Bullish: Transaction Capital’s David Hurwitz says defensive sectors are resilient in the wake of the pandemic. Photo: Elaine Banister Photography

Transaction Capital chief executive David Hurwitz is keenly aware that used-car salesmen don’t command high levels of trust.

This reputation, however, was not enough to deter the JSE-listed finance group from moving in on WeBuyCars, which is on the cusp of developing one of the biggest second-hand car dealerships in the world.

Transaction Capital’s confidence in WeBuyCars is because mistrust has never been a dealbreaker for the firm — which owns SA Taxi, the country’s biggest minibus financier, as well as a debt collection business.

“What we do is we identify, invest in and operate businesses in sectors with historically low levels of stakeholder trust … We like going into these kinds of markets, where the banks and traditional financial service players don’t operate in,” Hurwitz says.

Defensive

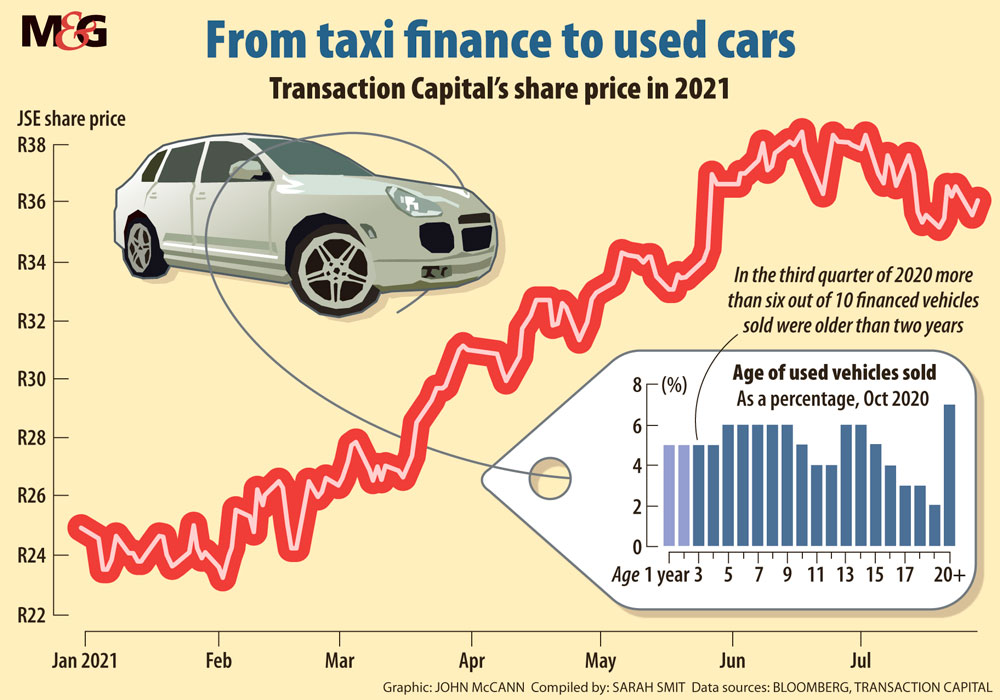

It is a strategy that has seemingly served Transaction Capital well, even as Covid-19 ravaged the economy. The company’s share price has soared well above pre-pandemic levels. And, in the six months ended 31 March, the company recorded a 56% increase in earnings compared to the same period a year ago.

The firm’s performance, Hurwitz and analysts say, is underpinned by its investments in defensive sectors which have proven their resilience in the wake of the pandemic.

Transaction Capital has capitalised on its growth by increasing its foothold in the used-car business, which like the other sections of its operations, Hurwitz expects will become “even more relevant than before”.

At the end of May, Transaction Capital announced it would be upping its stake in WeBuyCars from 49.9% to 74.9%. Less than a month later, the used car retailer made its own big announcement: It had closed a deal to purchase the TicketPro Dome in Northgate, Johannesburg.

Last week, the Competition Commission recommended the approval of Transaction Capital’s acquisition of a majority shareholding in WeBuyCars.

The firm was able to increase its WeBuyCars shareholding, Hurwitz says, because of the finance group’s strong balance sheets and because its other businesses managed to dodge many of Covid-19’s blows.

The taxi industry, for example, recovered very quickly as lockdowns were lifted and the economy reopened. “Consumer movement and consumer mobility precedes any economic activity. So as people had to move to work, the minibus taxi industry was the beneficiary. It shows how resilient the industry is,” Hurwitz noted.

Transaction Capital’s debt collection business was similarly poised to operate in a post-coronavirus economic environment.

“South African consumers are under huge affordability constraints. They can’t repay their loans. Banks and retailers have higher levels of non-performing loan portfolios than ever before. And we are kind of well positioned to assist them in collecting on those portfolios,” Hurwitz explained.

Nolwandle Mthombeni, a senior bank analyst at Intellidex, said Transaction Capital’s defensive businesses allowed it to generate a steady stream of revenue, even in a downturn. “Their business model will allow them to continue to grow,” Mthombeni said.

“The acquisition of WeBuyCars gives them additional revenue. When you add those things together, they will continue to grow profits within the short to medium term.”

(John McCann/M&G)

(John McCann/M&G)

Driving growth

When Transaction Capital announced its initial investment in WeBuyCars last September, it noted the gains in the used-car market, which over the five years prior experienced a compound annual growth rate of 1.7%.

“This steady growth has been achieved despite the segment being fragmented and inefficient, characterised by low levels of consumer trust,” Transaction Capital said.

At the time, WeBuyCars was selling around 6 000 cars every month, slightly more than in the months before the pandemic hit South Africa. By May this year, WeBuyCars had increased this number to 8 000.

Hurwitz explains that Covid-19 has driven used car sales, as consumers go for the cheaper option. The pandemic caused new car sales to plummet and market recovery has been delayed amid computer chip and battery shortages, which have led to short-term price hikes.

In the US, the Wall Street Journal reported, some used cars are now worth as much as — or even more — than what sellers initially paid for them, as consumers seek alternatives to pricier new vehicles in second-hand lots.

First National Bank portfolio manager Wayne McCurrie says “we will have to wait and see” if Transaction Capital’s WeBuyCars move was a good one. “They obviously want to benefit from changes in the market. But it is very competitive. It is not the only player.”

Noting that Transaction Capital is a strong pick for investors, McCurrie says the company’s success is borne out of it offering a “one-stop shop” for taxi owners. SA Taxi facilitates vehicle financing and insurance and also sells parts.

The pandemic has not been a “dramatic hindrance” to Transaction Capital’s business, McCurrie says. But the company has also not necessarily benefited from Covid-related economic headwinds: “There are fewer jobs. Not as many people are going to work … There are clearly a lot fewer people driving. So though it hasn’t affected them materially, I certainly wouldn’t say they have benefited.”

Though he is upbeat about the resilience of the firm’s businesses, Hurwitz notes that if South African consumers continue to suffer from the Covid-19 pinch, Transaction Capital will feel the pain.

“If people aren’t employed, they don’t have disposable income to pay their debt, they aren’t moving around the country and they are not buying cars. So we do need South Africa to recover,” he says.