%) and Kenya (61%), while in South Africa, 68% of high-net-worth individuals were most concerned about the stock market volatility.

However, the younger respondents polled were less concerned about the political environment, yet more worried about their security and safety than the older generation. They were also less bothered by stock market volatility and global economic changes.

Thando Maeko is an Adamela Trust business reporter at the Mail & Guardian