Based on current price action and overwhelmingly positive investor sentiment, it seems almost inevitable that the current Bitcoin rally will see prices climb to previous highs. It’s not too late to get behind the latest Bitcoin bull run, but if history has anything to say about it, a predictable flow of money from fiat through to small-cap altcoins is likely to be catalysed by this Bitcoin rally and present smart investors with a series of opportunities to realise significant returns.

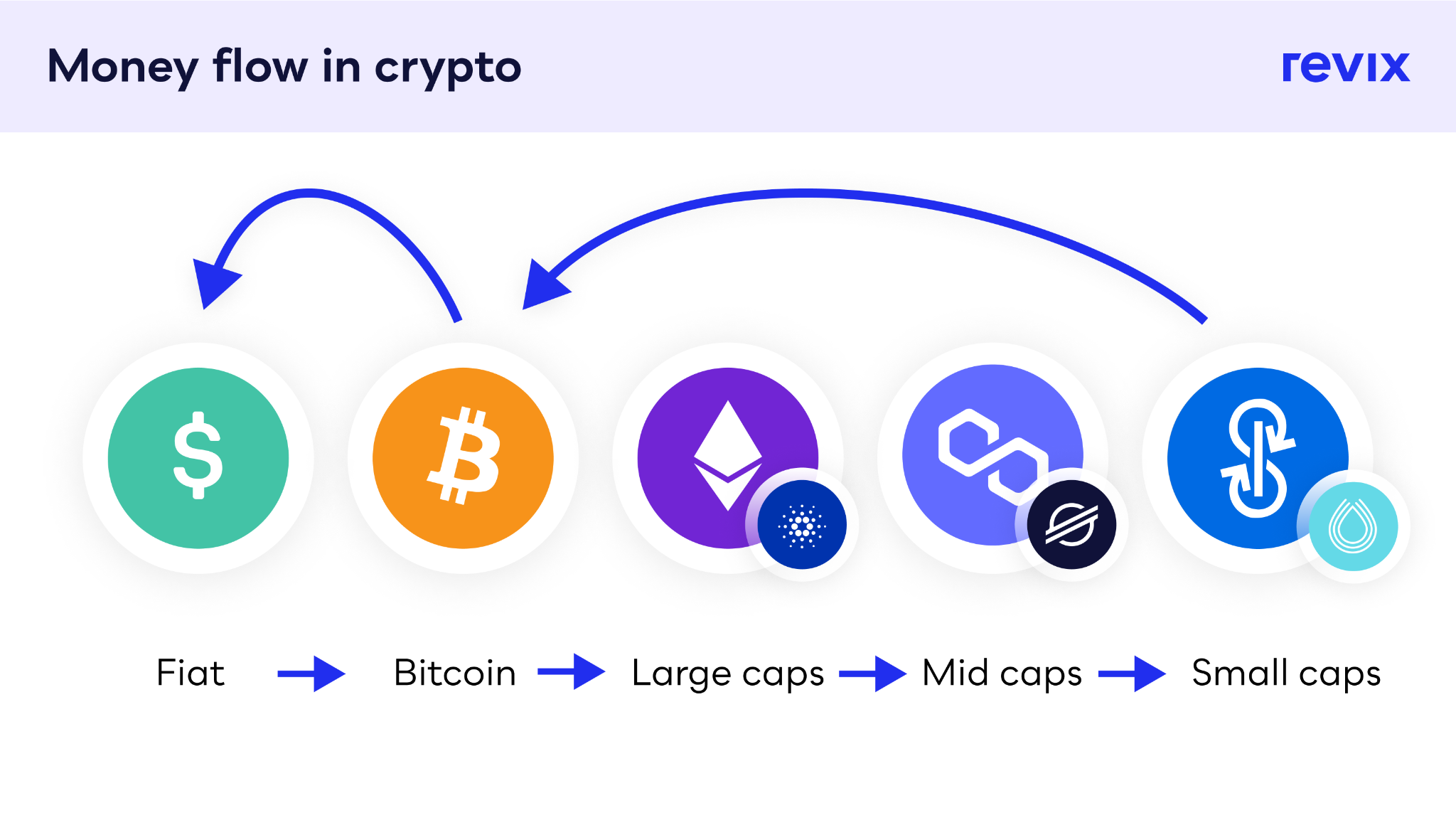

Historical analysis shows that a Bitcoin rally is followed by a logical flow of money, driven primarily by a set of behavioural triggers amongst the crypto investment community.

