MEC for Limpopo Economic Development Environment and Tourism Thabo Mokone and CEO of Musina Makhado SEZ Lehlogonolo Masoga as they unveil the new logo

The Special Economic Zone programme is one of the important tools that the South African government has introduced to drive economic growth and regional development. More importantly, the SEZ programme is used as a critical tool for accelerating the country’s industrial development agenda. This programme is mandated by the SEZ Act, which was proclaimed in February 2016. The purpose of the SEZ programme is, among others, to attract foreign and domestic investments, increase the number and value of exported products, accelerate the development of industrial infrastructure, help accelerate the beneficiation of the country’s resource endowments, and to create decent jobs.

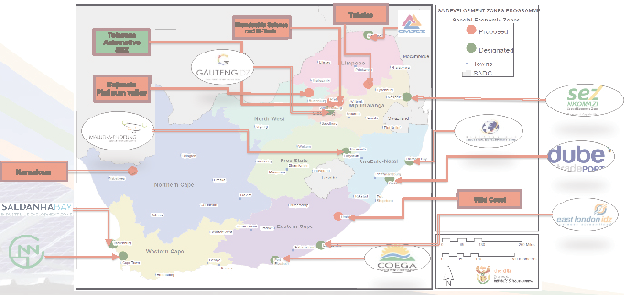

To date, there are 11 approved Special Economic Zones in seven provinces; the latest one is Tshwane Automotive SEZ, launched by President Cyril Ramaphosa in November 2019. In addition, there are five additional proposals that the Department of Trade, Industry, and Competition (the DTIC) is exploring in partnership with provinces.

The SEZ Programme continues to make a meaningful contribution to the country’s economy. It has to date attracted 234 investors, with an estimated value of over R61-billion; 135 of these investors are operating in SEZs, creating approximately 15 000 direct jobs. Coega and Dube TradePort SEZs continue to be at the forefront of sustaining this growth in investment attraction. Substantively, Coega’s value of operational investments grew from R7.063-billion to R11.292-billion, while DTPSEZ experienced growth in excess of R500-million in this regard.

The geographic location of designated and proposed SEZs

The geographic location of designated and proposed SEZs

Our SEZs

South Africa has eleven SEZs located in different provinces, namely:

– Coega SEZ (Eastern Cape)

– Richards Bay SEZ (Kwazulu-natal)

– East London SEZ (Eastern Cape)

– Saldanha Bay SEZ (Western Cape)

– Dube Tradeport SEZ(Kwazulu-natal)

– Maluti-a-phofung SEZ (Free State)

– OR Tambo International Airport SEZ (Gauteng)

– Musina/Makhado SEZ (Limpopo)

– Atlantis SEZ (Western Cape)

– Nkomazi SEZ (Mpumalanga)

– Tshwane Automotive SEZ

In an effort to further optimise the country’s comparative and competitive endowments, there are additional pending SEZ applications that are at various stages of development. The most notable of these include the proposed Bojanala SEZ (NW), Namakwa SEZ (NC), Vaal SEZ (GP), Tubatse SEZ (LP) and Wild Coast SEZ (EC).

SEZ TAX INCENTIVES

To complement the DTI’s SEZ strategy, a package of tax incentives will be available to companies located in certain SEZs, subject to specific criteria. The tax incentives that companies may qualify for include VAT and customs relief if located within a Customs-Controlled Area (CCA), an employment tax incentive, a building allowance and a reduced corporate income tax rate.

The design and eligibility criteria for each incentive seeks to strike a balance between achieving the objectives of higher levels of investment, growth and employment creation, and ensuring that the incentives are appropriately targeted for efficiency purposes, while minimising any deadweight loss to the fiscus.

Businesses located within a CCA will qualify for VAT and customs relief (similar to that for the current IDZs). The employment tax incentive will be available to businesses located in any SEZ. Businesses operating within approved SEZs (by the Minister of Finance, after consultation with the Minister of Trade and Industry) will be eligible for two additional tax incentives. Firstly, all such businesses can claim accelerated depreciation allowances on capital structures (buildings) and, secondly, certain companies (carrying on qualifying activities within an approved SEZ) will benefit from a reduced corporate tax rate (15% instead of 28%).

