e.tv and SABC have been named by government as the culprits responsible for the latest delay in the DTT migration process. (AFP)

Broadcasters, tired of dithering and delays around the migration to digital terrestrial television (DTT), have cashed in on the gap in the market to introduce new satellite offerings in both the free-to-air and pay-TV sectors.

Broadcasters, tired of dithering and delays around the migration to digital terrestrial television (DTT), have cashed in on the gap in the market to introduce new satellite offerings in both the free-to-air and pay-TV sectors.

The concern by some in the broadcast sector, in particular the Save our SABC (SOS) coalition, is that the new offerings could seriously delay, if not kill, the migration to digital terrestrial television.

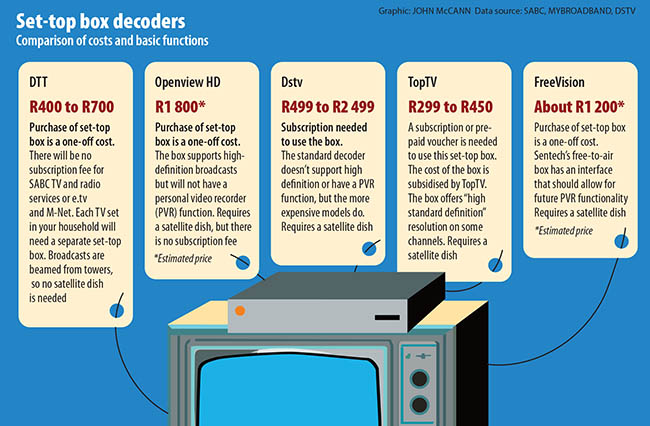

After all, who would want to buy another set-top box (decoder) if you already have a monthly contract with DStv, TopTV or the new satellite broadcast entrant, which has yet to be announced, or you have paid a once-off fee to e.tv for their OpenView HD satellite offering.

The costs for consumers — should they want to get a variety of viewing options (keeping in mind that the set-top boxes are not compatible) — will be about R625 a month for DStv’s Premium package, about R600 once off for the DTT set-top box, and a once-off payment of R1 800 for OpenView HD. Sentech’s satellite offering, Freevision, is expected to have a once-off cost for the decoder of about R1800 when it launches at the end of this month.

Digital and technology expert Arthur Goldstuck sees the new satellite offerings as beneficial for consumers, because they will mean more choice and greater competitiveness in the pay-TV sector.

The recent announcement that e.tv’s sister company, Platco Digital, is to launch OpenView HD’s direct-to-home satellite platform in October, is a case in point. Goldstuck believes e.tv’s parent company, Hoskens Consolidated Investments, “saw the gap and expanded into the market”.

Naming the culprits

Ironically, e.tv and SABC have been named by government as the culprits responsible for the latest delay in the DTT migration process.

In April this year, former communications minister Dina Pule said the department of communications had been unable to award a set-top manufacturing contract because it was waiting to be advised on the set-top box’s access system.

This followed a successful court action by e.tv, in which free-to-air broadcasters won the right to determine who controls access to the set-top boxes.

To date the communications department is still waiting for “free- to-air-broadcasters to communicate their decision on set-top box control”, it said in reply to questions.

SABC spokesman Kaizer Kganyago said: “The SABC has not yet finalised its position on conditional access. We are engaging with all relevant partners on this issue.”

No more information was provided on what the status of the talks is, and e.tv failed to respond before the Mail & Guardian went to print.

Access control

In May last year the communications department assigned state-signal provider Sentech to handle the access controls for the set-top boxes, but e.tv objected, saying it wanted to be in charge of its own access control, and the court agreed.

On August 27, newly appointed minister Yunus Carrim told Parliament’s portfolio committee on communications that he was working hard to bring all the parties involved around the table to find a way forward.

SOS campaign co-ordinator Sekoetlane Phamodi said: “While the conditional access system remains a mandatory technical specification, the entire tender award, manufacture and distribution of the set-top boxes remains in limbo until those specifications are resolved.”

The implementation of digital terrestrial television has already been delayed by the decision in January 2011 to move from the widely used European DVB-T standard to an updated DVB-T2 standard, and then there were debates about whether set-top boxes were to be equipped to allow users to pay utility bills and interact with government through the system.

The original agreement to switch off analogue in 2015 was signed between South Africa and the International Telecommunication Union in 2006.

United Kingdom-based company Digital TV’s research shows that full digital transition will have been completed in Kenya, Tanzania, Uganda and Zambia by the end of 2015 if not sooner. Kenya will switch of its analogue signal in Nairobi in December as part of a trial run.

Taking on SA's pay-TV market

The set-top boxes being used in Kenya were produced by StarTimes, the Chinese group that bought roughly 40% of the then struggling TopTV earlier this year. StarTimes, which already has a presence in Africa, plans to take on South Africa’s pay-TV market, which, as DStv has shown, is very lucrative for its parent company, Naspers.

StarTimes is presently taking DStv operator MultiChoice to task in Kenya for allegedly “locking up key football rights”.

Sentech, which is spending an estimated R1-billion on upgrades to accommodate the new DTT system, has successfully completed a trial in the Northern Cape. Last month it relaunched its satellite service, now called Freevision, which will cater for viewers in outlying areas who are unable to receive the DTT signal.

Sentech insists the new system is not a challenge to e.tv and is intended to cover areas not reached by digital terrestrial television .

Phamodi said: “Our view is that if DTT is delayed any longer commercial satellite broadcasters will jump at the opportunity to lock the public into their offerings, as they already have, and ultimately frustrate the viability, let alone success, of the migration to DTT.”

A delay will have a significant effect on the SABC and its ability to deliver on its mandate as a public broadcaster, he said.

Consequences for the SABC

“If DTT is not embraced … the consequences for the SABC are profound,” said Phamodi. “We might find ourselves in a situation where SABC is no longer a viable terrestrial broadcaster in the traditional sense of the word, but a content producer for other broadcasting platforms.

“This jeopardises the availability of quality public [educational] programming for which the SABC is known [and required] to produce.”

The three SABC channels are required to be available on all pay-TV channels in South Africa — but additional educational programming is not.

The DTT delay will also affect people whose hearing or eyesight is impaired and who are not being catered for by existing broadcast platforms because “the additional captioning and descriptive audio service promised by digital will no longer be prioritised”, he said.

One source close to the DTT discussions said the biggest problem was that SIM cards from one set-top box could not be used in another, so different decoders have to be purchased.

The communications department told the M&G that, apart from waiting for the set-top box control information, it was “happy with [the] SABC’s readiness in terms of infrastructure” and the successful trials involving Sentech, which to date has rolled out the signal to more than 80% of South Africans.

Committed to meet the deadline

“As a department we are committed to ensuring that we meet the June 17 2015 deadline set by the United Nations’s International Telecommunication’s Union,” it said in a statement. “We are doing all we can to ensure that we implement digital migration and, as far as possible to proceed consensually with all role players, not least of them the South African public and the broadcasters.”

Like Goldstuck, the department does not see the growth in satellite offerings as a threat, but instead as offering consumers a choice.

“The government is primarily concerned with helping poor households migrate to digital television. However, it’s good when consumers have more choice. Ultimately the consumers have to be the beneficiaries of digital migration,” it said.

Sentech said its decoders will not be sponsored and details of its distribution network for its decoder will be announced at its launch this month.