Bitcoin hype as a catalyst

Why does a Bitcoin rally seem to set off a cascading series of opportunities to invest in crypto-assets in descending order of market cap size? The answer is primarily because a Bitcoin rally is a precursor to a general resurgence in the popularity of crypto-assets as an investment. When the Bitcoin price shows consistent growth, diversifying into crypto once again becomes something that even the most resistant investor starts to consider. At the same time, seasoned crypto investors with fresh capital earned through savvy small-cap crypto trades will certainly not allow themselves to miss out on earnings to be had during a Bitcoin rally.

The result is an unusually large inflow of fiat currency into Bitcoin. With a market cap in excess of a $1-trillion, though, the days of the Bitcoin price surging +40% overnight are well and truly over. It takes a huge number of well-funded and enthusiastic investors to drive a change in Bitcoin’s price in 2021.

For investors wise enough to get in on the Bitcoin rally before it does start to lose steam, gains will already have been realised. The result is a reinvigorated group of happy investors, many of whom will be seeing returns on their crypto investments for the first time. Emboldened by newfound confidence in the legitimacy of crypto as an investment, these investors begin to ask, what’s next? Based on the historical flow of money we’re looking at here, it will be the next biggest crypto-assets by market cap that will start to see positive price action.

The runners-up get their moment in the spotlight

As the rush of a Bitcoin rally begins to subside, it only makes sense that investors would now look for the next best opportunity to grow their portfolios. History shows that large market cap “alt-coins” are where the money flows next. Let’s take Ethereum as an example of a crypto-asset in this class. The table above compares the Bitcoin and Etherum prices during the Bitcoin bull run of 2017. The dramatic flow of money from Bitcoin to the next crypto-asset by market cap couldn’t be clearer. In this instance, we saw Etheruem steal Bitcoin’s flame to the point where it went from barely any price movement to outperforming Bitcoin by over 76% in just two months. This isn’t the first or the last time we’re likely to see this happen.

Here we see the same data presented in the above table in graph form. We can clearly see Ethereum attracting the lion’s share of investment once the Bitcoin rally begins to slow down.

Time for the upstarts to shine

All good things must come to an end, and a price rally among large market cap crypto-assets is no exception. From this point, making smart investment decisions becomes significantly more difficult. The options available among mid and small market cap crypto-assets is vast and growing by the day, and every investor, influencer and alleged crypto expert will have their own opinions on which holds the key to unimaginable wealth.

Nonetheless, if market trends follow historical patterns, money will flow to crypto-assets in this class, and there’s no way around the fact that an investor’s own research and intuition is the only way that earnings through previous stages of the cycle can hope to be matched … at least that used to be the case.

Revix: The death of guesswork

Revix, a Cape Town-based crypto investment platform, has made it its mission to take the guesswork out of making smart crypto investment decisions, regardless of which stage in the price cycle you choose to invest. Want to get in on the current Bitcoin rally? Revix is running a zero buying fees promotion on Bitcoin between 15 and 21 October.

When the time comes, you can also buy Ethereum simply and safely and get the best possible market price via Revix’s proprietary service, which secures the best price from multiple third-party exchanges.

Most significantly, when the time comes to build a portfolio based on your own research, don’t. Instead, simply opt for one of Revix’s crypto bundles. Most relevant in this case is the Smart Contracts bundle, an incredibly simple way to add five of the highest performing crypto-assets that define the future of finance and computing to your portfolio. Revix balances and reviews its bundles monthly, so you’re always invested in the best-performing assets in the market. It’s a simpler, smarter way to ensure you’re not missing out on returns in the final stage of the crypto price cycle.

Revix Promotion

Revix is offering everyone the opportunity to be a part of this Bitcoin rally with its zero buying fees offer on Bitcoinhttps://revix.com/products/BTC?utm_source=MG&utm_medium=MG&utm_campaign=MGBTC&utm_id=MG purchases when using ZAR and GBP for one week. (15 – 21 October 2021)

Let’s profit from this cycle together!

About Revix

Revix brings simplicity, trust and great customer service when investing in cryptocurrencies. Its easy-to-use online platform enables anyone to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.

To learn more, visit www.revix.com