VAT AND CUSTOMS RELIEF

Companies located within a CCA will be eligible for VAT and customs relief, as per the current IDZs.

Characteristics of a CCA include the following:

• Import duty rebate and VAT exemption on imports of production-related raw materials, including machinery and assets, to be used in production with the aim of exporting the finished products;

• VAT suspension under specific conditions for supplies procured in South Africa; and

• Efficient and expedited customs administration.

More information on CCAs can be found on the SARS website www.sars.gov.za

EMPLOYMENT TAX INCENTIVE

All employers of low-salaried employees (below R60 000 per annum) in any SEZ will be entitled to the employment tax incentive (ETI). This aims to encourage employers to hire young and less experienced work seekers. It reduces an employer’s cost of hiring people through a cost-sharing mechanism with government, while leaving the wages the employee receives unaffected. The employer can claim the ETI and reduce the amount of Pay-As-You-Earn (PAYE) tax payable by the amount of the total ETI calculated in respect of all qualifying employees.

BUILDING ALLOWANCE

Businesses operating within approved SEZs (by the Minister of Finance, after consultation with the Minister of Trade and Industry) will be eligible for an accelerated depreciation allowance on capital structures (buildings). The special rate of capital (depreciation) allowances in lieu of normal allowances will be available for erecting or improving buildings and other fixed structures. This rate will equal 10% per annum over 10 years.

Companies engaged in the following activities, based on the Standard Industrial Classification Code issued by Statistics South Africa, will not qualify for the building allowance:

• Spirits and ethyl alcohol from fermented products and wine (SIC code 3051)

• Beer and other malt liquors and malt (SIC code 3052)

• Tobacco products (SIC code 3060)

• Arms and ammunition (SIC code 3577)

• Bio-fuels if that manufacture negatively impacts on food security in South Africa.

REDUCED CORPORATE INCOME TAX RATE

Certain companies will qualify for a reduced corporate income tax rate of 15%, instead of the current 28% headline rate. To qualify, the following conditions must be satisfied:

• The company must be located in a SEZ that is approved by the Minister of Finance;

• It must be incorporated or effectively managed in South Africa;

• At least 90% of the income must be derived from the carrying on of business or provision of services within that SEZ; and

• The company must not be engaging in activities listed in the Government Gazette No. 39930.

The SEZ programme is a central part of South Africa’s efforts to reignite economic growth by attracting strategic investments with the greatest potential for sustainable growth and development. Since the introduction of the SEZ Act in 2016, there has been massive interest from investors to locate in the SEZs. This is attested by the rand value of signed and not yet operational investors.

Atlantis SEZ expands greentech sector

The youth of Atlantis has benefited from training, mentoring and exposure to greentech due to the Special Economic Zone there

The youth of Atlantis has benefited from training, mentoring and exposure to greentech due to the Special Economic Zone there

In December 6 2018, the Atlantis Special Economic Zone (ASEZ) was officially launched by President Cyril Ramaphosa. This priority development node is about 40km north of Cape Town and 76km south of Saldanha Bay. It lies between the N7 to Namibia and the R27 West Coast Road.

The president described Special Economic Zones as manufacturing hubs for the entire African continent, capable of reaching and servicing a rapidly growing market for goods and services. The Atlantis SEZ is expected to grow the greentech sector in the Western Cape more broadly, and revitalise Atlantis as a key industrial node in the region.

Greentech refers to green technologies that reduce or reverse the impact of people on the planet. Wind turbines, solar panels, insulation, biofuels, electric vehicles, materials recycling and green building materials are all examples of green technology.

The impact of investment in the Atlantis SEZ

Situated on South Africa’s West Coast, the Atlantis SEZ capitalises on the Western Cape province’s already booming renewable energy and green technology sector, and taps into the $3-trillion global clean technology market.

The zone welcomes manufacturers, service providers, suppliers and other players in the value chains of green technology manufacturing. Investors have access to extensive investment support through the One Stop Shop and the rest of the investor support ecosystem, which includes InvestSA, GreenCape, the City of Cape Town and Wesgro. Together, the ecosystem provides information and advocacy; market intelligence; facilitated access to permits and licences, planning and development approval; and skills training.

