Brazen: When the government announced a relief package for workers whose livelihoods were affected by lockdowns in April 2020, Lindelani Gumede (above and left) allegedly immediately jumped into action, fraudulently registering three existing companies, and one he created, for Ters payments. He is then alleged to have kept the payouts, which should rightfully have gone to the affected workers. (Delwyn Verasamy/M&G)

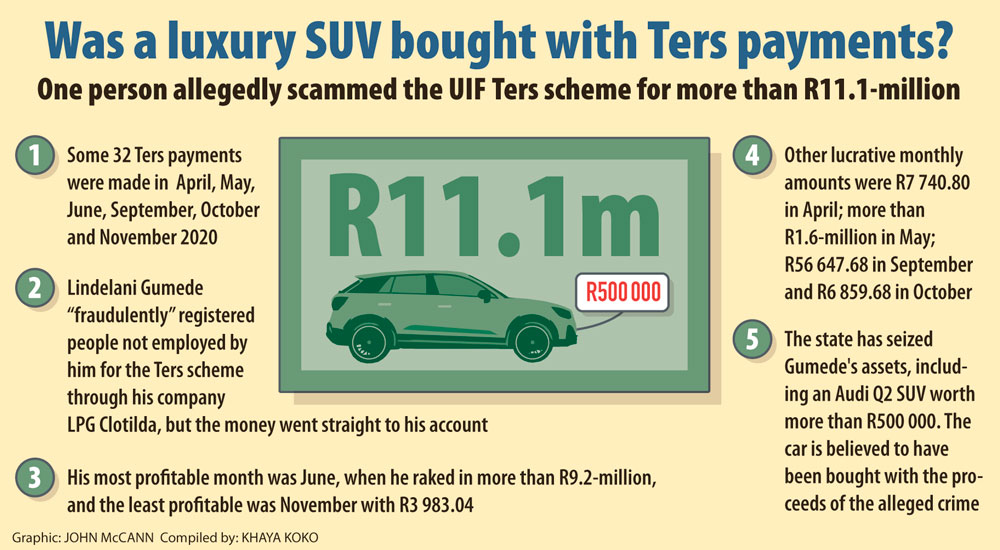

The arrest of Lindelani Gumede, who allegedly swindled more than R11.1‑million from the Covid-19 temporary employer/employee relief programme (Ters), has put the R827-million stolen from the government-backed initiative back in the spotlight.

Last week, Gumede, a convicted fraudster and bookkeeper, made his first appearance in the Johannesburg specialised commercial crimes court on 32 counts of theft for the same number of allegedly fraudulent transactions he made in six months last year.

A luxury Audi SUV as well as a sizable contribution towards his brother’s bond repayments formed part of the spending spree the state claims Gumede, 39, went on with the proceeds from his allegedly fraudulent scheme.

According to the National Prosecuting Authority’s charge sheet, Gumede “fraudulently” created profiles and registered four companies on the employment and labour department’s portal to receive Ters funding from the Unemployment Insurance Fund (UIF).

The four companies are Country Pies, Odonus Investments, La Mela and LPG Clotilda, of which Gumede is the sole director.

Lindelani Gumede

Lindelani GumedeThe Ters programme was set up to pay a portion of a salary to employees who either lost their jobs or had salary cuts as a result of the economic downturn brought on by the Covid-19 pandemic.

The state claims that Gumede took advantage of the initiative immediately when it launched in April last year, when the first “fraudulent” payment — of R7 740.80 — was deposited into his First National Bank business account.

The elaborate scheme was unravelled when employees of the three companies to which Gumede was not affiliated started demanding their employers pay them the Ters funds the firms had supposedly claimed on the workers’ behalf.

The employers then approached the police, which led to Gumede’s arrest on 25 August in Durban.

“[Gumede] was not duly authorised, entitled to transfer, to instruct and request staff members of the department of labour to authorise and transfer the said amounts from the Ters fund into [his] First National Bank business account,” the NPA’s charge sheet reads.

“The said amounts were not transferred to the banking accounts of the [three] entities … for the benefit of their employees, but instead transferred to the accused’s … business account.”

