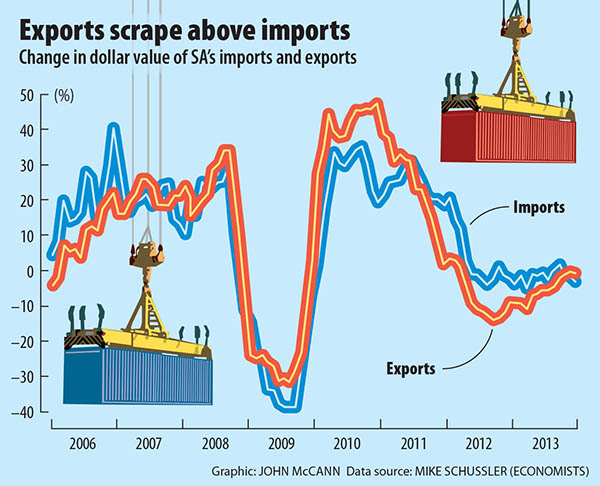

Exports are expected to increase this year and may even outpace imports, but analysts believe the improvements should be attributed to global growth, not the weaker rand.

Despite the rand depreciating 36% over the past three years or so, an expected and corresponding 3% increase in exports did not occur, said economist Mike Schussler this week.

Stanlib chief economist Kevin Lings agreed.

"There is still no clear or overwhelming indication, in terms of the most recent trade data, that the weaker rand is helping to improve South Africa's exports," he said. "This is partially because growth in exports is more a function of global growth than merely rand weakness."

Bank of America Merrill Lynch data shows that a strong rand, rather than a weak currency, is linked to improved local output, said economist Matthew Sharratt.

Schussler said: "The weak rand that many economists said would be our saving grace … did not help. During the strong rand phase we had a much better growth by far, including in manufacturing, and we created more jobs in the strong rand phase than we have now."

Deficit widens more than expected

In September, the rand reached R10.39, yet South Africa's current account deficit widened much more than expected in the third quarter, indicating that the country was still buying more than it was selling and paying more in interest and dividends to foreign investors.

Where the weaker rand is being felt, however, is with regard to the petrol price, with consumers now paying a record R13.96 a litre.

The recent trade figures are important because increased exports would have an important part to play in reducing South Africa's current account deficit.

The Reserve Bank's bulletin for the third quarter showed that the current account recorded a shortfall of 6.8% of gross domestic product (GDP), or R233-billion.

This is from a downwardly revised deficit of 5.9% of GDP, or R197-billion, in the preceding quarter.

Sharratt said the bulletin showed "export volumes accelerating in the third quarter to reach the same pace as import volume growth for the first time in about four years".

Analysts upbeat about export growth

Increased exports and reducing imports are the result of a combination of factors, he said, which include rand depreciation, improved global demand and "softening domestic demand".

Though some economists and analysts are upbeat about export growth, it's important to keep in mind that increases are coming off years of relatively flat export growth.

In a note, Lings said the trade data showed that, during December: "The value of imports fell by a significant 12.8% month on month (-R10.999-billion), while exports decreased by 10.3% month on month (-R8.913-billion)."

In 2013 as a whole, the trade deficit totalled –R69.907-billion, well in excess of the -R34.677-billion recorded in 2012. The surplus recorded in December was also 12.6% lower, year over year, than in December 2012.

Lings said the decline in exports in December 2013 included a "massive" 24% month on month fall in export of precious metals, while the fall-off in imports was broad-based and comprised a large decline in machine and electronics, chemicals, rubber, plastics, base metals and textiles.

"Unfortunately, oil imports rose by almost R1-billion in the month."

Indication of further improvements

Sharratt sees the December trade data as an indication of further underlying improvements in the current account should the conditions remain the same.

The last-quarter trade deficit measured in non-seasonally adjusted terms narrowed to -R10.9-billion from -R28.8-billion in the third quarter.

"With imports under pressure from weak domestic demand combined with a modest pick-up in exports as global demand strengthens against the backdrop of a weak rand, we believe the current account deficit could narrow to -3.9% of GDP by the second quarter of 2014," he said.

Sharratt said improvements in the trade balance are generated more "by the compression in imports than a notable rebound in exports".

Schussler believes, however, that import figures are likely to go up again as soon as the government's investment programme gets under way.

A World Bank report warns that infrastructure bottlenecks are holding back export growth.