The mining industry has the potential to grow if there is more investment in exploration projects. (Michele Spatari/Bloomberg via Getty Images)

South Africa remains one of the world’s most mineral-rich countries but needs to invest more heavily in exploration to extract wealth and keep the declining sector going.

This is according to experts interviewed on the sidelines of the 31st Mining Indaba in Cape Town.

“A big problem with South African mining is that, for many years, we’ve had very little spending on exploration,” said Hugo Pienaar, the chief economist at the Minerals Council South Africa.

“To have a sustainable mining sector, in 10, 15 or 20 years’ time, we need to be doing more on the exploration side.”

Minerals and Petroleum Resources Minister Gwede Mantashe told delegates at the annual conference that the country is diversifying from gold to a wide range of mineral resources.

Referring to a study by his department and Mintek, the national mineral research organisation, Mantashe said, despite declining reserves, in 2023, the industry was the world’s 13th-largest and the country was Africa’s fourth-largest gold producer.

The gold sector contributed more than 90 000 jobs, making it the third-largest employer after coal and platinum group metals.

Last year, 474 876 jobs were provided by mining, which contributed R432.7 billion to the economy, according to the Minerals Council.

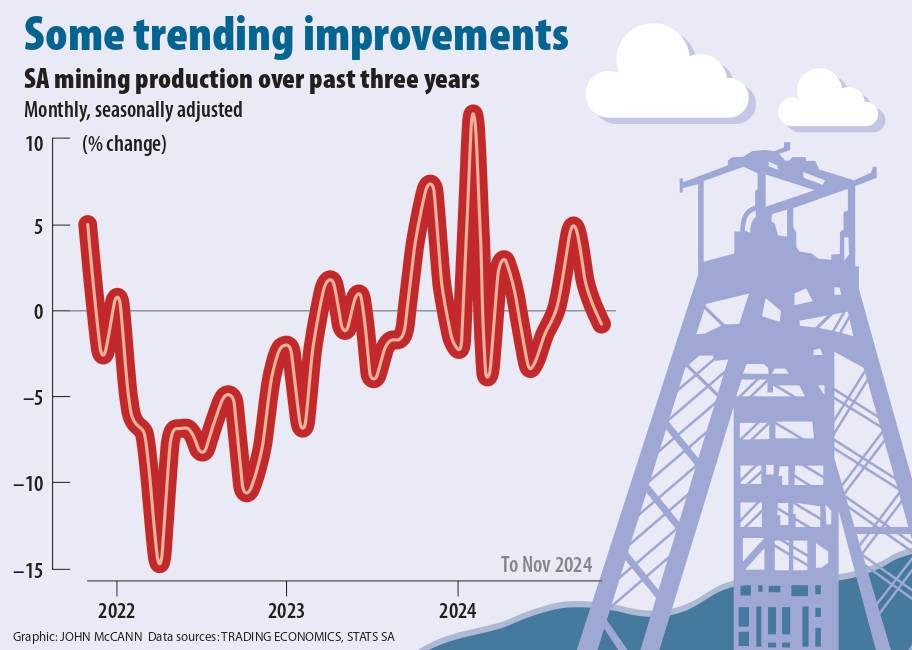

Data from Statistics South Africa also shows that, although total real mining production fell by 7.8% in 2022, the industry has since shown slight growth. Output increased by 0.1% a year later, and last year growth was projected at 0.7%.

There is still a long way to go, however. The level of real mining output in December was still lower than 2019, before the Covid-19 pandemic.

Pienaar said growth in other minerals, including platinum group metals, manganese and iron ore, would be stronger when infrastructure issues — including the electricity supply and state logistics firm Transnet’s port and railway network — improved.

“In 2024, the sector was still under pressure but, importantly, we started to put some building blocks in place that will help us in the future … to really start to unlock the potential of our mining,” he said.

The industry expects load-shedding to “remain absent” this year, while Transnet’s improved rail performance helped mining in the second half of last year, Pienaar said.

Reforms are under way to include the private sector in the transportation of bulk commodities, including coal and iron ore.

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)

According to the minerals council, Transnet’s target is to rail 170 million tonnes of goods in the financial year ending next month, up from 151.7 million tonnes in 2023-24.

Data on bulk commodity exports show that there was an improvement in rail performance in the second half of last year.

South Africa was still heavily reliant on coal, mainly for electricity production, but the shift towards renewable energy was raising concerns about what would happen to industries that depend on coal and the colliery workforce.

A shortage of funding for coal exploration is also affecting the sector, said Makwe Masilela, the chief executive and founder of Makwe Fund Managers.

Masilela argued that, despite environmental concerns, South Africa needed to benefit from its “abundance of coal” while talks about the shift to renewable energy continue.

“It might take a little bit of a knock but there is still a future for coal mining in the country — most definitely.”

Masilela said unlocking more investment in coal required more exploration, as well as technological advancements that support deep mining at lower prices.

The country also needed a predictable, business-friendly regulatory environment to sustain growth.

Pienaar noted South Africa’s coal exports have shifted over the past decade, as more countries turned to renewable energy or an energy mix.

Last year, 83% of South Africa’s total coal exports were to Asia. India purchased the bulk of these (44%) while export volumes to Europe crashed from 28.1% to 9% in 2022, the minerals council said.

“Europe used to be the place where we exported most of our coal but it has moved to renewables to a large extent. So we’re exporting to fast-growing Asian countries like India,” Pienaar said.

He added that the shift away from fossil fuels would be gradual and “coal will continue to play important roles in the South African economy for many years to come”.

South Africa does not have to be overly concerned about geopolitical risk, especially with regard to the US under President Donald Trump, Masilela said. This was because gold exports to the US were significantly smaller than to India and China.

If US interest rates remain elevated, and the price of the dollar increases, that could have a negative effect on the value at which gold is sold.

The price of gold is slated to rise to $3 000 in the first half of this year. In November, after Trump’s election win, gold prices stood at $2 652, the council noted.

Exports and local gold sales are expected to increase by 1.9% and 8.4%, respectively, “as smelters like Rand Refinery process both stockpiled and newly mined gold ore to meet demand in domestic and international markets”.

Masilela said, over the past 20 years, competition in the African mining sector had grown although South Africa remained an attractive investment destination because of its sophisticated infrastructure and respect for the rule of law.

However, he cautioned, “gone are the days where South Africa was a launching pad for foreign entrepreneurs to go into Africa. Nowadays, people are able to do that directly. So, our competitive advantage is no longer as strong as it used to be.”