Gumede’s most profitable month, according to the NPA’s records, was June 2020, when he raked in more than R9.2-million from just 14 transactions.

The June figure included the only time more than R1-million was deposited into his account at once. Four payments exceeded the million-rand mark for the month.

The second-most successful month, the state alleges, was May, when Gumede allegedly netted more than R1.6-million.

The remaining figures in the three other months were September with R56 647.68, October with R6 859.68 and November with R3 983.04.

State prosecutor Frans Mhlongo, who read out the charge sheet during Gumede’s bail application, told the court that the Asset Forfeiture Unit (AFU) had already obtained a preservation order against the accused and had seized his assets. The AFU is a division of the NPA.

Mhlongo said a luxury Audi Q2 worth more than R500 000 was part of the seized belongings.

“When the accused received the funds from the department of labour, he used R560 000 to settle the bond [payment] of his brother,” Mhlongo said.

But Gumede, through an affidavit that was read out by his legal representative, maintained that he was innocent of all counts with which the state had charged him.

“I deny having conducted this offence and I will disclose my whole defence during the trial. I do not know the length of the evidence that the state has against me, but I am going to plead not guilty [to all charges],” Gumede asserted in his affidavit.

It emerged during his bail application that he has a previous fraud conviction. Gumede received a five-year suspended sentence in 2012. Gumede further pleaded poverty in court and said he could not afford the R20 000 bail that Mhlongo had requested because the state had seized all his assets.

Gumede was granted bail of R10 000 and will return to court in October.

Meanwhile, the employment and labour department, which is responsible for the Ters programme, welcomed Gumede’s arrest in a statement, saying that it proved that its so-called “Show me the money” project to trace Ters fraud was working well.

The department added that the project had managed to recover R827-million that was fraudulently taken from the Ters initiative.

“I hope the latest arrest [of Gumede] sends a strong and clear message to other would-be fraudsters that the long arm of the law will catch up with you. Those who have helped themselves to the funds earmarked for workers during lockdown should always remember: The long arm of the law is creeping towards them and they will not have peace,” said advocate Mzie Yawa, the UIF’s acting commissioner.

“Working together with law enforcement agencies we will continue investigating every lead pointing us to suspected fraudulent activities, and we thank the public for being vigilant about abuse of Ters funds.

“We cannot tolerate the siphoning-off of workers’ benefits by unscrupulous individuals. All fraudsters are on notice and we hope more of these suspects will be arrested and sent straight to jail,” Yawa added.

In total, 17 suspects had been arrested and appeared in courts around the country for trying to fleece the Ters funds, the employment and labour department has reported.

(John McCann/M&G)

(John McCann/M&G)

Covid and looting relief schemes in numbers

More than R59.2-billion had been paid out to 5.3-milion workers since the government-backed temporary employer/employee relief scheme (Ters) was launched to assist an economy ravaged by the pandemic.

The workers are employed by a total of 267 428 employers who had to curtail or close their businesses following Covid-19 lockdown periods that began in March last year. The Ters benefit initiative began in April 2020.

The last iteration of the Covid‑19 Ters fund had ended in July, after President Cyril Ramaphosa moved the country to alert level four on 27 June.

Many industries were hard hit, especially the hospitality, tourism and entertainment sectors.

But in August, the Unemployment Insurance Fund (UIF) reopened to provide relief to KwaZulu-Natal and Gauteng workers who were affected by unrest after the looting that swept both provinces in July.

The employment and labour department announced in a statement last month that more than 75 000 workers had been affected by the July destruction, which necessitated the reopening of a Ters fund for destroyed, affected or looted workplaces.

To register for the relief, according to the department, “the employer must provide details of the destruction, closure, or damage to, or looting of, its workplace and submit documentary proof of a report to the South African Police Services, with proof that a case has been opened by providing a case number, and, if insured, proof of submission and acknowledgement of receipt of the insurance claim”.

The UIF, which falls under the employment and labour department, said the maximum to be paid out would be R6 700 and the minimum R3 500.

The UIF did not announce any time limits for destruction relief payments.

[/membership]