It emerged this week that apart from the initial charge of fraud that Warriner is facing after his co-trustee, Christian Ashcroft, reported him to the police, additional fraud charges have been opened against directors of two other firms and 11 associated financial services entities

Susan Marais and a family member have just over R1.3 million invested in the BHI Trust, once believed to be worth R2.7 billion, with no hope of recovering their money after the fund came crashing down in the lates financial scandal to rock South Africa, estimated to be on a similar scale to the Masterbond fiasco.

This was after co-trustee Craig Warriner, a St Stithians College old boy, handed himself over to police for his alleged “irresponsible” management of the fund last month.

Marais, 57, said she had invested R360 000 over the past five years on the advice of her financial adviser, Peter Haupt of TCF Investment Consultants, after working in the United Kingdom for years to save the money.

Marais and her relative are two of at least 37 known investors out of what could be as many as 2 000 investors in South Africa and abroad who put money into the BHI Trust.

It emerged this week that apart from the initial charge of fraud that Warriner is facing after his co-trustee, Christian Ashcroft, reported him to the police, additional fraud charges have been opened against directors of two other firms and 11 associated financial services entities — five based locally and six internationally, some located in the British Virgin Islands and the United Kingdom. The names of the companies are known to the Mail & Guardian.

The police confirmed only that an additional fraud case had been opened. The Directorate for Priority Crime Investigations (the Hawks) has not yet confirmed the additional charges, although the Financial Sector Conduct Authority (FSCA) said it was investigating Warriner, the BHI Trust “and other persons” including unregulated and regulated companies.

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)

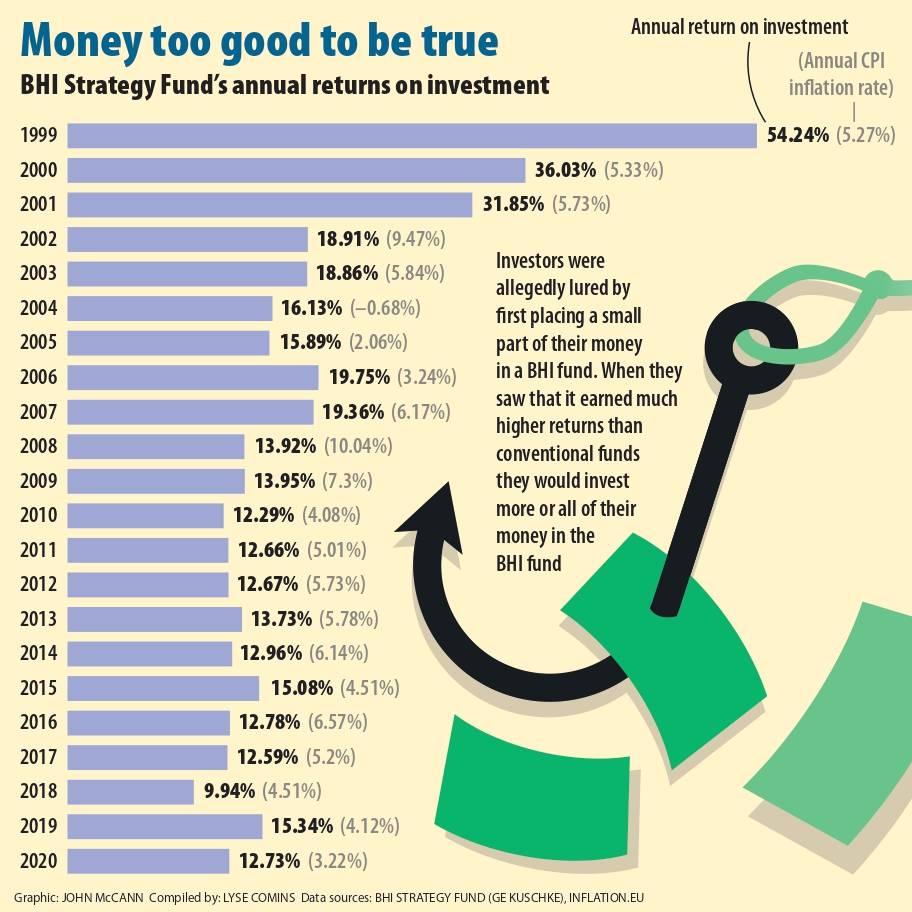

BHI Strategy Fund is another entity with which Warriner has been associated, according to an undated advice letter sent to investors by financial adviser GE Kuschke Financial Services (not on the list of those being investigated) indicating that he had been investing funds that purportedly had paid out huge returns.

