(Graphic: John McCann/M&G)

This week’s medium-term budget policy statement (MTBPS) was a bitter pill for markets to swallow and could affect how ratings agencies, especially Moody’s, view the country’s prospects, according to analysts.

“We expect Moody’s to change the outlook of our Baa3 sovereign credit rating from stable to negative, at the very least, with a potential downgrade after the 2019 budget if significant measures are not taken,” said Isaah Mhlanga, the executive chief economist of Alexander Forbes Investments.

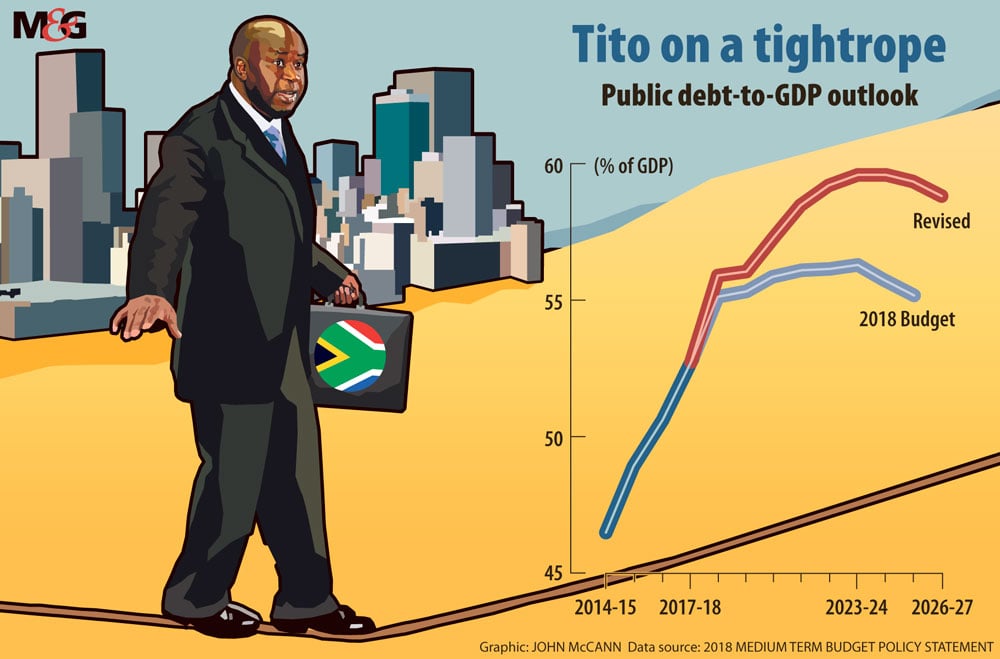

Key assumptions made in the 2018 February budget were revised as the treasury took account of shrinking economic growth, turmoil in international markets and steep cuts in revenue estimates.

Economic growth forecasts have been cut from the 1.5% announced in February to a much weaker 0.7%, and the budget deficit for this year is now projected to reach 4% of gross domestic product (GDP) compared with the 3.6% expected in February. Revenue collection estimates have been revised down from February by R27.4-billion in 2018-2019, R24.7-billion in 2019-2020 and R33-billion in 2020-2021.

Government debt is now expected to increase to 55.8% of GDP for this year, rising to 58.5% of GDP by 2021-2022, well up from February’s estimates of 55.1% and 56.2% respectively.

Moody’s is the last remaining ratings agency to class South African government debt as investment grade — albeit by only one notch — and its ratings outlook is stable.

In a credit report last week, Moody’s noted that South Africa’s debt could be downgraded “if it were to become clear that the government will not stabilise its debt burden and contingent liabilities [from state-owned enterprises], and that prospects for a revival in growth falter”.

The outcome of the MTBPS could affect Moody’s position, according to Citi’s South Africa chief economist, Gina Schoeman. This could be seen in some of the figures it published in its report. For example, it had forecast government debt levels moving to 55.5% of GDP in 2018-2019 and 55.6% in 2019-2020, compared with the treasury’s revised figures of 55.8% and 56.1% for the same period.

But she did not think it would result in an immediate downgrade. “It wasn’t as awful as the 2017 MTBPS and that comes down to institutional strength.”

Finance Minister Tito Mboweni sent important signals to the market about the reform of state-owned companies and privatisation, she said.

“They [the treasury] haven’t announced anything there but he’s really paving the way as to which direction that’s going,” she said.

The treasury made no additional budget allocations to fund increases granted in the public sector wage agreement signed between the state and unions earlier this year. Instead, departments and provinces must find ways to pay for the increases from their existing budgets.

That was positive because it showed political will, said Schoeman.

Nevertheless, it was difficult to reconcile the positive message of Mboweni’s speech and the treasury’s renewed realistic forecasts with the scale of the changes in the numbers, she said.

“The realism is not necessarily a bad thing; it’s just that the change has been quite drastic,” she said, adding that “the markets don’t like this”.

The rand slid by about 2% on the day and government 10-year bond yields leapt from just over 9% before Mboweni delivered his speech to more than 9.3%.

But Mboweni was relatively sanguine about the market reaction.

“Once the markets look at what is contained in the statement overall, I think they will get a sense of a balance,” he said.

Maarten Ackerman, the chief economist of wealth management firm Citadel, said an important factor was Mboweni’s emphasis on the need to address the mismanagement of funds, reduce irregular expenditure and ensure that government spending was more efficient. So too was his focus on prioritising investment rather than on consumption spending.

Although the markets did sell off, with bond yields rising and the currency slipping notably, “we should not discount the positives contained in this important MTBPS”, Ackerman said.

“The economy may look a little bit weaker over the medium term, [but] eventually these policies will restore confidence and attract investment back into South Africa.”