The department of forestry, fisheries and the environment has refused to grant environmental authorisation to Karpowership SA for its three gas-to-power projects.

The South African consortium holding a 49% share of the controversial 20-year Karpowership SA floating power station deal announced in March by Minerals and Energy Minister Gwede Mantashe was formed less than a year ago.

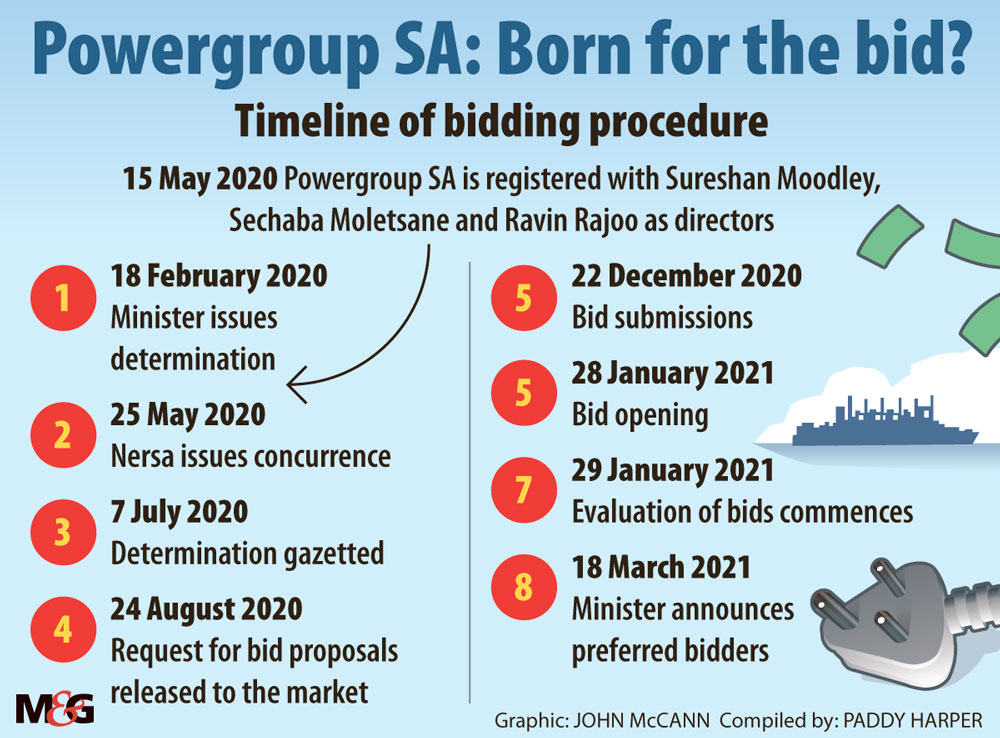

Powergroup SA — a consortium comprising four companies, which is in partnership with Turkish Karadeniz Energy Group — was registered with Companies and Intellectual Property Commission (CIPC) only on 15 May last year.

Two of the companies involved in Powergroup have experience in the energy industry, but two others, owning 35% collectively, have none.

Karpowership — of which Karadeniz holds 51% — was named as preferred bidder to provide 1 220MW of electricity through three floating power stations using liquefied natural gas.

Its appointment as a preferred bidder in a 20-year deal worth R218-billion, has been challenged by one of the unsuccessful bidders in the process, DNG Energy, whose executive director, Aldworth Mbalati, has claimed that the bidding procedures were manipulated.

The award has also been questioned by opposition parties, which called for an investigation into the award of the contract, but they were outvoted in parliament.

The 20-year powership contract is yet to receive approval from the department of environment or Transnet, which operates the Saldanha, Coega and Richards Bay harbours off which Karpowership’s vessels will be moored.

According to CIPC records, on 15 May last year, Powergroup’s directors were Durban lawyer Ravin Rajoo, energy investor Sechaba Moletsane and former banker Sureshan Moodley.

Rajoo, an adviser to the taxi industry in KwaZulu-Natal and his-sister-in-law, Narissa Ramdhani, are directors of Bodasing Investco, which holds 15% of Powergroup.

Ramdhani has extensive business interests, none of them in the energy sector; Rajoo is managing partner of Bodasing and Company attorneys in Umhlanga.

Rajoo has served as a legal advisor and strategic consultant to the South African National Taxi Council. He also acts as a legal adviser to the National Taxi Alliance.

Among his higher-profile clients is Mandla Gcaba, head of KwaZulu-Natal’s most influential taxi family and a nephew of former president Jacob Zuma.

Karpowership spokesperson Kay Sexwale said Rajoo had been requested to assist in providing legal and commercial advice and was later invited to become shareholder.

She said Rajoo had been “part of an energy demand-side management patented solution that addresses load-shedding mitigation before his involvement with this project and, therefore, had knowledge of the energy space and challenges in South Africa.”

Sexwale confirmed that Bodasing Investco had been created as a special-purpose vehicle for the project.

Former banker Moodley and his wife, Devarasi, a property investor, own 20% of Powergroup through their investment company, 1st Group Investments.

Moletsane and his wife Lusanda own 45% of Powergroup through Khumo ea Tsebo Advisory Services. Lusanda Moletsane is the co-director of Matlama Resources, together with George Mokoena, a lawyer and former adviser to former state security ministers Bongani Bongo and David Mahlobo.

According to CIPC records, on 28 May last year Moletsane, Rajoo and Moodley resigned as directors of Powergroup.

On the same day, Ramdhani, Devarasi Moodley and Lusanda Moletsane were registered as active directors of the Powergroup, together with Anthea Mokoena. She later resigned from Powergroup, shortly before the Karpowership bid was submitted to the department of mineral resources and energy.

Bid evaluation began on 29 January, with Mantashe naming the preferred bidders on 15 March. The department has defended the award, saying it was made in accordance with procurement and financial management procedures, and through a transparent and fair process.

Spokesperson Nathi Shabangu said the department would defend the application by DNG, but declined to comment further.