This was highlighted in a schedule of “historic annual results” for the period from 1999, when a whopping 54.24% return was apparently posted, followed by 36.03% in 2000 and 31.85% in 2001, dipping to below 20% over the next 19 years before hitting 12.73% in 2020.

Marais said a family member, who has asked to remain anonymous, had invested his pension of R300 000 in BHI Trust, which grew to R1 million over the years as it constantly obtained “good” annual returns. He has been relying on a monthly pension from his investment but is now penniless.

“We got monthly statements that tell you have had growth of 1% or whatever and there would be the odd month where you get a negative return but every year it was positive, it was just a steady good return with the occasional bad return over the years,” she said. “I was wary. I don’t like sticking my money in any investment where I don’t know how it works, but my relative already had his money with them and he was receiving positive statements, and he [the broker] came here, and it was convincing.

“I remember saying what happens if this man [Warriner] dies. I can’t remember the explanation, but it sounded safe, that there were plans in place and that your money would be safe, that there wasn’t risk.”

But Marais later learned this could not have been further from the truth. Her broker sent her an email, after Warriner handed himself in, advising her to open a charge of fraud at her local police station.

“I have no hope of getting my money back. This has devastated lives. What else can I do? My insurance broker says he has received death threats, and you trust your insurance broker is innocent in all this. I don’t understand how money can disappear like this on such a grand scale without the authorities picking up on it,” she said. Haupt had not responded to questions at the time of going to print.

Warriner, 59, appeared in the Randburg magistrate’s court on a charge of fraud in mid-October saying he had “borrowed from Peter to pay Paul” , a move that led to the revelation that investors had banked on a man of straw in a collapsed investment scheme. Media reports have compared the BHI Trust to the Bernie Madoff multibillion-dollar Ponzi scheme in the United States.

Warriner’s arrest led to the provisional liquidation of the BHI Trust in the Johannesburg high court when Cawood Attorneys director Werner Cawood applied for the urgent provisional sequestration of the fund on 23 October. Cawood and his law firm, which has R653 658 invested in the BHI Trust for a flat R7 500 fee per client, also offered to take up the cudgels on behalf of other investors.

Forensic investigator Bart Henderson, who spoke to the M&G this week, said it was not necessary to go the liquidation route and incur legal fees, because the Special Investigating Unit (SIU) and the Hawks should prioritise the case as a “serious economic crime” and under the Prevention of Organised Crime Act could freeze what is left of BHI’s assets as well as those of other companies allegedly involved.

He said the effect of the scandal in terms of value appeared to be on a scale of the Masterbond scam, which led to 20 000 investors losing about R600 million in pension money in the 1980s and 1990s. It also echoes the J Arthur Brown Fidentia scandal in which 60 000 investors, including widows and orphans of mineworkers, lost an estimated R1.2 billion in the 2000s.

Henderson said he had been referred to 35 investors who had put funds into BHI Trust and that he had 20 sworn affidavits from the group. He said 90% of the investors had allegedly been introduced to the fund by Global & Local Investment Advisers.

“They all tell virtually identical stories of how they were encouraged to increasingly invest over time, and there are warnings in the contract, and the indemnity clauses, just in itself, is an indictment,” he said.

According to one such clause: “The investor acknowledges that he understands that the investment is not registered under any law and that it is unregulated.”

Henderson said: “People realise that there is a risk so they invest R100 000 and 90% goes to other funds like Allan Gray and 10% to this risky fund and then months later when they see the returns are so much higher they take 20% from the safe fund and put it there, and so over time they get further and further away from the clauses.

“I think the SIU should get involved, the Financial Sector Conduct Authority and the minister of finance should launch an inquiry into the matter. This type of collapse is not good for the country or the economy,” he said.

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)

“This is a serious economic crime, and I don’t think it has been treated that way. The FSCA was already warned about BHI Trust in 2018.”

Global & Local director Michael Haldane (who was also a director of Rubicon Administration until 2005, the BHI Fund administrator and in 2013 was a director of a company called Amalgum that became BHI +) could not be reached for comment at the time of publication, despite several attempts to contact him.

