the country’s government debt to GDP ratio is unsustainable at 73.45%. In other words, our debt stock is worth nearly three-quarters of the total value of goods and services produced in the country in any given year. (Waldo Swiegers/Bloomberg via Getty Images)

South Africa’s long-term economic growth trajectory will not produce broad-based benefits for citizens until its political institutions are configured to produce more accountability.

This is another way of saying that economic growth that serves the people, and not only elites, is a function of strong institutions.

Institutions are best defined as the social systems that motivate regular human behaviour.

The norms, beliefs, cultures and values that constitute these social systems all need to work together to generate a stronger sense of accountability.

A good Constitution is a great start. It is the key governing institution by which our country operates.

But it is only ever likely to be as strong as the underlying set of informal norms onto which it is mapped.

And, as economists put it, it will only work if it is incentive-compatible with the distribution of power.

Over the past 30 years, South Africa has drifted uncomfortably into a world of weakened governance institutions and limited accountability.

For this reason, electoral reform that grants citizens a more direct say in the distribution of power is critical.

At the same time, the economy cannot be left to its own devices.

By the time you read this, the president will have delivered his State of the Nation address.

No doubt there will be material in there on how his government of national unity plans to deliver economic dividends for the shareholders of the country — the citizens.

But the coalition government needs to think seriously about some weighty headwinds.

First, the country’s government debt to GDP ratio is unsustainable at 73.45%. In other words, our debt stock is worth nearly three-quarters of the total value of goods and services produced in the country in any given year. This ratio is up from 44.1% 10 years ago. At the same time, our government budget deficit is sitting at about 5% of GDP. Servicing this debt consumed 3% of our GDP in 1999. It now consumes about 6% of GDP.

The economic evidence is clear that debt to GDP shocks (where the ratio is positive) result in a decline in employment growth. Persistent positive shocks also result in larger and prolonged real GDP growth declines, non-agricultural employment growth and investment growth. As it stands, the World Bank expects South Africa’s nominal GDP growth to reach only 2% by 2027. That is not going to dent persistent unemployment. South Africa needs strong labour-absorptive, real (inflation-beating) growth, which requires decisive leadership and a clear strategy.

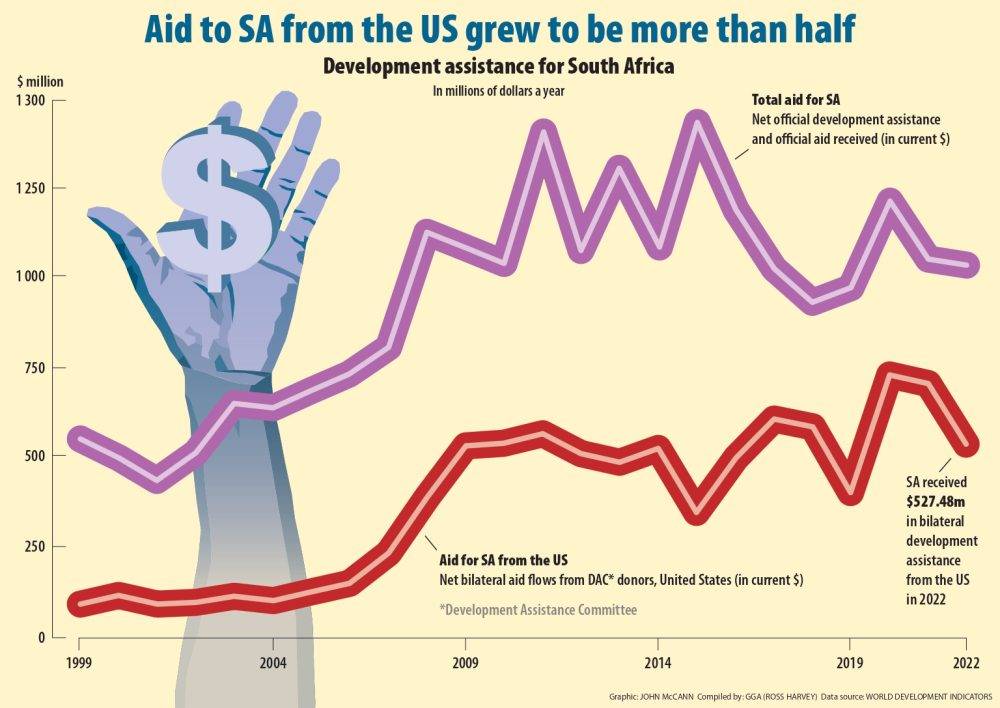

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)

Second, load-shedding is back after an absence of almost a year. And electricity prices are now higher, thanks to the recent tariff hike. This is negative news for employment growth, because energy-intensive sectors such as manufacturing are typically the worst hit by increased prices and more volatile availability.

Third, our international affairs standing with the United States appears precarious. President Donald Trump is unhappy with our Expropriation Act and is using anti-apartheid language to justify his administration’s opprobrium. We don’t have space here to explore the ironies of the situation.

But it’s not only this: we’ve come under increasing US suspicion in recent years through a close association with Russia and China.

And now — although we’re not alone — Trump has decided to also cut aid to South Africa, pending a review into how the United States distributes its global development assistance.

As the graph indicates, bilateral development assistance from the US in 2022 was $527.48 million, more than half of the total aid received by South Africa that year. Much of this money funds critical healthcare and education services. Even if it all comes back, the opportunity costs of having that money frozen have clearly not been considered by the US. Consider, for instance, the effect of having no anti-retroviral treatment for HIV-positive children for 90 days (even though the US has apparently said that no essential humanitarian services will stop).

At the same time, the shock (in the economic sense of that word) should wake the South African government up to the importance of switching from an aid-dependent mindset to one of creating an investment-attractive environment that can withstand negative shocks. That is not going to happen until there is more accountability.

The auditor general report on public finances in 2024 recorded that fruitless and wasteful expenditure totalled R10.34 billion (over the five-year term of the 6th administration). That’s almost equivalent to the development assistance from the US in one year. The auditor general’s remarks are scathing: “The no-consequence culture in national and provincial governments will continue to slow down progress towards improved service delivery and financial performance.”

And the report euphemistically indicated that there was “limited value and benefit for money spent”.

An uncomfortable truth we must recognise is that — at a macro level — aid receipts are not positively correlated with GDP per capita growth. This is partly because aid can be as much of a curse as resource rents — political elites are encouraged to pilfer rents instead of creating a broad tax base through growing the economy.

At the same time, many projects funded by US aid money are vital to — and fruitful for — South Africa, ironically often bolstering our ability to better hold the government to account, or at least allowing pockets of excellence to thrive despite poor governance at many official levels.

The country needs to find ways of being less reliant on external aid over time. Much of this will come down to our ability to attract investment, because investment and trade beat aid hands down in the long-run.

As we build up investment attractiveness and the economy grows, the more likely we are to be able to drive down the debt to GDP ratio. This, in turn, means that more budget will be freed up to spend in areas currently funded by external aid (and currently servicing debt).

But it all comes back to governance and ensuring much greater levels of accountability across all spheres of government in South Africa.

Ross Harvey is the director of research and programmes at Good Governance Africa.