On a monthly basis, all governments measure the quantum of inflows into and from their country.

Global investors watch these numbers closely to try to gain a sense of where the money is flowing, because over shorter periods of time money flows move prices.

Last week we discussed the recent appreciation in the US dollar relative to the Euro.

Statistics out this week from the US, in their TIC report — treasury international capital report — indicates that foreigners continue to be net purchasers of US securities.

The TIC report measures the US financial account — it is of great importance in demonstrating the flow of foreign capital into the US, which is used by the private sector for investments and by the government for borrowing and spending on its various government programmes.

Source: wells Fargo Securities

In November foreigners bought $126-billion-worth of securities and in December this came in at $63-billion.

The graph above indicates that on a 12-month moving average basis, the decline from 2007 started to reverse in mid 2009, but still only at 50% of its peak inflows.

Commodity prices

Commodity prices in general have moved up sharply over the last year from lows. Copper has doubled in price; oil is up 63% and platinum 41%.

Over the last six months the gains have been more muted, but nevertheless in an upward direction.

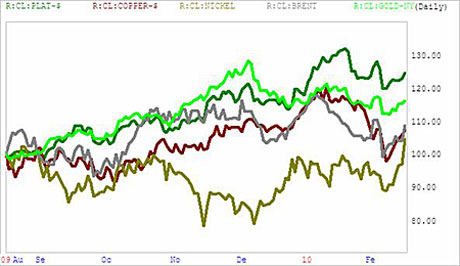

The chart below bases selected commodities to 100, six months back.

Over this time period, platinum is up 25% and gold around 17%, with nickel, oil and copper up around 10%.

Source: Sharenet and Market Tracker

When demand is increasing, competition for scarce resources causes prices to rise. Demand will increase when consumer sentiment is high and vice-versa.

What creates demand for commodities? Demand for finished goods.

China is the biggest consumer of commodities. While authorities are trying to slow the economy, forecasts indicate that another 10% GDP growth for 2010 is quite possible. The CEO of BHP Billiton in its interim results said that commodity markets would be largely dependent on Chinese and Indian demand, but that monetary tightening in China would have an effect.

Ian de Lange, www.seedinvestments.co.za