Through these combined investment promotion efforts, R700-million has already been invested in the Atlantis SEZ, including manufacturers of wind turbine towers, geotextiles, double-glazed windows, wind tower internals and acetylene gas. More than 332 new jobs have been created in the zone to date; most of the positions are filled by Atlantis residents.

The combined work of Wesgro, City of Cape Town (InvestCT), InvestSA and GreenCape in promoting and landing investors is a uniquely effective approach that has yielded results recognised by the United Nations Conference on Trade and Development on more than one occasion.

Living Lab for green industrialisation

The Atlantis SEZ aims to operate as a viable industrial hub contributing to green technology industrialisation and job creation in South Africa. As such it represents South Africa’s leading foray into green industrialisation and is a tool to unlock green industrial development, manufacturing, employment, technology development, enterprise development and skills development, among others. These initiatives will provide investors with a secure and well-serviced operating environment and build the credibility of their greentech credentials. The aim of the SEZ is to work together with investors to create mutually supportive systems that enhance performance and reduce impact on the environment.

There are three key principles that underpin the greentech concept:

1) Low carbon goods and production: pursuing production of goods that help reduce the utilisation of carbon (such as solar power) and, where possible, encourage production processes that use substantially less or zero carbon (for example, utilisation of solar power in production, or energy efficient production).

2) Resource efficient goods and production: pursue resource efficient production. This includes low carbon/zero carbon production processes, but also extends to water and waste efficiencies (cleantech), either in the way goods are produced and/or production of goods that enable much greater resource efficiency among consumers.

3) Socially inclusive production processes: encourage production of goods and services in the SEZ in a manner that builds the social and economic capital of Atlantis and surrounds. This means prioritising skills and enterprise development in Atlantis and surrounds, in particular maximising the “spillover” backward and forward linkages of companies operating in the SEZ.

In a nutshell, these principles aim to reduce or remove the impact of humans on the environment. The ASEZ is a “living lab” that seeks to embody these objectives in the way it services and runs the zone. It has ambitious goals such as building skills and enterprise in and around Atlantis for the green economy, supplying its own renewable energy, being a net-zero water user and having little to no waste to landfill.

In future, all industrial development should be done this way, especially if we are to achieve a semblance of sustainability, grow the circular economy and tackle the drivers exacerbating the climate crisis. This concept is closely aligned to the Eco-Industrial Parks framework. The in 2017, the United Nations Industrial Development Organization defines eco-industrial parks as: “…an earmarked area for industrial use … that ensures sustainability through the integration of social, economic and environmental quality aspects into its siting, planning, operations, management and decommissioning.”

One of the major implications of this approach is, in fact, to grow social inclusion.

The community’s role has been fundamental to the ethos of the development of the ASEZ. The designated area of the SEZ is embedded in the existing Atlantis Industria and is mere blocks from the residential area. The work with community members in Atlantis has been unique in the landscape of economic infrastructure development. In 2019, the ASEZ successfully established an ASEZ Community Stakeholder Network. This elected group of 15 community members represents eight sectors in a structure that acts as a conduit for communication between the ASEZ and the Atlantis community.

In addition to jobs and investments, the people of Atlantis have also benefited in a number of other ways. Skills development has been prioritised to ensure local skills meet the needs of industry located in the area. To this end, the youth has benefited from training, mentoring, exposure to greentech, and participation in the annual Atlantis Renewable Energy Challenge and career expo, all of which will potentially help them tap into greentech job opportunities emerging from the Atlantis SEZ.

In 2018, 88 learners received tutoring through the Atlantis Ikamva Youth Programme; 81% of grade 12 learners passed their matric exams, with 68% achieving bachelors and diploma passes. Skills development and training for adults has taken the form of training sessions on solar PV for people from Atlantis and surrounds, and the recruitment of three female interns from Atlantis to work in the SEZ project office. The women successfully transitioned into permanent appointments at the SEZ project office in 2016. Other benefits for Atlantis include the upgrade of the power supply, fibre connectivity and MyCiti transport links.

Creating an environment for regional economic development

• Owing to its strategic location and envisaged growth, the ASEZ is demonstrating its potential to contribute towards regional economic and spatial development. Here are some key ways in which the ASEZ contributes to growth in the region:

• Supporting the growth of the West Coast Development Corridor through strategic positioning, linking the Saldanha Bay SEZ, Port of Saldanha, Atlantis SEZ, Port of Cape Town and the economic nodes in the City of Cape Town.

