The uncertainty created by the possibility of a coalition government

is putting people off big-price buys

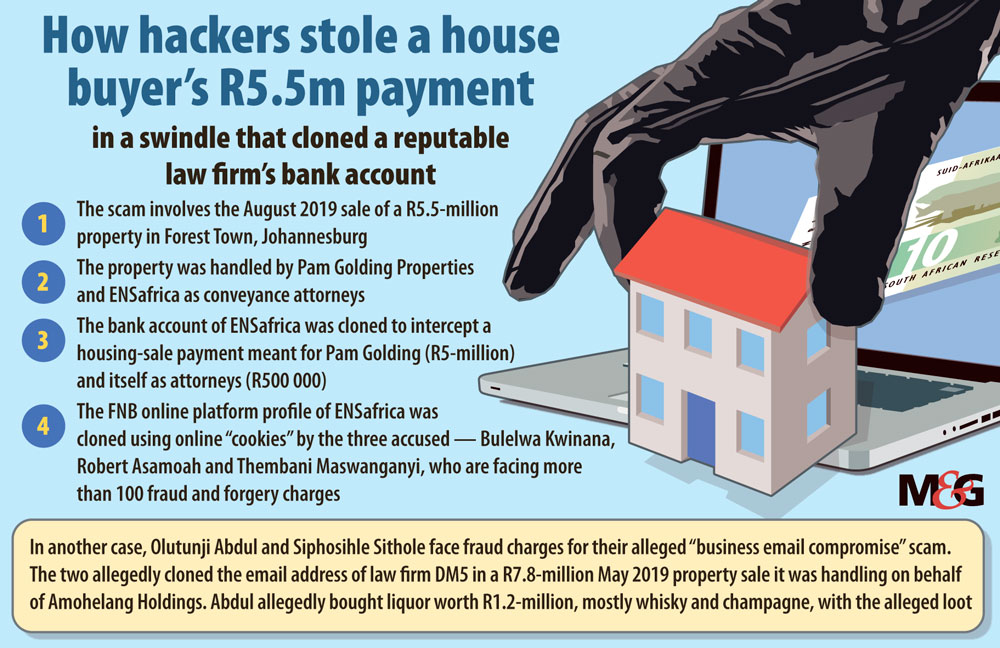

A new multimillion-rand business email and cyber scam, which targets major property companies such as Pam Golding Properties, is gaining momentum following the recent arrest of a controversial Limpopo businessman.

The fraud uses spyware or viruses to clone email addresses in order to intercept property sales from unsuspecting traders, who are duped into paying money into fraudulently opened bank accounts.

Alleged fraudsters are also duplicating bank accounts of property traders in order to illegally seize proceeds of sales before payment reaches its intended beneficiaries.

This is according to charge sheets in two separate court cases. The latest of which sat this week and involved Pam Golding and law firm ENSafrica in the alleged R5.5-million interception of funds in an August 2019 Johannesburg property sale.

Bukelwa Kwinana, Robert Asamoah and Thembani Maswanganyi appeared in the Johannesburg specialised commercial crimes court on Tuesday on 16 counts of fraud, the contravention of the Prevention of Organised Crimes Act, forgery and uttering.

Asamoah, a Ghanaian citizen, is also facing a single charge of breaching the Immigration Act as he is allegedly in the country illegally.

Maswanganyi was arrested in his hometown of Giyani in Limpopo over the Easter weekend.

The state claims that the three accused “executed a common purpose” when they allegedly intercepted the R5-million that Mary Hawadern thought she had paid to Pam Golding and the R500 000 paid to an ENSafrica account for a house in Forest Town.

ENSafrica, the charge sheet stated, were the conveyancing attorneys who assisted in the purchase and sale of the property.

Kwinana, accused one, is accused of changing her online banking file, known as a “cookie”, on her FNB bank account to duplicate that of ENSafrica, which was supposed to receive R5.5-million on 22 August 2019. The money landed in Kwinana’s account, the state alleged.

“After receiving the said amount in her FNB account, the money so deposited in [Kwinana’s] account was then transferred to different accounts, and to an FNB account held in the name of Thembani Maswanganyi. The money was transferred by way of online banking by Asamoah,” reads the charge sheet.

“Furthermore, after receiving the funds in her account, Kwinana also withdrew large amounts of money on different occasions.

“When the complainant [Hawadern] contacted ENS’s attorneys to enquire if they received the full purchase price of R5.5-million, she was informed that ENS never received such deposits, and that the banking details that the complainant transferred the money to was not [ENSafrica’s] account.”

Pam Golding said in a statement: “Pam Golding Properties became aware of this unfortunate situation during the course of our involvement in the sale of the property in question. In terms of the sale agreement the balance of the purchase price (R5.5-million) was payable directly by the purchaser to the seller’s appointed conveyancers.”

“We were advised that the conveyancers were investigating the matter after it became apparent that the balance of the purchase price payment made by the purchaser had not been received by them,” it added.

ENSafrica’s spokesperson Ashleigh Faber said: “We are unaware of the criminal case and it is inappropriate for us to comment further.”

Maswanganyi gained infamy when he claimed that late minister in the presidency, Collins Chabane, was assassinated following a March 2015 crash with a truck in Limpopo. Maswanganyi was arrested and charged for these statements after Chabane’s family distanced itself from the accused fraudster and asked for a case to be opened.

The matter was provisionally withdrawn from the roll in May 2015.

Kwinana and Asamoah, who was refused bail, have indicated their intentions to plead not guilty should the matter go to trial, while Maswanganyi has yet to make his intentions heard. Maswanganyi is in custody and is expected to make a formal bail application next week.

In a separate matter, which returns to the same Johannesburg court next month, Olutunji Abdul, a Nigerian national, and Siphosihle Sithole, face a R7.8-million matter in another business email compromise scam.

The two accused, who were both arrested and denied bail in November 2019, allegedly spoofed the email of DM5 law firm during a transaction it was handling on behalf of Polokwane-based Amohelang Holdings, which primarily provides student accommodation.

Captain Oscar Mopedi, who is involved in both of the cybercrime’ investigations, testified in 2019 during Abdul’s bail application that the scam and other cybercrime fraud targeting property sales were relatively new in South Africa.