Before you commit to acquiring life insurance, it is important to understand how the premium escalations on your new policy are determined.

Are you contemplating acquiring Life Insurance?

Before you commit to acquiring life insurance, it is important to understand how the premium escalations on your new policy are determined.

Risk benefits could be either payable on death, disability, or severe illness. Ideally, each benefit should be calculated and cost separately as different terms and escalation/amortisation (timeframe of repayment) rates apply from a financial planning point of view.

If one wants to retain a traditional policy for life it must be affordable both now and in the foreseeable future. Various factors can influence your initial premium, and these include, but are not limited to, your age, health, occupation and smoker status.

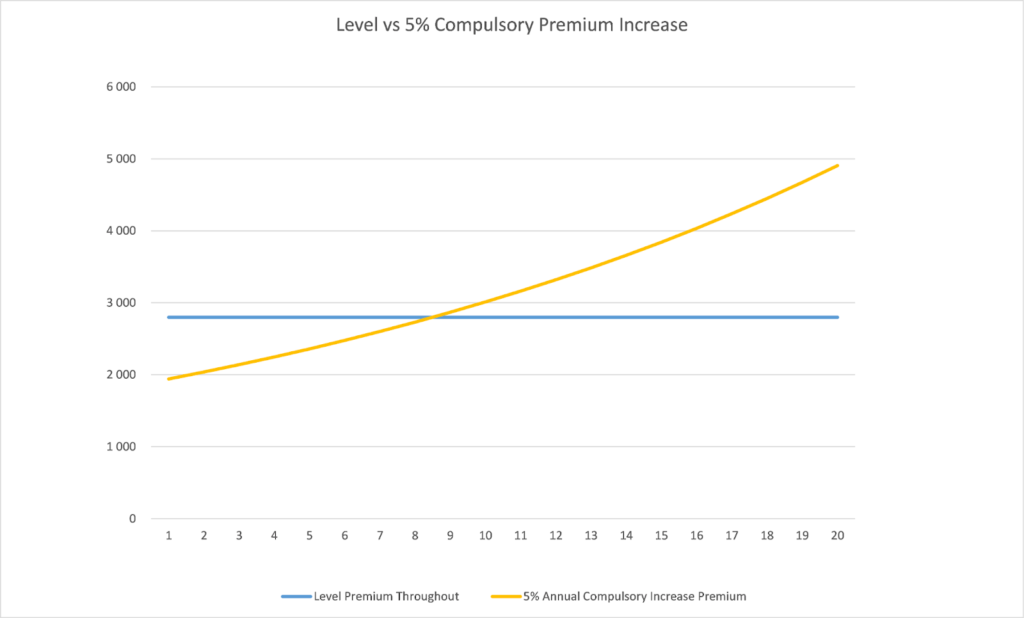

For this discussion, we are going to look at the engine of the traditional policy: the premium patterns constructed by the insurance company’s actuaries. Conventional wisdom dictates that you would choose a certain amount of life insurance cover which increases over a term with a corresponding increase in premiums. There are two premium patterns which determine future premiums: Level and Compulsory Escalating premiums.

Level premium

A constant premium applies throughout the life of the policy for the same amount of initial cover. This premium pattern is designed so that the premiums remain level for the life of the policy but is only guaranteed for a term of between 15 and 20 years. If you increase the cover annually the premiums will increase proportionately on a level basis as well. If you stop taking annual cover increases the premiums will then remain level throughout.

Compulsory increasing premiums

A compulsory increasing premium starts cheaper than a level premium at the beginning of the policy but then has annual compulsory increases for the initial cover bought. The premium increases as it compounds annually but the cover remains the same. There are many types of compulsory increase cover patterns, e.g., a fixed percentage increase, an age-rated increase, a stepped increase, and a combination of these. (The latter increase is not offered by all companies.) If you increase the cover annually the premiums will increase on a compulsory increase basis. Let us compare the premium patterns with reference to an actual example.

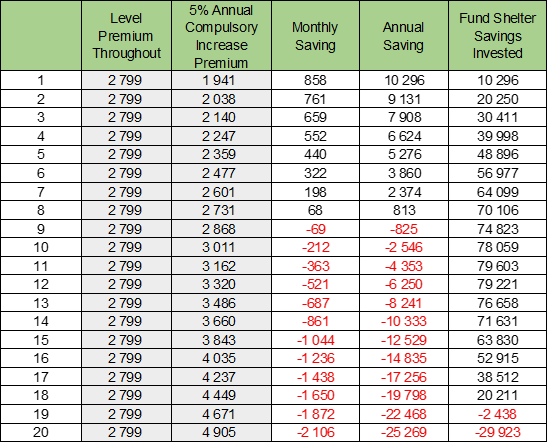

Male, 35-year-old, non-smoker. Quoted by no-frills, fully underwritten insurer. Death cover of R10 million and accelerated disability cover to age 65 of R10 million. (Accelerated disability means that if the man has a disability claim for R10 million the life cover will fall away).

