Gerald Mwandiambira is the acting chief executive of the South African Savings Institute

The South African Savings Institute has noted the December 2017 SARB Quarterly Bulletin numbers, which reveal household savings to disposable income at 0.2% per month, meaning households are saving 0.2% of their income. This represents a positive savings ratio from the last quarter of 2016, and it means that South Africans are starting to save again. Debt to household income remains stubbornly high at 72.5% in the same bulletin. Although these numbers paint a gloomy picture, they still represent improvements from record highs for debt to income of 80% in the second quarter of 2013 and a savings of -2.3% in the last quarter of 2012.

South African households are saving again. By saving, this means that the wealth creation cycle has restarted. Although the numbers are still low, they are moving in the right direction and these numbers represent cumulative efforts by national treasury and the financial sector at large over several years. Many people have also learnt the hard way the importance of saving!

It is hoped that with the economy expected to recover from 2018 in a five-year economic cycle, this bodes well for wealth creation in South Africa. The environment is becoming more favourable to saving.

Savings behavior

According to the 2017 Old Mutual Savings and Investment monitor, there is an ever-growing “sandwich generation” who are saving less and less. The sandwich generation is those individuals aged between 31 and 49 who are caring for children as well as elderly family. This generation should be saving, but most of their disposable income is spent on current financial responsibilities and debt. Many also refer to this phenomenon as “black tax”, a non-formal tax on black South Africans who are still not in the habit of saving, or living lifestyles that don’t encourage saving.

Tax-free savings

The South African government through national treasury is trying to encourage individual savings, and introduced Tax-Free Savings Accounts (TFSAs) in 2016. All proceeds, which includes interest income, capital gains and dividends from these accounts, are tax free. Individuals are allowed to open two tax-exempt savings accounts per year. These accounts can invest in equities, fixed income accounts or both. However, the total contribution per year that qualifies for an income tax exemption is R33 000 on interest earned, up to a maximum of R500 000 per lifetime, though the account balances including interest can exceed R500 000 in a lifetime. Any amounts withdrawn from these accounts cannot be replaced and still get the exemption.