Gauteng police spokesperson Colonel Dimakatso Nevhuhulwi confirmed this week that a case of fraud had been opened and Warriner had been arrested.

“He made his first court appearance on 12 October 2023 and the case was remanded to 29 November 2023 at Randburg magistrates’ court,” Nevhuhulwi said, adding that another fraud case had been opened at Sandton police station.

Cawood’s founding affidavit in the liquidation application against Warriner and Ashcroft on 25 October highlighted how Warriner had earlier appeared in court saying he would be representing himself and wanted to plead guilty to any charges against him and to waive his right to bail.

“He stated that … following his guilty plea, sentencing procedures could be postponed … Mr Warriner stated that he could not understand why the matter needed to be postponed for further investigation,” the affidavit said. “The magistrate confirmed that the matter is complex and that the prosecution needs to investigate further. She explained that there would probably be multiple charges and complainants.”

Warriner then asked the magistrate to assist him with his request to move to a single cell because he was receiving death threats from inmates at Johannesburg Correctional Centre. The court granted his request.

Cawood said in his affidavit that he had later established the following in discussions with the prosecutor:

• Warriner had handed himself over to the authorities, confessing he had been running the trust in “an irresponsible” manner and that he had made “substantial losses from which the trust can never recover”.

• He had allegedly suffered significant losses with trust funds during the 2008 recession. He said he had been attempting to trade the funds in the trust to bring it back to a position of liquidity.

• He has made further “substantial losses” from which he believes the trust will not be able to recover.

“I confirm that all indications are that Mr Warriner has mismanaged the funds invested with the trust,” Cawood said in the affidavit.

The court granted an order for the provisional sequestration of BHI Trust and the master of the high court appointed Gert Louwrens Steyn De Wet and Sumaya Mohamed Ali as joint provisional trustees (JPTs).

In their first circular to creditors on 2 November the joint provisional trustees confirmed that “we have been made aware of funds held in a Nedbank account in the name of the trust in the amount of R4 785 164.96 as of 25 October 2023.

“It has been confirmed that the Nedbank account has temporarily been attached by the Financial Intelligence Centre … The JPT has in the interim requested Nedbank to pay these funds over to BHI Trust’s estate account.”

They said all creditors (investors) could submit claims against the fund for proof, which will be accepted or rejected at a statutory creditor meeting chaired by either the master of the high court or a magistrate.

The FSCA confirmed in a statement that it is investigating BHI Trust, Craig Warriner “and other persons”.

“The focus of the FSCA investigation is on the activities of the BHI Trust and the possibility that it was conducting unauthorised financial services business and unauthorised collective investment scheme business,” it said.

“The FSCA also confirms that it is looking into authorised financial services providers that may have advised or assisted their clients to invest in BHI Trust products. The main focus of this part of the investigation is to determine whether these providers acted with due care and diligence and considered suitability and risk when advising their clients.”

The regulator warned that it was “not permissible” for financial services providers to recommend financial products not issued by licensed entities.

“When investors buy financial products and services from entities that are not licensed as financial institutions, they do so at their own risk, and they do not enjoy the protection and risk mitigation measures associated with appropriately licenced and authorised entities.

“The FSCA has extended its investigation to include regulated entities that may have promoted the products of BHI Trust. If found to have done so, this is a serious contravention of financial laws, and may be subject to a fine, debarments of individuals involved from the sector and possibly removal of licence,” the FSCA said.

Ashcroft’s attorney, Caitlin Gottschalk, said her client had a close personal working relationship with Warriner and had plunged his entire inheritance into the fund before he realised something was horribly wrong.

“Warriner was an influential person at Mr Ashcroft’s school. When Mr Ashcroft’s parents became terminally ill, the funds raised for their care were placed in the care of Warriner,” Gottschalk said, adding that Ashcroft had only invested his personal money in the BHI Trust in December 2022, being his inheritance of about R1.3 million.

When Ashcroft wanted to make a withdrawal from the investment, he realised something was amiss when Warriner became cagey and refused his request. He then opened a case of fraud against Warriner with the Sandton police on 4 October.Ashcroft is now cooperating with the relevant authorities in the investigation and has “made himself available to help in any way he can”, she said, adding that he does not have any information regarding the number of investors affected nor the value of the fund.