• Contributing to the achievement of the national, provincial and city green economy vision through green industrialisation and manufacturing.

• Enabling the socioeconomic development leg of the National Development Plan (NDP) by supporting three NDP Strategic Infrastructure Projects (SIPs) — SIPs eight, nine and 10 — which focus on greening the South African economy, electricity generation and electricity transmission.

• Supporting local content manufacturing, linked to the Renewable Energy Independent Power Producer Procurement Programme and driven by the national department of energy.

• Developing gas-to-power projects: The conversion of Ankerlig to gas creates an opportunity for additional gas-to-power and gas for industrial applications in the zone.

• Contributing to climate change adaptation through green economic growth and industrialisation.

Collaboration creates momentum

The Atlantis SEZ is the result of six years of collaborative effort with the City of Cape Town, the Western Cape government and the national department of trade and industry (the dti).

After the signing of a memorandum of understanding with the dti in 2013, the Western Cape government submitted an application in 2015 to the dti to have parts of the Atlantis Industrial area declared an SEZ.

The dti held public consultations in October 2017, and received overwhelming support in favour of establishing the Atlantis SEZ. On June 7 2018, the South African Cabinet approved the decision by the then minister of trade and industry to designate the ASEZ. This was after the Special Economic Zones Advisory Board was satisfied with the rationale and scale of economic opportunities in the region, and recommended that the minister designate the proposed area and grant an SEZ licence to the Western Cape provincial department of economic development and tourism. On December 6 2018, the ASEZ was officially launched by President Cyril Ramaphosa.

The zone complements the Western Cape Government Green Economy Strategy Framework, and the City of Cape Town’s Atlantis 2023 strategy.

Why would investors want to invest in the Atlantis SEZ?

There are strong and growing South African and African markets for greentech. The South African greentech manufacturing market is worth at least R5-billion, with a growing greentech market in the neighbouring countries. South Africa has opportunities in energy, waste, agriculture, transport and other sectors and is a great entry point to the SADC market.

Atlantis is a great location and development ready. Ninety-three hectares of zoned City of Cape Town land is available for leasing to investors. Bulk infrastructure is in place and Atlantis has new public transport, fibre connectivity and shipping links. Atlantis is also close to major ports, roads, universities and greentech markets.

Investors have access to extensive investment support through the One Stop Shop for investor support and the rest of the investor support ecosystem, which includes InvestSA, GreenCape, the City of Cape Town, and Wesgro.

Investors and tenants are accessing attractive incentives in the form of tax relief and allowances, employment tax incentives, fast-tracked development approvals, fee exemptions and subsidies.

There is an attractive, wide-ranging skills base to recruit from, with five universities and many more colleges in the province, and a large range of unskilled, semi-skilled, technical and professional candidates.

Musina-Makhado SEZ takes the next step

An artist’s impression of the Musina-Makhado Special Economic Zone

An artist’s impression of the Musina-Makhado Special Economic Zone

Special Economic Zones (SEZs) have emerged as strategic platforms to spur industrialisation, job creation, technology transfer and economic growth in various countries across the globe.

SEZs are one of the most important tools for a sustainable economic recovery after the debilitating Covid-19 lockdown. The SEZ Programme was mandated by the SEZ Act of 2016, where they are described as a tool to help:

• promote industrial agglomeration

• build the required industrial infrastructure

• promote co-ordinated planning among key government agencies and the private sector, and

• guide the deployment of other necessary development tools.

The Musina-Makhado SEZ SOC (MMSEZ) is one of the more recently promulgated SEZs. The project was initiated by the Department of Trade, Industry and Competition through an act of Parliament. This month it took the key step towards its corporatisation with the launch of a new corporate identity and website, as part of a brand re-launch. Since its establishment it has so far managed to attract investment of up to R150-billion for the province and is expected to create between 21 000 and 26 000 jobs in its initial stages.

