This week we take a closer look at the emerging markets, currencies and specifically the rand versus the US dollar.

Because the global financial market is becoming more and more integrated, we see a high degree of correlation between the movements in asset prices across markets that have been similarly classified.

The MSCI emerging market index is a market capitalisation index designed to measure equity performance across the following 22 emerging markets country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

The index had a recent peak on the January 20 and has since declined, nearing its 200 day moving average.

Source : Sharenet, Market Tracker

Asset-price movements and currency-exchange rates are also invariably very closely linked, because of the degree to which global liquidity moves asset prices.

What this means for the rand

The rand, along with many other emerging currencies has been very firm over the past 12 months, reflecting the global increase in risk appetite and a commensurate flow of funds away from developed markets to emerging markets.

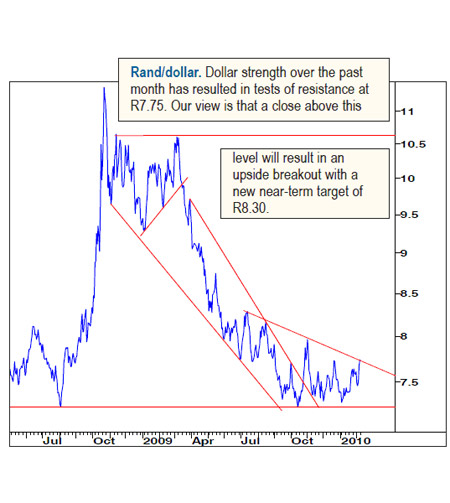

But since October/November 2009, this exchange rate has been forming a base and is recently showing some signs of a possible weakening.

From a technical aspect, the rand/dollar appears to be testing the R7,75 level. Should this break through, then a JP Morgan technical analyst is looking for a near-term target of R8,30 and a medium- to long-term target of R9,25.

Source: JP Morgan, Prime charts

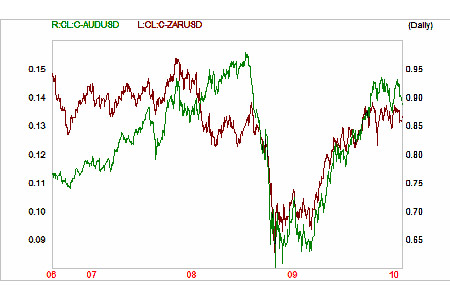

The Aussie dollar is one of the favourite G10 and emerging market currencies. It has followed a very similar pattern to the rand against the dollar. The chart below reflects the correlation of the AUD/USD in green and the ZAR/USD in red.

Source: Sharenet, Market Tracker

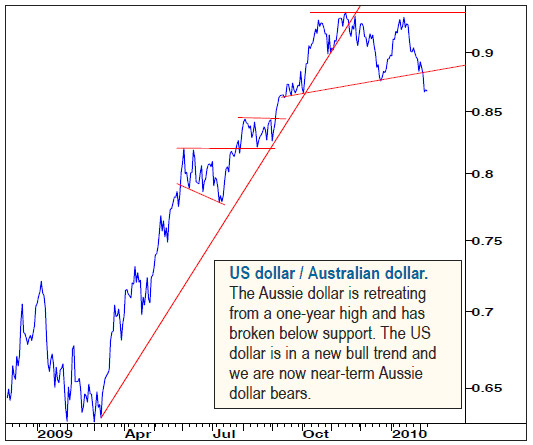

When viewing the AUD against the dollar, there are signs that the recent Aussie dollar weakness may continue.

Source: JP Morgan, Prime Charts

The more recent weakness in emerging market currencies versus the dollar, is naturally also indicative of dollar strength, which after a long period of weakness, has appreciated against its major counterpart, the euro in recent weeks.

Evidence from some of the major local investment companies is that where possible, they are maintaining a full offshore weighting in their asset allocation.

Seed Investments