Limitations

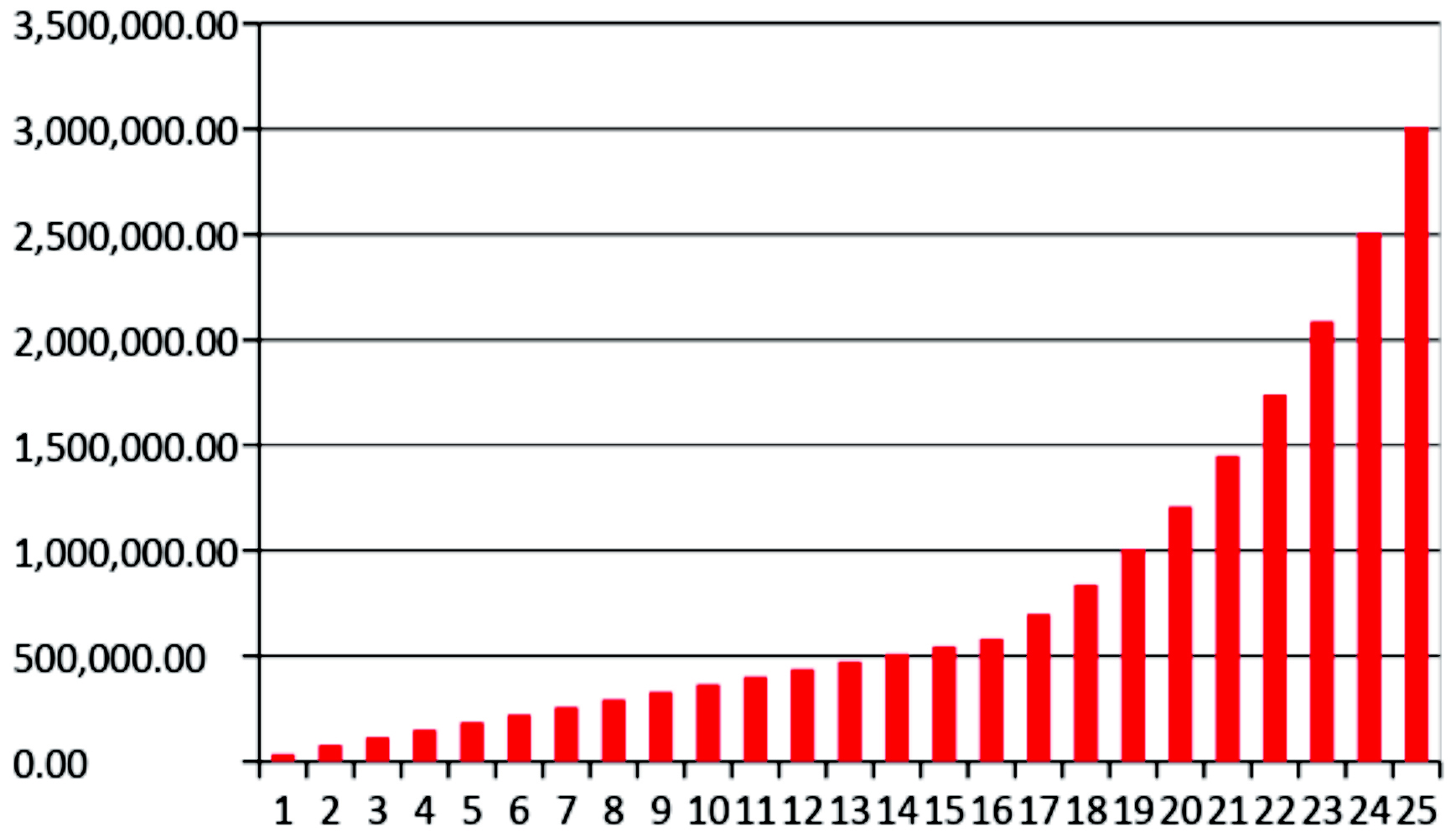

Tax-Free Savings Accounts are part of non-retirement savings and to maximise on the tax relief, it is recommended to invest the maximum amount permissible every year for 15 years, allow compounding to happen and watch your money grow. The graph (above) shows the maximum permissible amount invested for 15 years with an annual return of 15% excluding fees and compounded to the 25th year. Over the 10 years (January 1 2002 to December 31 2012) annual returns on the JSE (calculated each month) averaged 18.4% per annum. It is however important to select a TFSA with fee charges that are low.

At an average annual return of 15% per annum, R500 000 invested in a TFSA can accumulate to the amount of R1 695 005 in the 25th year, a great wedding present or a gift to a child starting a new life!

Best use of TFSA

Tax-Free Savings Accounts make excellent savings vehicles for education or gifting a child on adulthood, if parents open such an account when a child is born or an infant. Young people starting to save may also find such accounts useful for long-term savings. Although these accounts will assist savers who are in the habit of saving already, they do not however change attitudes toward saving.

When not to consider TFSAs

Tax-free accounts are a financial product suited to provide the foundation to a personal financial planning strategy. Few, if any financial planning professionals can speak ill of TFSAs, such is the beneficial gain accrued by holders of such accounts. However, all financial planning solutions can never be looked in isolation, and at times, for various reasons, the need may be for a single solution. In these instances a TFSA may not be the best solution.

Non-residents

Non-South African citizens or non-permanent residents are not eligible to receive the benefits of TFSA. One needs to have a South African identity number to buy and utilise a TFSA. In the hands of a foreign national, a TFSA becomes similar to a regular savings vehicle, with income tax liability on accumulated interest income using the standard South African Revenue Services (SARS) income tax tables.

Investment horizon

The very nature of a TFSA requires long-term investment of over 10 years. This longer vested period allows the investor to earn interest on the saved amount that would have otherwise been paid towards income tax. This interest on interest is known as compounding and is a very effective way to grow an invested amount. The main ingredient to this formula is the time invested. Using the earlier example, an amount invested at annual return of 15% will double the principal every 4.96 years. If one is seeking a short- or medium-term investment, a TFSA may not be best suited for this purpose.

Special purpose investments

If an investor is looking to save for a specific purpose such as retirement, a TFSA may not be best suited, as TFSAs have limitations on the investable amount that can grow tax free. As part of a broader retirement plan, one can utilise TFSAs, but this solution would be highly unsuited as a standalone savings vehicle.

TFSAs do not have the ability to offer annuity income (regular payments) to an investor who may be seeking an investment vehicle that pays regularly.

TFSAs can also only be held by juristic persons (real people), making them unsuitable to corporate savings or stokvel investments. For special purpose investing, it may be best to consult a financial planner.

Alternatives to TFSAs

Tax-Free Savings Accounts are just one of a myriad of available solutions that allow regular contributions towards a savings goal. Many alternatives are available on the market and alternatives include regular savings accounts, notice savings accounts, retail savings bonds, unit trusts, endowment policies, retirement annuities, stock market investments and exchange traded funds. It is important to set goals and examine your risk profile (acceptance of potential losses) with a professional in order to choose the most appropriate savings vehicle for your purpose.

Availability

Most leading financial institutions have launched various TFSAs. These accounts may be branded or named differently, but the main feature is the interest income exemption. These products are all registered with SARS and the tax-free exemption is done automatically. TFSAs are unique and cannot be ignored in any investment plan and indeed, every single South African is recommended to have at least one account in their lifetime.

Since their launch TFSAs continue to grow in popularity, with wide acceptance in the investing community; they also make an excellent “starter” investment solution for the novice investor.

Gerald Mwandiambira is a certified financial planner, a director of the Financial Planning Institute of Southern Africa, acting chief executive of the South African Savings Institute, and an author, entrepreneur and speaker