PwC forecasts that 72% of South Africans will access the internet through their cellphone by 2018. Will Cell C still be competing in this market and will these new mobile data consumers be getting bang for their buck?

These are some of the questions facing the Independent Communications Authority of South Africa (Icasa), which this week held hearings as part of its inquiry into the state of competition in the telecommunications, broadcasting and broadband sectors.

Cell C has called for urgent regulatory intervention from Icasa if it is to survive as a competitor to Vodacom and MTN. “Cell C’s business plan is not sustainable without urgent intervention,” it says in its submission to Icasa.

The Internet Services Provider Association (Ispa) argues there is ample evidence that South Africa has an “affordability gap” rather than an “access gap” in the mobile data market.

Ispa has called for Icasa to intervene to address the “market failure” in the mobile data market in South Africa, which has resulted in a lack of competition and high prices.

Price reductions

Ispa argues that, although competition in the past few years in the fixed-line broadband market has led to massive price reductions, there is a lack of competition in the mobile data market, through which most South Africans access the internet.

Telkom states in a submission to Icasa that fixed-line access accounted for 92.3% of broadband access in 2004.

That contribution dropped to 26% in 2013.

Ispa’s Dominic Cull argues in the written submission: “Given that the majority of South Africans currently access broadband services through a mobile device, addressing this market failure has the potential to address the obstacle that affordability presents to achieving the SA Connect target of universal service and access to broadband services for all South Africans by 2020.

“It is obvious that service competition is largely absent in the mobile services sector outside of the incumbents, notwithstanding that there are a substantial number of new entrants who would enter the mobile services resale market …

“Ispa strongly suggests that the mobile network operators should be regulated to offer wholesale solutions on their networks to qualifying third parties at prices related to those which they effectively charge to their own retail arm.

‘Reseller market’

“This will create a fully competitive reseller market below the mobile network operators, in the same manner that such a market exists below Telkom.

“Properly regulated, we have no doubt that this will have a substantial impact on broadband penetration and usage in South Africa.”

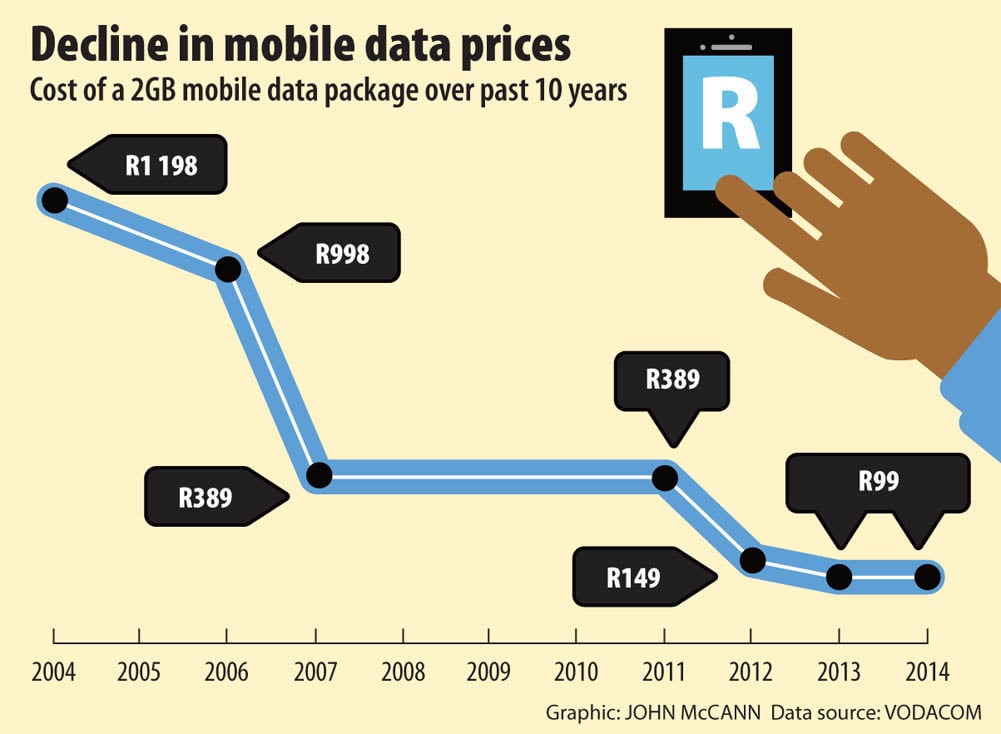

In its written submission, Vodacom says over the past 10 years the price of mobile data products has plummeted from R1 198 for two gigabytes of data in 2004 to R99 in 2014. “The price drop in ADSL data is even more significant.”

MTN in its submission states that if indeed data pricing is of concern, Icasa should provide clarity about what information it is lacking in data pricing.

“There has been exponential data growth at much lower prices. Data prices have fallen by more than 70% in the last three years but require further and continuous investment to attain the policy goal of broadband for all,” argues MTN.

“While pricing may be one of the parameters of a sustainable industry, equally important is that investors in networks are capable of making the necessary returns to invest further in the required infrastructure.”

Consumer incentives

Cell C argues that Icasa needs to accelerate the formal inquiries under chapter 10 of the Electronic Communications Act, with a view to determining market failure in any markets that Icasa regulates.

Cell C also wants Icasa to look at number portability regulations that prevent mobile operators from offering consumers incentives to switch to their network, insisting that the ability to “port” customers is at the heart of competition.

The main issue MTN and Vodacom want Icasa to deal with is the allocation of spectrum freed up in the digital terrestrial television migration process.

Both mobile giants argue that the spectrum should be allocated to the established players and not to new entrants.

“Vodacom is of the view that the South Africa mobile market is competitive and does not require extensive regulatory intervention,” states Vodacom’s written submission.

“The authority has not in this inquiry indicated any market failures in the mobile sector.”