(John McCann/M&G)

What if, with the patient stealth of a big cat stalking its prey, one could steal R26-million over a six-year period from a ceramic tile and bathroom retail giant?

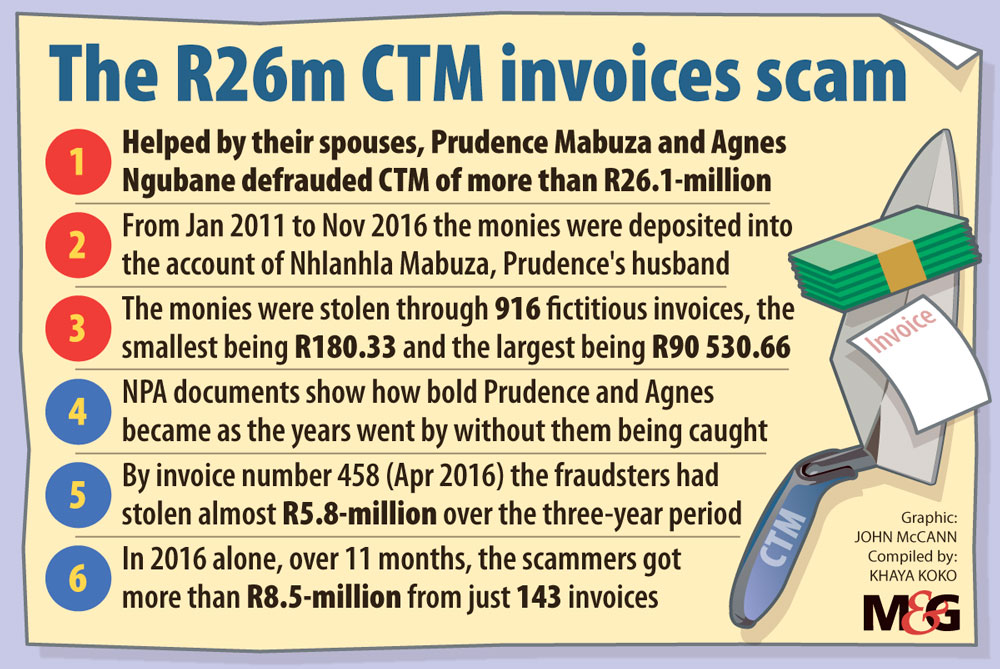

Two women, one of whom had roped her spouse in, were the leaders of what the National Prosecuting Authority (NPA) called a syndicate to defraud CTM of more than R26.1-million through 916 fictitious invoices from January 2011 to November 2016.

Prudence Mabuza, who worked with her husband, Nhlanhla Mabuza, and Agnes Ngubane have been convicted of 997 charges of fraud, theft, money laundering and assisting another to benefit from proceeds of unlawful activities. They will be sentenced in the Johannesburg specialised commercial crimes court sitting in Palmridge in Ekurhuleni on 18 March.

Prudence and Agnes were employed by Cinque Funding Solutions, which Cladding Finance subcontracted to handle debtors on behalf of CTM.

To not give their scam away, the two women filed and paid invoices for small amounts ranging from R180 to R90 530.66, according to the NPA’s spreadsheet detailing each transaction and the bogus invoice numbers. The spreadsheet was used as part of the evidence before the court.

It shows how the two women became more brazen in the amounts of money they stole as the years went by.

(John McCann/M&G)

(John McCann/M&G)

By April 2014, they had stolen almost R5.8-million over three years — the halfway mark of their scheme.

The fraudsters then grew bolder and amassed more than R8.5-million in 2016 alone from just 143 transactions.

Prudence and Agnes had access to the Cladding account, which was used to store CTM’s money and then pay the ceramic company once its debt was retrieved, according to the NPA.

CTM would generate the debt at its company-owned and franchise stores, and Cladding Finance would buy the debtors’ invoices, provide monthly statements and collect monies, the NPA said. Cladding had no staff, and so it outsourced this work to Cinque Funding Solutions, where Prudence and Agnes were employed, added the NPA.

“Accused one and three [Prudence and Agnes] had access to the banking account of Cladding and conducted various electronic transfers from the entity’s account into the banking account of accused two [Nhlanhla Mabuza].

“[The accused], in furtherance of a common purpose, created fictitious invoices for goods bought at CTM and sold them for their benefit,” reads the indictment.

Since their arrest in 2017, all three said during the trial that they were not guilty and that the state would not be able to prove any guilt.

Brandon Wood, the chief financial officer at Italtile, CTM’s holding firm, said the company had been following the case over the past four years and they were satisfied that justice had prevailed.

Wood added that although the fraud was confined to Cinque Funding Solutions, the discovery of it “was of grave concern”.

“Effectively, the case relates to an internal fraud at Cinque, and therefore very difficult for us to determine. Cinque provided a full-function service on the particular funding solution to CTM [30-day builder accounts] — from credit vetting to collection.”

Wood said forensic investigations were conducted at Italtile and it was evident that there was no breach of the company’s in-house controls and systems by the accused.

Although Italtile continues to work with Cinque — the ultimate victims of the fraud, Wood said — the company has introduced new measures to manage their debtor book, including insourcing for Cinque.

Cinque director Darrell von Broembsen said Prudence and Agnes had been with the company for 10 and eight years respectively. Their scheme, he said, had shown how technological advances in counterfeiting bank statements had made fraud “so much easier, and fakes are very difficult to distinguish from the real thing”.

“As a whole, we have moved away from the outsourced model and will rather use our experience gained in this ordeal to provide advice to our clients to prevent this from happening,” Von Broembsen said.