The following is a projected comparison of future premiums to help him to choose between a level premium and a 5% compulsory increasing premium:

Understanding the fund shelter

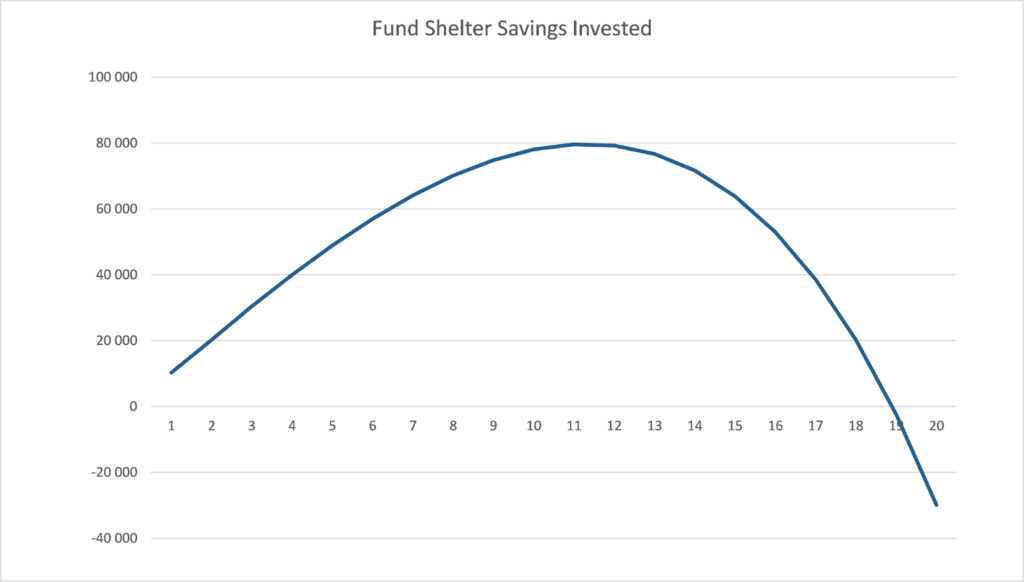

During the first seven years the difference between level and 5% escalated pattern could theoretically be invested in unit trusts at a projected rate of 8% so that it grows to a surplus in year eight of R70 106 and as the compulsory escalated premium becomes more expensive than the level premiums, they can be paid from the fund shelter.

In year 19 the fund shelter will have been depleted and the cost difference must be borne from one’s budget, which is the problem we are addressing.

The 35-year-old person in this example would then be 55. Disability cover would fall away at age 65 and premiums for the life cover will then reduce to R1 615 which would be payable for life on the level plan and R4 987 on the 5% escalation.

How do I choose between the two premium patterns?

You should buy the cover you need when you have dependents and few assets. If this means that you should use the early savings generated by a compulsory premium pattern be mindful that you will have higher premiums in future. Your future salary increases will likely be more than 5% so that in effect the premium is just keeping pace with inflation. In the example above cover has been kept level and the effect of annual cover increases both on a level and compulsory escalating premium basis should be considered and illustrated by your financial adviser.

Given that you should be allocating at least 15% of your monthly income towards building up an emergency fund and long-term investments you should get a good balance between risk and investment spending.

Spending on risk cover should be limited in favour of greater spending on investment.

If you want a predictable, fixed insurance expense in your monthly budget, you have an emergency fund and you are investing sufficiently for the long term, then the level premium pattern is for you.

Things to discuss with your financial planner:

· What are the premium projection and benefit projection of your current policies? Could you be paying less for your cover and investing more? Consider pricing separate financial needs separately, for example, reducing term cover on a mortgage bond and increasing life cover for liveable expenses.

· What can you do to prevent high increases in your policies? Your circumstances might have changed since you took out your policy which may entitle you to lower premiums by being re-underwritten, for example you have stopped smoking, lost weight, changed your career, spent less time travelling, got married and might be entitled to use your spouse’s rating for your cover.

You should not be planning to pay huge amounts for life policies after retirement. The central idea of personal financial planning is to build capital which will provide you with the passive income you need.

· When you do not have sufficient assets, insurance provides personal capital. By the time you want to retire, you should have accumulated sufficient investments to generate the required income. Certain products and insurers incentivise you to pay for life and disability cover long after retirement. The costs and benefits thereof must be carefully considered and cash flow projections should be done to understand the long-term premium commitment.

Some companies incentivise you to have your life policies and your retirement annuities with them or have loyalty programmes which are costed separately on the understanding that you will be financially rewarded if you improve your health. This is an excellent idea, but if you are not engaging with the loyalty programme and do not intend to, you might be paying too much for the basic product and wasting money on the loyalty programme.