Lehlogonolo Masoga, MMSEZ Chief Executive Officer, expands on its purpose: “The MMSEZ has positioned itself as a platform to revitalise the Limpopo economy through industrialisation. Our focus is to generate much-needed base-load electricity, establish a metallurgical complex, develop a manufacturing hub, enhance agro-processing and develop a regional logistics centre. The close proximity of the Beit Bridge border post and abundance of mineral and agricultural resources gives the MMSEZ its competitive advantage.”

Thabo Mokone, MEC for Limpopo Economic Development, Environment and Tourism, says: “Our ambition is not just to build an industrial park but rather to use the SEZ as a catalyst to unlock a plethora of other opportunities, including the potential of realising a new smart city.”

The MMSEZ development will cover approximately 11 500 hectares of land situated along the N1 highway that connects South Africa to the Southern African Development Community (SADC) region and the rest of the continent via Zimbabwe. The overall development will include the building of a power station and smelters.

“Given our strategic location, the MMSEZ will be the epicentre of the SADC,” says Mokone.

Limpopo Premier Chupu Mathabatha says that the SEZ is expected to be a major catalyst in the fight against unemployment and stimulation of business opportunities. In his State of the Province Address earlier this year, he noted that the external master plans for both the Southern and Northern sites of the MMSEZ have been completed.

It is estimated that construction of the infrastructure for the MMSEZ will take between 15 and 30 years to complete. The SEZ aspires to strengthen South Africa’s terms of trade through the production and export of value-added commodities, the creation of stronger value chains and provision of much-needed jobs in previously disadvantaged regions. It will also add to industrial diversification in the province through the establishment of an energy and metallurgical processing complex. Iron ore, coking coal and other minerals that are key inputs into the iron and steel production process will be part of the downstream value addition process. The MMSEZ will also include light and medium industries, logistics and agro-processing that will be supported by strong retail, residential centres and recreational facilities.

What the Musina Makhado SEZ comprises

The MMSEZ comprises two geographical locations that address unique industrial clusters: the site in Musina targets the light industrial and agro-processing clusters, while the Makhado site is a metallurgical/mineral beneficiation complex.

The SEZ is strategically located along the N1 North-South route into the SADC, close to the border with Zimbabwe. It forms part of the Trans-Limpopo Spatial Development Initiative and has been developed as part of greater regional plans to unlock investment, economic growth and employment, and to address the development of skills.

Newly built infrastructure enables full utilisation of the area’s unique combination of mineral endowments and supports industries in the full value chains for mineral beneficiation, agro-processing and light industrial manufacturing.

With the MMSEZ’s location in close proximity to the main land-based route into SADC and the African continent, together with supporting incentives and a good logistics backbone, the intention is to brand it as the location of choice for investment in the mineral beneficiation, agro-processing and petrochemical industries.

Water Resources

Extensive studies on security of water supply have been conducted in the last few years, which concluded that existing surface and groundwater in the region are not ideal to sustain the project. Other options were explored and are currently under further vigorous scientific research to determine the volumetric of sources, abstraction models, infrastructure roll-out, commercial viability, funding options and governance models.

Our options have been disclosed in the published (01/09/2020) Environmental Impact Assessment and there is a Draft Report for consultation with stakeholders.

In the main, our investigations have recommended two primary sources, the first being harvesting runaway annual flood water in the Limpopo basin and a cross-border water transfer scheme. We have no intention of exploiting the already distressed alluvial aquifers in the Limpopo basin.

MMSEZ is a two-in-one project made up of two sites, a heavy industrial park for energy generation and metallurgical complex and a light-to-medium industrial hub focusing on general manufacturing, agro-processing and logistics. The latter site, which already has an environmental authorisation, requires pretty much minimal water supply compared to the former. The two towns of Musina and Makhado have been classified as growth points by the provincial government and they require new water sources with or without the MMSEZ. The SEZ is currently conducting a comprehensive feasibility study on the development of a multi-billion rand new dam, anchored on harvesting the flood water from the Limpopo River.

This initiative will mitigate the velocity of the destructive floods which annually cause unspeakable destruction at the river downstream in Mozambique. Similarly, the regular discharge of the water from the storage facility will help to continuously replenish the dry river for the benefit of water users downstream. The other study on water reconciliation is from our neighbouring country Zimbabwe to determine the capacity of their existing sources and potential surplus available for sharing is being conducted by the Department of Water and Sanitation. — Eamonn Ryan